Please use a PC Browser to access Register-Tadawul

V.F. Corporation (VFC): Examining Valuation Following Class Action Lawsuit and Brand Turnaround Disclosures

V.F. Corporation VFC | 20.91 | -0.90% |

Most Popular Narrative: 4.1% Undervalued

According to the most widely followed valuation narrative, V.F is considered modestly undervalued at today’s share price, mainly due to improved operational performance and anticipated future growth.

The strategic focus on expanding higher-margin channels, including direct-to-consumer and e-commerce, is beginning to drive improved gross margins and deeper customer engagement. This is expected to lift both revenue growth and net margins over time as V.F. capitalizes on the sustained consumer shift toward digital and premium shopping experiences.

Think this valuation narrative is just about optimism for a struggling legacy brand? Think again. The story behind this number combines surprising changes in margins, a sharp shift in how products reach customers, and some bold assumptions about future profitability. You might be shocked by the financial leap V.F analysts are projecting and what it means for investors if it happens.

Result: Fair Value of $15.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness at Vans or a failure to deliver on projected margin improvements could quickly challenge the case for a sustained recovery.

Find out about the key risks to this V.F narrative.Another View

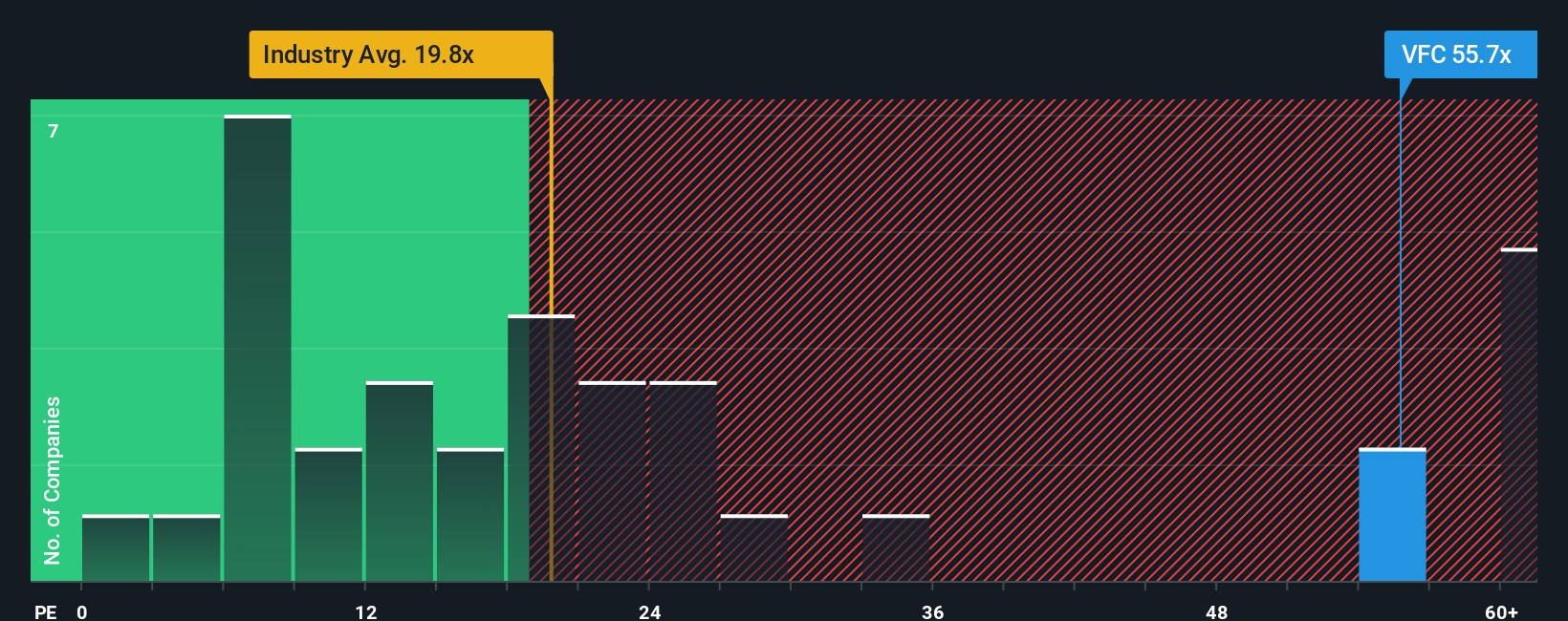

While the first valuation suggests V.F is undervalued, another method—comparing its current valuation to the broader industry—paints a different picture. By this measure, V.F actually looks expensive today. So which view tells the real story?

Build Your Own V.F Narrative

If you think the mainstream story is missing something, or you prefer to follow your own data trail, you can build your narrative in just a few minutes. Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your potential. Some of the market’s most promising opportunities are just a few clicks away. If you’re serious about building a smarter portfolio, these handpicked themes can help you spot value and innovation where others aren’t looking.

- Capture steady income potential and reduce volatility by checking out dividend stocks with yields > 3%. This selection features shares offering generous yields above 3% for reliable, long-term growth.

- Tap into the booming world of artificial intelligence breakthroughs and fast-growing innovators with AI penny stocks. Here, disruptive ideas are reshaping entire industries.

- Target businesses built for the future by browsing quantum computing stocks, which spotlights companies pioneering advances in quantum computing and next-generation technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.