Please use a PC Browser to access Register-Tadawul

Vistra (VST): Evaluating Valuation as Strong Growth Catalysts Drive New Investor Optimism

Vistra Corp. VST | 152.94 | +2.20% |

Vistra (VST) has been front and center lately, due to its ties to the current surge in electricity demand linked to artificial intelligence and booming data center construction. Market watchers are buzzing about what this means for the company. Recent analyst upgrades, strong earnings, and favorable results from power capacity auctions have all added fuel to the conversation, making investors naturally wonder whether Vistra is setting up for a new era of growth or if this momentum is already priced into the share price.

The excitement around Vistra does not come out of nowhere. Over the past year, the stock has climbed an eye-catching 153%, with much of that enthusiasm building in recent months. Backed by annual revenue and profit gains, and major investments in its diversified energy portfolio, including nuclear, Vistra has managed to ride structural changes in the power sector. While there have been other gains and dips along the way, this year’s run-up highlights just how much the market now pays attention to the company's positioning in a changing industry.

After such a strong rally, investors have to ask themselves: does Vistra still offer compelling value here, or is the market already pricing in all of its future growth?

Most Popular Narrative: 13.8% Undervalued

The prevailing view among analysts is that Vistra's current share price underestimates its potential, suggesting the stock is trading at a notable discount to fair value.

Accelerated diversification into grid-scale battery storage and renewable projects, leveraging existing sites and interconnects, positions Vistra to capture growth from rising demand for grid flexibility, reliability services, and support for decarbonization. This approach may widen future revenue streams and improve net margins.

Want to know the bold thinking driving that price target? The magic lies in some eye-catching assumptions about Vistra’s future profit growth and the market’s willingness to reward it. Is a leap in profitability paired with a premium valuation multiple truly in store? Find out what numbers underpin this bullish fair value and why so many are paying attention.

Result: Fair Value of $218.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated debt from acquisitions and ongoing reliance on fossil fuels could limit Vistra’s flexibility. This may potentially undermine profit and margin expansion expectations.

Find out about the key risks to this Vistra narrative.Another View: Comparing Against Global Industry

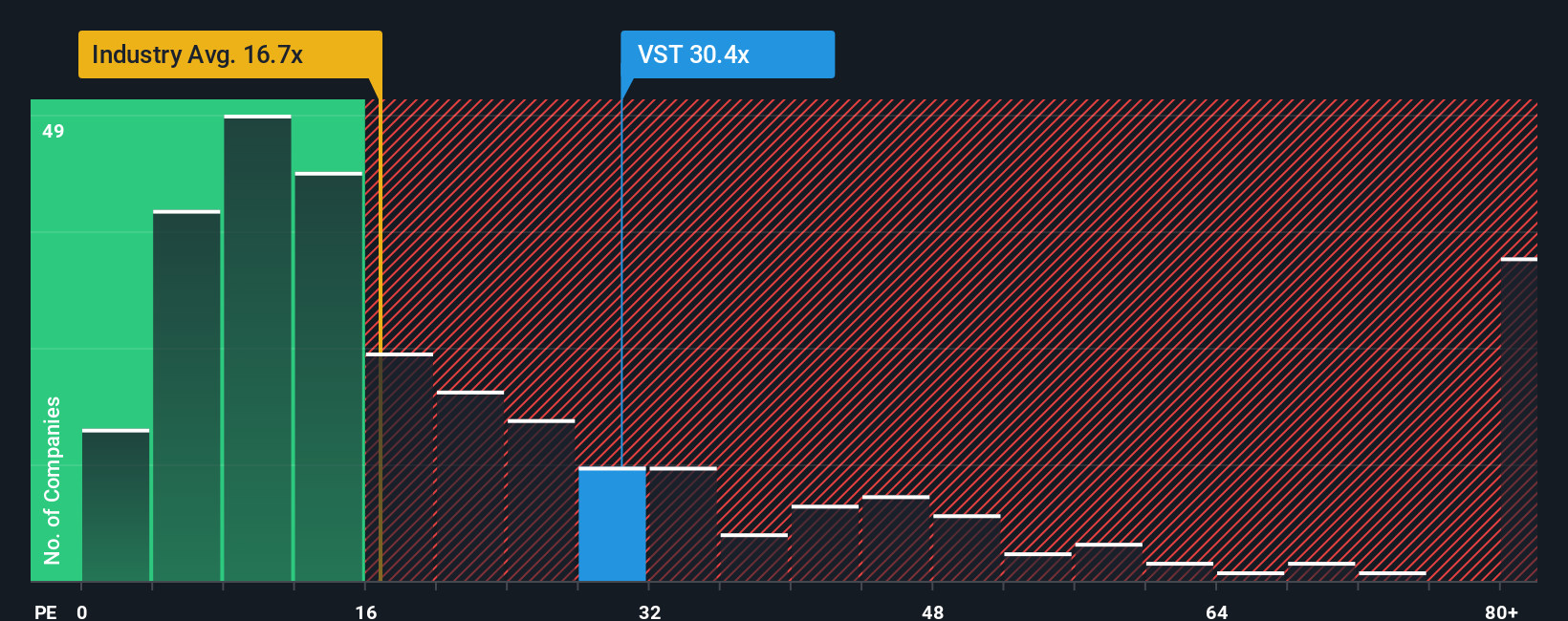

While analyst targets see further upside, a look at Vistra’s price-to-earnings ratio versus the global industry paints a more cautious picture. This approach suggests the shares may not be as cheap as some hope. Which lens offers the truest value?

Build Your Own Vistra Narrative

If you see things differently or want to dig deeper into the numbers yourself, it takes just a few minutes to develop your own perspective. Do it your way.

A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Actionable Investment Opportunities?

Smart investors never settle for just one idea. Broaden your search and grab the chance to uncover hidden gems or future outperformers with these targeted stock strategies from Simply Wall Street:

- Tap into future technology by scanning the market for the innovators driving advances in quantum computing using quantum computing stocks.

- Add steady potential to your portfolio by filtering for companies offering reliable income streams through dividend stocks with yields > 3%.

- Spot emerging disruptors as you scout groundbreaking businesses leading the charge in healthcare artificial intelligence with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.