Please use a PC Browser to access Register-Tadawul

Village Farms International (NasdaqCM:VFF) Valuation in Focus After $10 Million Share Buyback Announcement

VILLAGE FARMS INTERNATIONAL INC VFF | 0.00 |

Village Farms International (NasdaqCM:VFF) just announced a $10 million share buyback, authorizing the repurchase of up to 5% of its outstanding shares. This move signals management’s confidence in the company’s financial stability and growth trajectory.

This buyback announcement comes after steady momentum for Village Farms International, as its 1-year total shareholder return stands at a respectable 2%, with longer-term performance largely flat in recent years. While the buyback has sparked renewed investor attention, the decision reflects a growing belief in the company’s improving outlook and profit potential following a period of mixed results.

If you’re keen to find more opportunities where management is backing growth with bold moves like this, it’s a great time to broaden your horizons and uncover fast growing stocks with high insider ownership

With shares trading at a discount to analyst targets and profit expected within a year, the real question emerges: are investors looking at an undervalued turnaround story, or is the next stage of growth fully reflected in today’s price?

Most Popular Narrative: 24.5% Undervalued

With the current fair value pegged at $3.75 by the leading narrative and shares closing at $2.83, there is a compelling valuation gap. Investors are watching closely to see whether Village Farms’ international expansion can live up to these bullish expectations.

The rapid scaling of international cannabis exports, particularly driven by strong demand in Germany, the UK, and the Netherlands, indicates Village Farms is capitalizing on expanding global legalization, supporting future revenue growth and improving earnings visibility.

Can you guess the make-or-break variables steering this optimistic price outlook? Behind the narrative are ambitious targets for profitability, future margin expansion, and a discount rate that could change the game. Want to know which financial domino has to fall first for this forecast to materialize? Dive in to see which bold assumptions power this value story.

Result: Fair Value of $3.75 (UNDERVALUED)

However, shifting regulations in key export markets and intensifying competition could quickly change the outlook for Village Farms International’s margin expansion narrative.

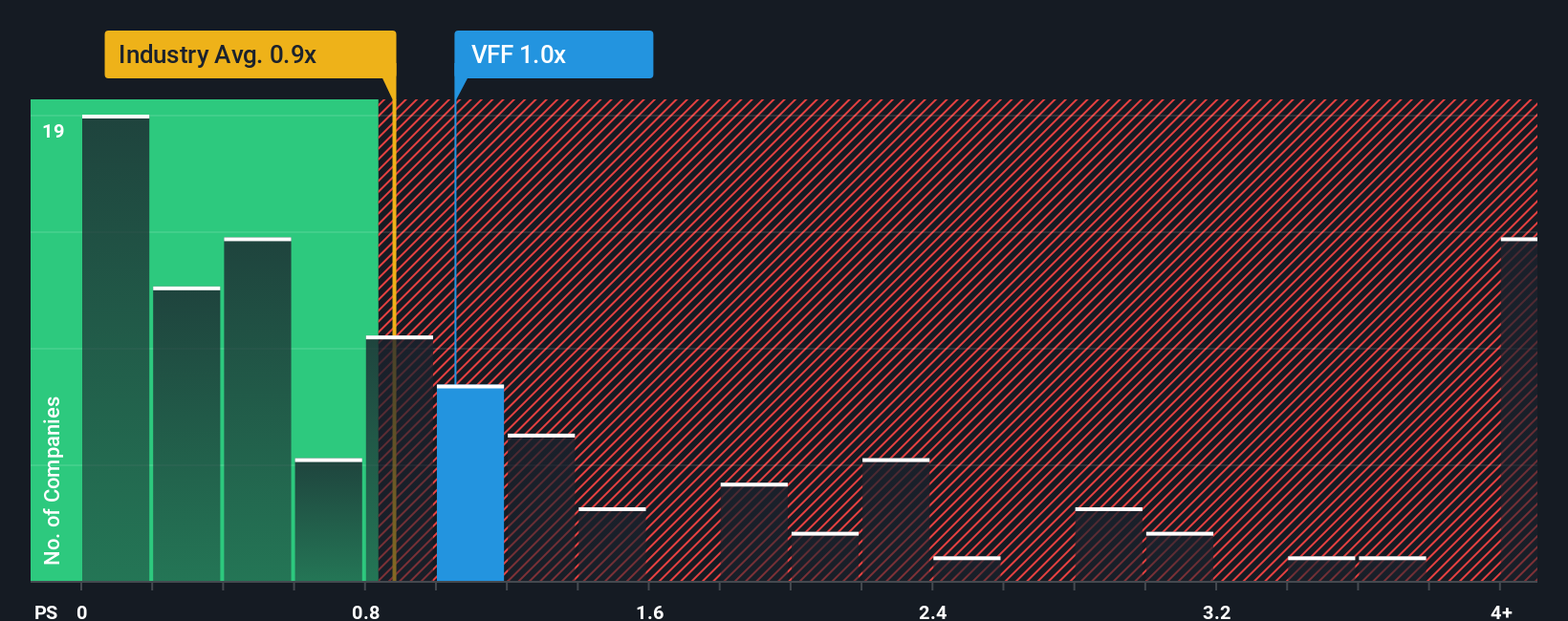

Another View: What Do Sales Multiples Show?

Taking a different angle, Village Farms International’s price-to-sales ratio stands at 0.9x, matching the broader U.S. food industry but sitting well above its estimated fair ratio of 0.5x. While the stock looks cheap against peers, this gap points to possible valuation risk if the market shifts. Does the future hold a correction down to fair value, or could earnings growth justify the premium?

Build Your Own Village Farms International Narrative

If the numbers or analysis above don’t align with your own perspective, you can review the figures firsthand and shape your own view in just a few minutes. Do it your way

A great starting point for your Village Farms International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stick to just one opportunity when dozens of overlooked winners could be within reach? Supercharge your watchlist by spotting trends most investors are missing.

- Tap into real-world disruption by scanning these 24 AI penny stocks that are pushing boundaries in automation, machine learning, and the next leap in digital innovation.

- Harness potential for eye-catching returns as you uncover these 3563 penny stocks with strong financials making waves with breakthrough products and agile strategies.

- Enhance your income portfolio by checking out these 19 dividend stocks with yields > 3% with reliable yields, steady growth, and resilience in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.