Please use a PC Browser to access Register-Tadawul

VNET Group (VNET) Is Up 6.6% After Upbeat Q3 Results and Raised Full-Year Revenue Guidance – What’s Next?

VNET Group, Inc. Sponsored ADR VNET | 9.31 | +0.22% |

- VNET Group, Inc. announced its third quarter 2025 results earlier this month, reporting sales of CNY 2.58 billion, up from CNY 2.12 billion a year ago, but posting a net loss of CNY 307.04 million compared to net income in the prior year period.

- Management raised its full-year revenue outlook, citing continued strength in wholesale data center and AI-related business as a significant driver for future performance.

- We'll examine how management's increased full-year revenue guidance and sector momentum shapes the company's investment narrative moving forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

VNET Group Investment Narrative Recap

To be a shareholder in VNET Group, one needs confidence in the rapid growth and utilization of wholesale data center capacity, driven by persistent AI and cloud demand, and belief that the company can convert this momentum into sustained revenue and margin improvements. The recent Q3 results, featuring strong year-over-year revenue growth but a return to net losses, support near-term catalysts centered around wholesale and AI expansion but do not materially reduce the most pressing risk: substantial near-term debt maturities and refinancing exposure amid ongoing losses.

Management's decision to increase full-year 2025 revenue guidance to RMB 9,550 million–9,867 million reflects continued confidence in wholesale and AI-driven project momentum. This upward revision is closely tied to the company's main catalyst, sustained wholesale capacity demand, but the ability to translate topline strength into profits is still hindered by high leverage and capital expenditure requirements.

By contrast, what investors should really watch for is how rising debt due in the next two years could force VNET into...

VNET Group's narrative projects CN¥14.2 billion revenue and CN¥484.1 million earnings by 2028. This requires 16.2% yearly revenue growth and a CN¥442.1 million increase in earnings from the current CN¥42.0 million.

Uncover how VNET Group's forecasts yield a $14.45 fair value, a 62% upside to its current price.

Exploring Other Perspectives

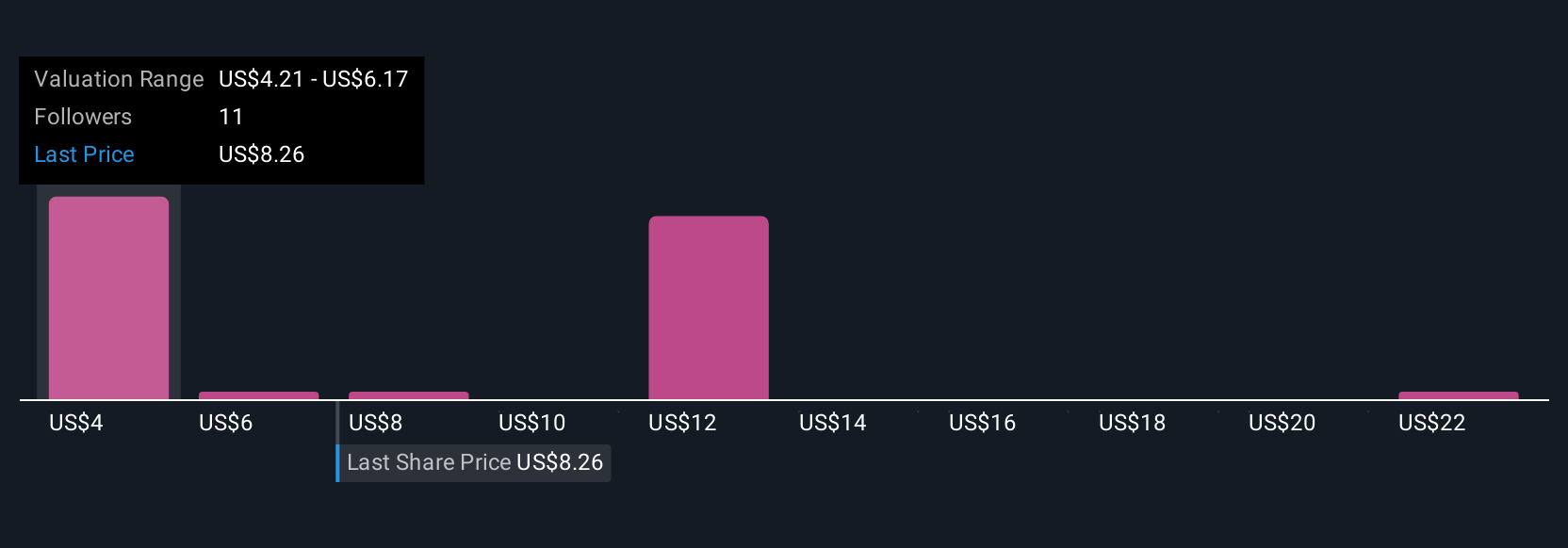

Simply Wall St Community fair value estimates for VNET range from CNY 2.97 to CNY 23.79 across 8 opinions. While shareholders see diverse upside, continued high leverage and refinancing needs could have wide implications for future returns, explore community viewpoints to understand the spectrum of risk and opportunity in this story.

Explore 8 other fair value estimates on VNET Group - why the stock might be worth over 2x more than the current price!

Build Your Own VNET Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VNET Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free VNET Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VNET Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.