Please use a PC Browser to access Register-Tadawul

Vistra (VST) Is Up 12.1% After New Meta Nuclear Deal And Analyst Upgrades - Has The Bull Case Changed?

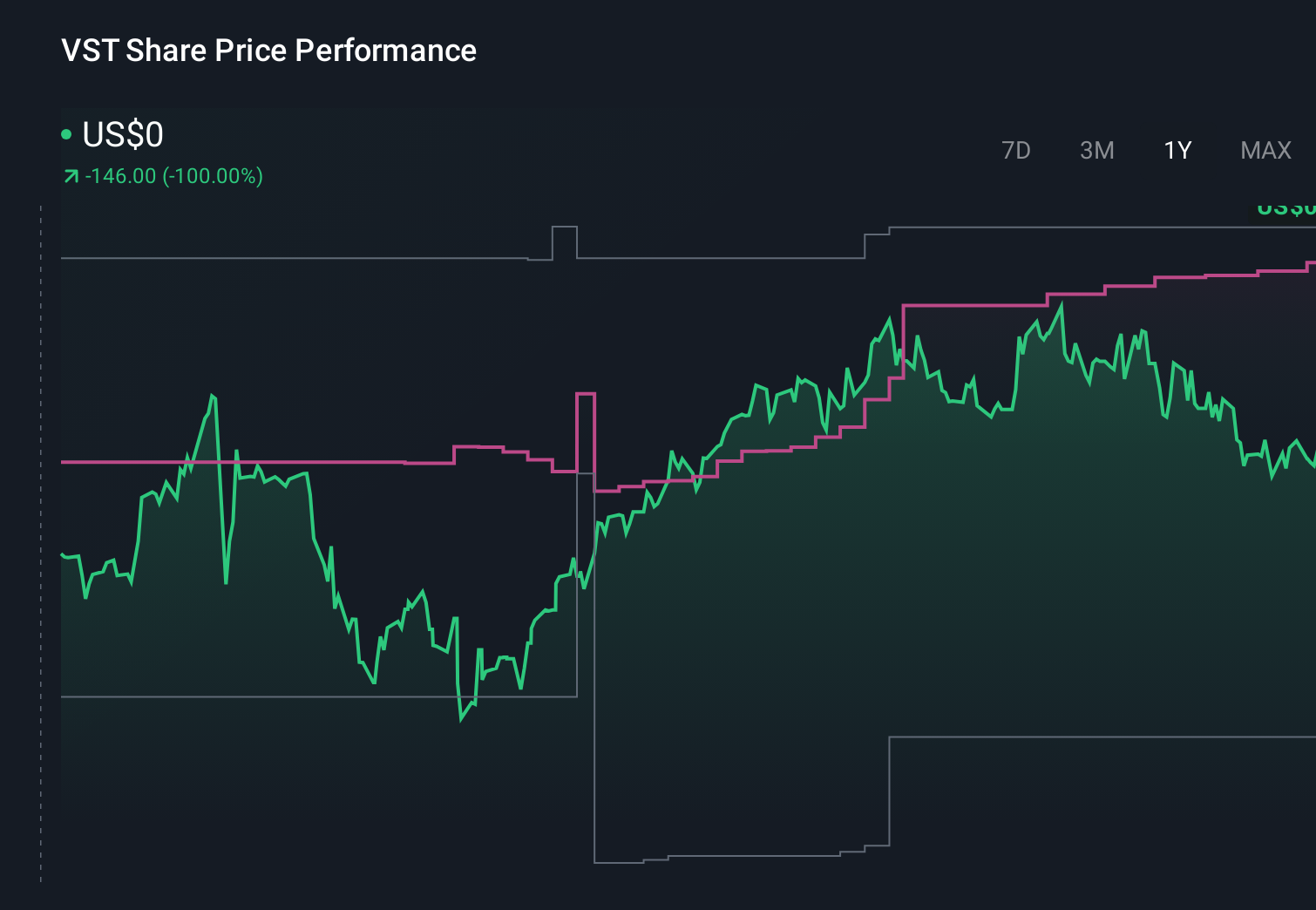

Vistra Corp. VST | 171.40 | -0.64% |

- In recent days, Vistra has been upgraded to Buy by both Jefferies and Goldman Sachs, while also announcing a 20-year agreement to supply more than 2,600 MW of zero-carbon nuclear energy to Meta.

- This combination of multiple analyst upgrades and a landmark long-term nuclear power contract highlights Vistra’s growing importance as a large-scale clean energy supplier to data center and corporate customers.

- We’ll now look at how this long-term Meta nuclear contract could reshape Vistra’s investment narrative and future earnings profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

Vistra Investment Narrative Recap

To own Vistra, you need to believe it can translate its large, mostly contracted power fleet into steady cash generation while managing leverage and its fossil exposure. The Meta nuclear agreement and recent analyst upgrades reinforce the short term catalyst around rising demand from data centers and corporate buyers, but they do not remove the key risk from Vistra’s elevated debt load and the capital needed to shift away from coal and gas.

The 20 year, 2,600 MW zero carbon nuclear agreement with Meta looks most relevant here, because it directly ties Vistra’s clean baseload capacity to one of the biggest data center operators. That kind of long duration offtake can support earnings visibility at a time when Vistra is investing heavily in renewables, storage, and nuclear uprates, potentially helping offset some volatility in power markets and execution risk across its broader growth pipeline.

Yet behind the attention on data centers, investors should still watch how Vistra’s debt costs and fossil fleet transition could...

Vistra’s narrative projects $24.5 billion revenue and $3.4 billion earnings by 2028. This requires 9.8% yearly revenue growth and about a $1.2 billion earnings increase from $2.2 billion today.

Uncover how Vistra's forecasts yield a $233.29 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Some of the lowest ranked analysts were already cautious, assuming earnings of about US$2.9 billion on roughly US$22.4 billion of revenue by 2028, and they focus more on risks like margin pressure from rising renewables and storage, even as the new Meta deal hints that data center demand could push outcomes above those conservative expectations.

Explore 12 other fair value estimates on Vistra - why the stock might be worth over 2x more than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The future of work is here. Discover the 32 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- Uncover the next big thing with 29 elite penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.