Please use a PC Browser to access Register-Tadawul

Victoria’s Secret (VSCO): Valuation in Focus as Executive Shakeup and Earnings Preview Heighten Investor Scrutiny

Victorias Secret & Co. Common Stock VSCO | 53.05 | -3.12% |

Victoria's Secret (VSCO) is on the cusp of a potentially pivotal moment, with investors watching closely ahead of its upcoming quarterly earnings report. The recent elimination of the Chief Operating Officer role signals a decisive move by the company to reshape its executive team at a time when brand performance and store closures are already under the microscope. Adding the arrival of activist investors to the mix makes it clear that both strategy and leadership are in flux and sets the stage for a fresh round of scrutiny on what comes next for the retailer.

Stock action reflects this uncertainty. Shares have slipped 8% in the past year, and while there was a modest rally this month, momentum has faded in the past quarter. Alongside these swings, Victoria's Secret continues to face pressure from cautious consumer spending and ongoing operational changes. This combination of internal and external developments means the company’s ability to stabilize (or revive) its brand is right at the center of investors’ minds.

With volatility building ahead of the next earnings call, the key question is whether Victoria’s Secret is trading at a discount that offers value, or if the market is already bracing for even tougher days ahead.

Most Popular Narrative: 2.5% Overvalued

According to community narrative, Victoria’s Secret is considered slightly overvalued based on analyst expectations for future earnings and revenue growth, as well as key assumptions about its long-term profit margins and business risks.

Analysts have a consensus price target of $21.6 for Victoria's Secret based on their expectations for future earnings growth, profit margins, and other risk factors. However, there is some disagreement among analysts, with the most bullish projecting a price target of $28.0, and the most bearish projecting a price target of just $14.0.

Which bold projections lie at the heart of this valuation? The path forward centers on the numbers that underpin the price target. Want to know what financial metrics could make Victoria’s Secret a contrarian play or a potential value trap? The full narrative has the answers insiders are debating.

Result: Fair Value of $21.6 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including shifting consumer trends and potential challenges in revitalizing the PINK brand. These factors could undermine the company’s growth plans.

Find out about the key risks to this Victoria's Secret narrative.Another View: SWS DCF Model Sees Different Story

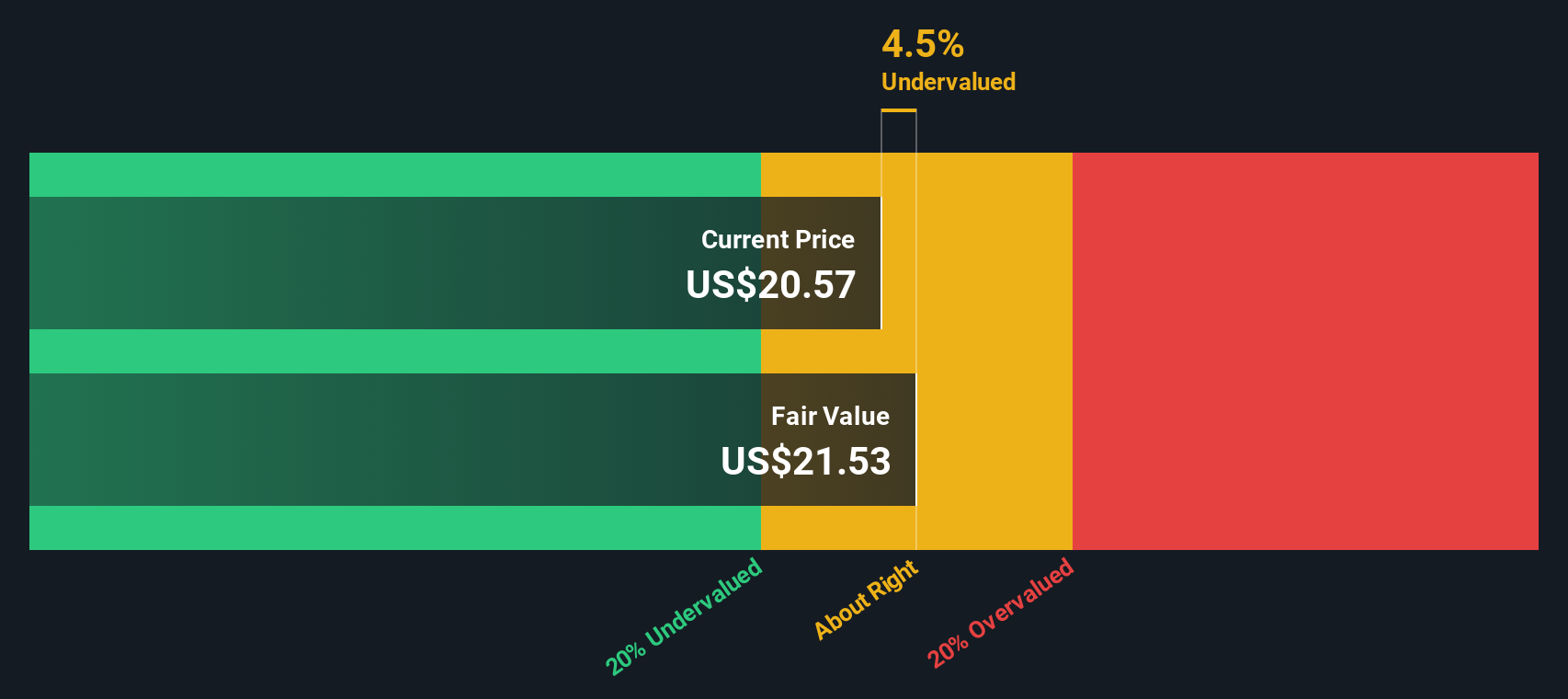

Taking a step back from analyst price targets, our DCF model presents a more optimistic outlook for Victoria's Secret, suggesting it may be undervalued by the market. Could this signal a hidden opportunity, or does it highlight deeper uncertainties?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Victoria's Secret Narrative

If you have a different take or want to dig deeper into the numbers yourself, you can put together your own narrative in just a few minutes and do it your way.

A great starting point for your Victoria's Secret research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors never stop at just one opportunity. If you want to strengthen your portfolio and stay a step ahead, check out these compelling angles below. Each one could reveal the next standout stock you have been searching for, so do not let these possibilities pass you by.

- Spot reliable returns by focusing on companies offering dividend stocks with yields > 3%—ideal for those seeking robust passive income and consistent cash flow.

- Tap into tomorrow’s breakthroughs by considering AI penny stocks and position yourself at the forefront of artificial intelligence innovation.

- Strengthen your portfolio’s foundation with undervalued stocks based on cash flows, allowing you to act on rare value opportunities supported by healthy financials.

Looking for More Winning Investment Ideas?

Smart investors never stop at just one opportunity. If you want to strengthen your portfolio and stay a step ahead, check out these compelling angles below. Each one could reveal the next standout stock you have been searching for, so do not let these possibilities pass you by.

- Spot reliable returns by focusing on companies offering dividend stocks with yields > 3%. This is an option for those seeking robust passive income and consistent cash flow.

- Tap into tomorrow’s breakthroughs by considering AI penny stocks so you can position yourself at the forefront of artificial intelligence innovation.

- Strengthen your portfolio’s foundation with undervalued stocks based on cash flows, giving you the chance to act on rare value opportunities supported by healthy financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.