Vipshop Holdings Limited (NYSE:VIPS) Looks Inexpensive After Falling 30% But Perhaps Not Attractive Enough

Vipshop Holdings Ltd Sponsored ADR VIPS | 0.00 |

Vipshop Holdings Limited (NYSE:VIPS) shares have had a horrible month, losing 30% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 19% share price drop.

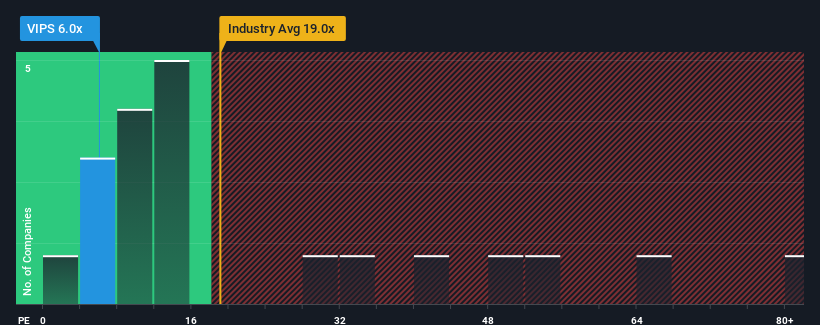

In spite of the heavy fall in price, Vipshop Holdings' price-to-earnings (or "P/E") ratio of 6x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 30x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

While the market has experienced earnings growth lately, Vipshop Holdings' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Is There Any Growth For Vipshop Holdings?

In order to justify its P/E ratio, Vipshop Holdings would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 118% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 3.0% each year over the next three years. That's shaping up to be materially lower than the 10% per annum growth forecast for the broader market.

In light of this, it's understandable that Vipshop Holdings' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Having almost fallen off a cliff, Vipshop Holdings' share price has pulled its P/E way down as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Vipshop Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Vipshop Holdings.

If these risks are making you reconsider your opinion on Vipshop Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

موصى به

- Sahm Platform 02/12 10:06

تتعاون Nvidia مع Fanuc لبناء روبوتات تستمع فعليًا

Benzinga News 02/12 16:36معاينة الربع الثالث لدولار جنرال ودولار تري: تقرير يُظهر زيادة في حركة المرور، لكن تعطل برنامج SNAP قد يُؤثر سلبًا على التوجيهات

Benzinga News 02/12 16:35أمازون تُجري تجربةً على خدمة التوصيل خلال 30 دقيقة - يقول المحلل إنها قد تجذب المزيد من المتسوقين عبر الإنترنت

Benzinga News 02/12 20:04لماذا ارتفعت أسهم أمريكان إيجل بنسبة 15%؟ إليكم 20 سهمًا في التداول قبل بدء التداول

Benzinga News 03/12 09:51Is Dollar General’s (DG) 24-Day Holiday Discount Blitz Deepening Loyalty or Squeezing Margins?

Simply Wall St 03/12 12:23المواطنون يؤكدون تفوقهم على أمازون في السوق، ويحافظون على هدف سعر 300 دولار

Benzinga News 03/12 15:44هذا الأسبوع في التجارة الإلكترونية - استراتيجيات البيع بالتجزئة المتطورة تستغل ذكاء بيانات الويب

Simply Wall St ساعتان