Please use a PC Browser to access Register-Tadawul

Viasat (VSAT) Is Up 9.4% After Winning Space Force SATCOM Contract and Direct-to-Device Breakthrough – Has The Bull Case Changed?

ViaSat, Inc. VSAT | 35.83 | -6.38% |

- Earlier this month, Viasat announced its selection for a prime contract award by the U.S. Space Force under the Protected Tactical SATCOM-Global (PTS-G) program, joining four other providers in a US$4 billion IDIQ to develop a secure, anti-jam satellite constellation with an initial launch projected for 2028.

- Concurrently, Viasat revealed a country-first direct-to-device demonstration in Mexico, enabling smartphones to connect directly to satellites using standardized 3GPP technology, underscoring potential for broad expansion in both defense and commercial satellite communications.

- We'll examine how Viasat's breakthrough in direct-to-device satellite technology could reshape its investment outlook and long-term market reach.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Viasat Investment Narrative Recap

To invest in Viasat, shareholders need to believe in the company's ability to translate rising government and commercial demand for secure, resilient satellite communications into sustainable revenue, while managing the financial strain of large capital projects. The recent U.S. Space Force prime contract award does buoy medium-term growth visibility in defense, but it does not materially change the most immediate catalyst for Viasat: successful launches and operational ramp-up of its ViaSat-3 satellites. The biggest near-term risk remains elevated capital expenditures, which continue to pressure free cash flow and constrain profitability, and these factors are unchanged by recent news.

Of the recent company announcements, Viasat’s launch timeline for ViaSat-3 Flight 2 in October 2025 is most relevant. The project's execution will be closely watched, as timely and effective deployment of new satellites is pivotal for unlocking additional bandwidth, serving new markets, and improving earnings, all key elements investors are focused on in the current outlook.

However, despite these promising advancements, investors should be aware that Viasat’s leverage and free cash flow are still heavily pressured by ongoing and planned capital spending...

Viasat's narrative projects $5.0 billion revenue and $534.2 million earnings by 2028. This requires 2.9% yearly revenue growth and a $1.13 billion increase in earnings from -$598.5 million today.

Uncover how Viasat's forecasts yield a $26.14 fair value, a 27% downside to its current price.

Exploring Other Perspectives

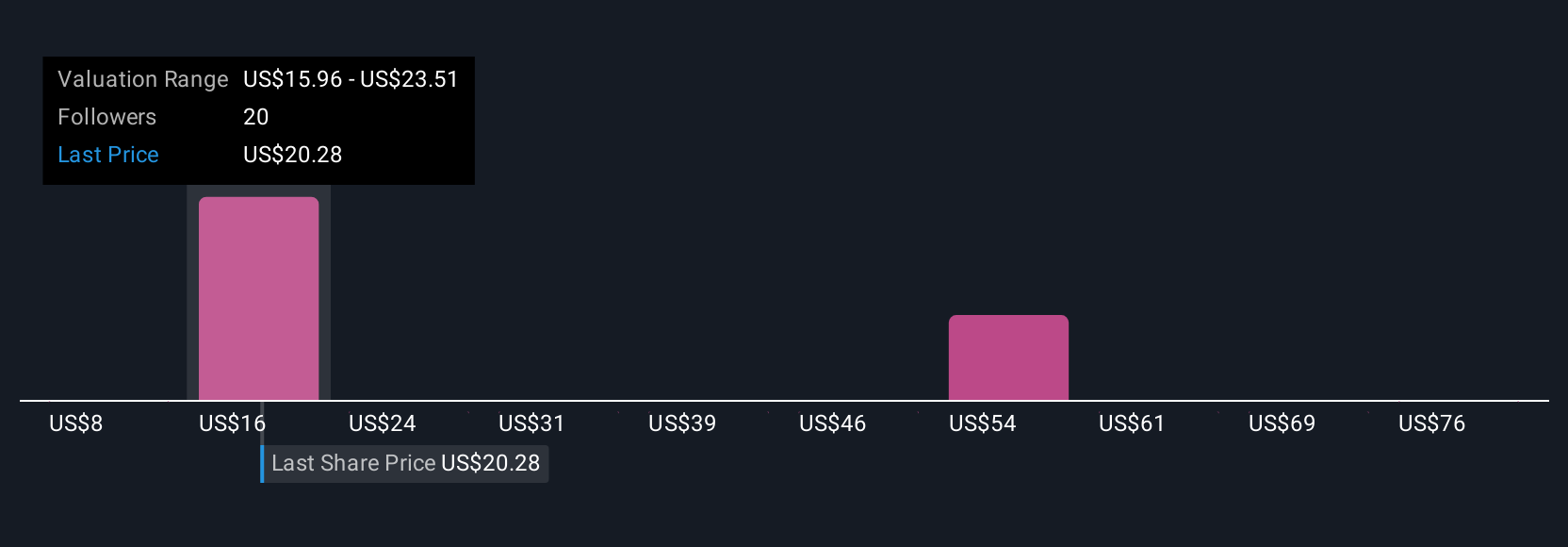

Ten individual fair value estimates from the Simply Wall St Community range widely from US$8.40 to US$116.92 per share, showing no consensus on Viasat’s potential. As operational execution on capital-intensive projects remains a core risk, explore how others balance optimism about growth with the realities of current financial pressures.

Explore 10 other fair value estimates on Viasat - why the stock might be worth over 3x more than the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Viasat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viasat's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.