Please use a PC Browser to access Register-Tadawul

Vishay (VSH) Is Down 12.8% After Profits Drop Amid Strong Q2 Sales and New Product Launches

Vishay Intertechnology, Inc. VSH | 14.88 | -1.78% |

- Vishay Intertechnology recently reported its second-quarter earnings, showing higher quarterly sales of US$762.25 million but a significant decline in net income to US$2 million, while also providing updated revenue guidance and introducing new automotive-grade inductors and transient voltage suppressors.

- The combination of financial results and the launch of advanced automotive components reflects both operational challenges and an ongoing commitment to product innovation for emerging vehicle technologies.

- We'll now examine how Vishay's sharp drop in profitability, despite robust new product launches, could influence its future investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Vishay Intertechnology Investment Narrative Recap

To be a shareholder in Vishay Intertechnology, you need to believe in the company’s ability to convert heavy investment in new capacity and advanced components into sustained earnings growth, especially as it seeks to capitalize on automotive and industrial technology trends. The recent earnings report, showing higher sales but a steep fall in net income, does not materially shift the near-term catalyst, which remains a post-expansion profit recovery, yet it does underscore the biggest risk: persistent margin pressure stemming from lack of operating leverage and manufacturing inefficiencies.

The launch of Vishay’s automotive-grade edge-wound inductors, capable of supporting high current with improved efficiency and temperature tolerance, stands out within their product announcements. This release is highly relevant given that expanding presence in electric and hybrid vehicle components could directly support the company’s strategy of targeting higher-growth, higher-margin market segments that might help mitigate ongoing profitability challenges.

In contrast, it’s crucial for investors to watch how below-trend margins and continuous losses might affect Vishay’s...

Vishay Intertechnology's outlook suggests revenues of $3.5 billion and earnings of $594.5 million by 2028. This is based on a 6.6% annual revenue growth rate and an increase in earnings of $682.2 million from current earnings of -$87.7 million.

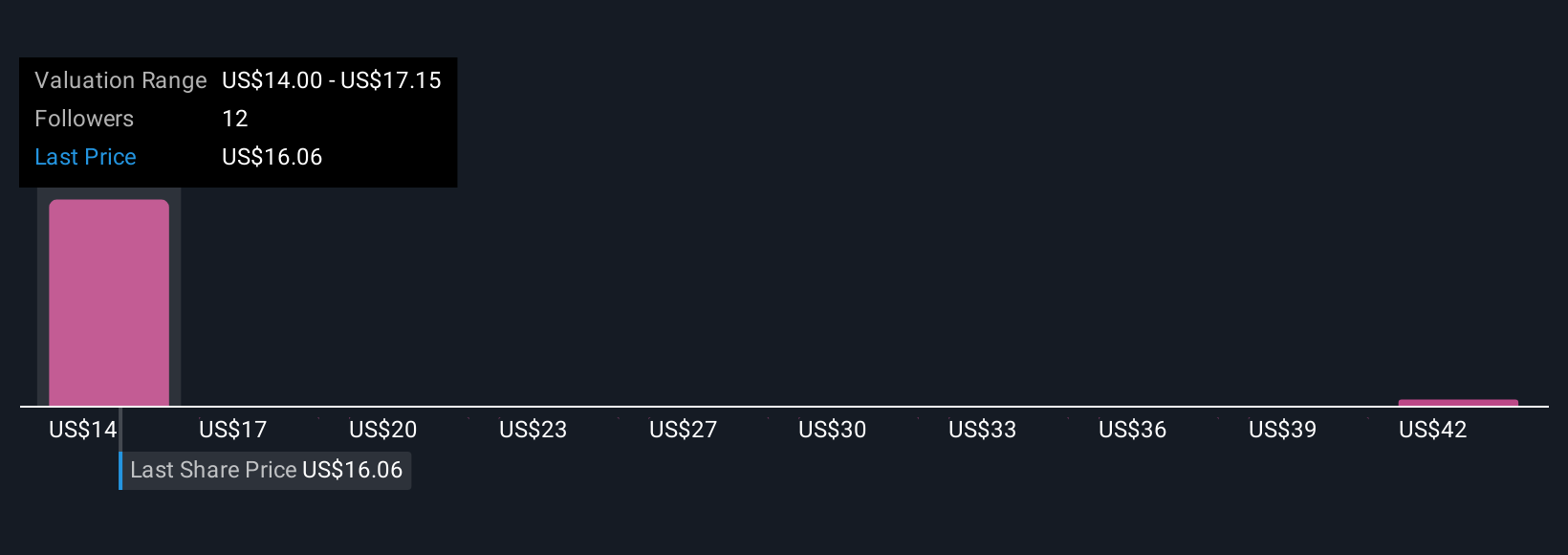

Uncover how Vishay Intertechnology's forecasts yield a $14.00 fair value, in line with its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community put Vishay’s worth between US$14.00 and US$14.61 per share. While some see potential value, persistent margin weakness raises broader questions about the speed and strength of any earnings recovery; consider how far your view aligns with these varied perspectives.

Explore 2 other fair value estimates on Vishay Intertechnology - why the stock might be worth just $14.00!

Build Your Own Vishay Intertechnology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vishay Intertechnology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vishay Intertechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vishay Intertechnology's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.