Please use a PC Browser to access Register-Tadawul

Visa (V) Valuation Check As Visa And Main Small Business Initiative Rolls Out

Visa Inc. Class A V | 314.08 | -3.12% |

Visa (V) just rolled out Visa & Main, a new small business platform anchored by a US$100 million working capital facility with Lendistry, along with upcoming grants and marketing support tied to major events.

Against this backdrop of new small business initiatives and fresh partnerships, Visa’s recent share price has eased, with a 30 day share price return of 5.20% decline and a year to date share price return of 4.30% decline. The 3 year total shareholder return of 48.99% and 5 year total shareholder return of 63.50% point to strong longer term compounding, while the 7 day share price return of 3.03% and 1 day share price return of 0.74% suggest short term momentum has picked up slightly.

If Visa’s push into small business support catches your eye, it could be worth broadening your view to payment infrastructure and transaction processing. Our screener of 22 top founder-led companies is a handy way to uncover other potentially resilient operators.

With Visa shares trading at US$331.58 and screens flagging roughly a 21% intrinsic discount, plus a value score of 3, you have to ask: is there still mispricing here, or is the market already baking in future growth?

Most Popular Narrative: 28.5% Undervalued

Visa’s most followed narrative pegs fair value at $463.49, well above the last close of $331.58, so the gap to that narrative price is wide.

At the core of Visa's strength is its vast and resilient global payments network. This network connects millions of merchants with thousands of financial institutions and their cardholders, creating a powerful moat that deters competition.

Curious what sort of growth and margins are baked into that kind of upside, according to QuanD? The narrative leans on steady compounding and a premium future earnings multiple. The fair value hinges on assumptions that may surprise you.

Result: Fair Value of $463.49 (UNDERVALUED)

However, you still need to watch for pressure from Mastercard on market share, as well as the potential for government backed stablecoins to reshape parts of the payment flows.

Another View on Visa’s Valuation

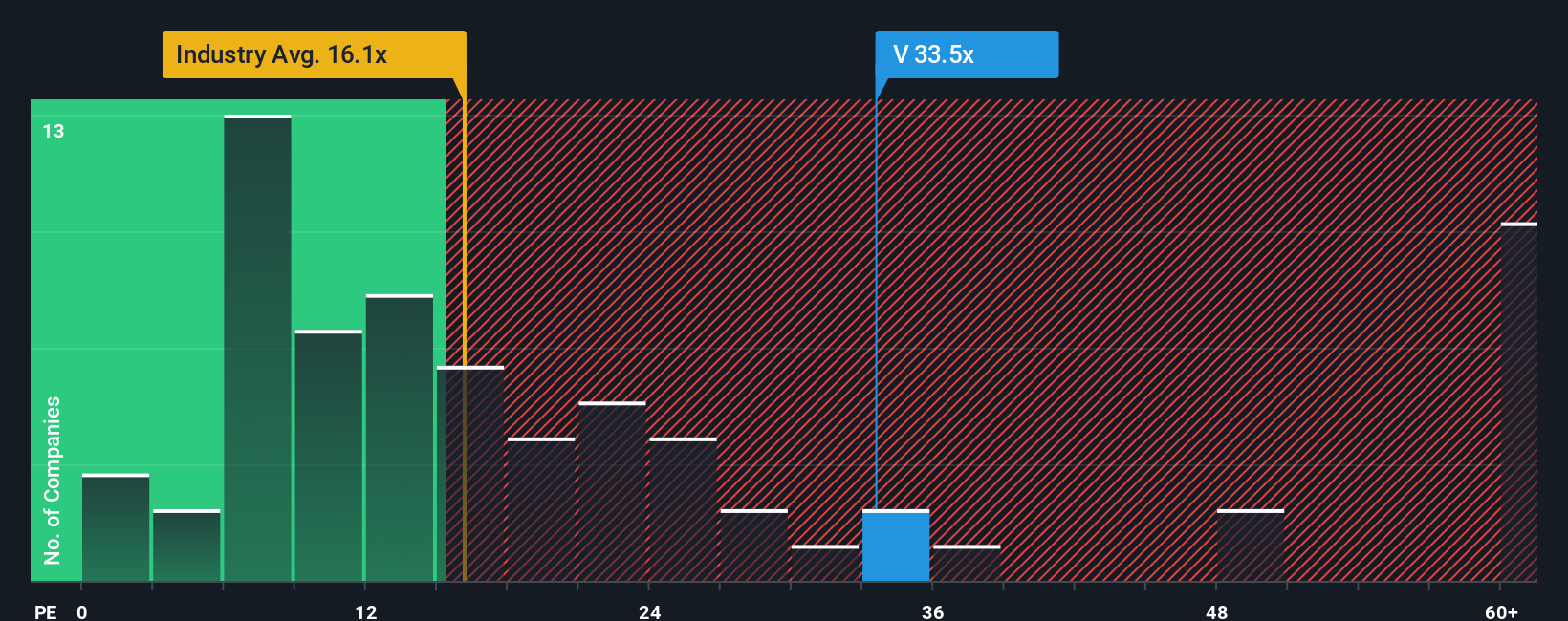

QuanD’s narrative leans on a rich future earnings multiple, yet our fair ratio work with the P/E tells a different story. Visa trades at 30.7x earnings versus a fair ratio of 20.8x, the US Diversified Financial industry at 15.8x and peers at 14.9x. This comparison points to meaningful valuation risk if sentiment cools.

Build Your Own Visa Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a fresh Visa story in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Visa.

Looking for more investment ideas?

Do not stop your research with one company. Use the screener to spot other opportunities that fit your style before they move out of reach.

- Target strong future potential by scanning our list of 52 high quality undervalued stocks that combine pricing support with quality fundamentals.

- Prioritize resilience by reviewing solid balance sheet and fundamentals stocks screener (45 results) that can help anchor a portfolio through different market conditions.

- Stay early to the story by checking out the screener containing 24 high quality undiscovered gems that the market may not be paying close attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.