Please use a PC Browser to access Register-Tadawul

Wall Street's Most Accurate Analysts Spotlight On 3 Energy Stocks Delivering High-Dividend Yields

Delek Logistics Partners LP DKL | 44.75 | 0.00% |

Mach Natural Resources L.P. MNR | 11.70 | -0.59% |

Veritas DGC Inc. Ordinary Shares VTS | 20.77 | -1.79% |

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

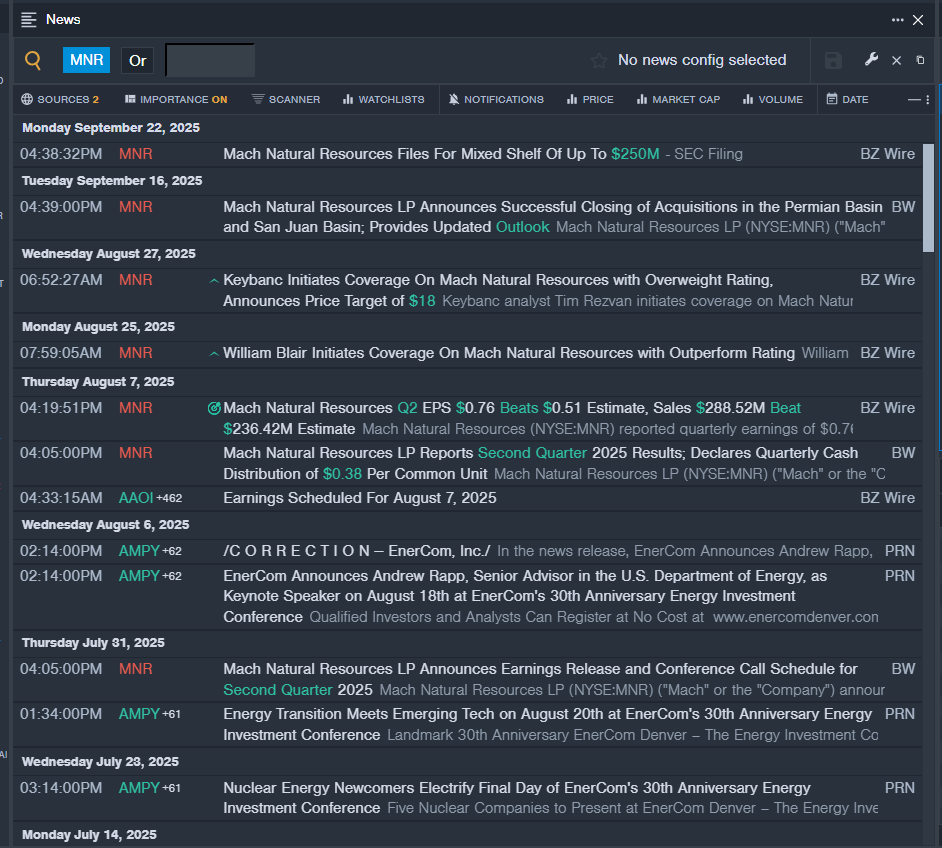

Mach Natural Resources LP (NYSE:MNR)

- Dividend Yield: 18.53%

- Raymond James analyst John Freeman maintained a Strong Buy rating and raised the price target from $21 to $22 on July 14, 2025. This analyst has an accuracy rate of 75%.

- Stifel analyst Selman Akyol maintained a Buy rating and increased the price target from $21 to $23 on Feb. 7, 2025. This analyst has an accuracy rate of 71%

- Recent News: On Sept. 22, Mach Natural Resources filed for mixed shelf of up to $250 million.

- Benzinga Pro’s real-time newsfeed alerted to latest MNR news.

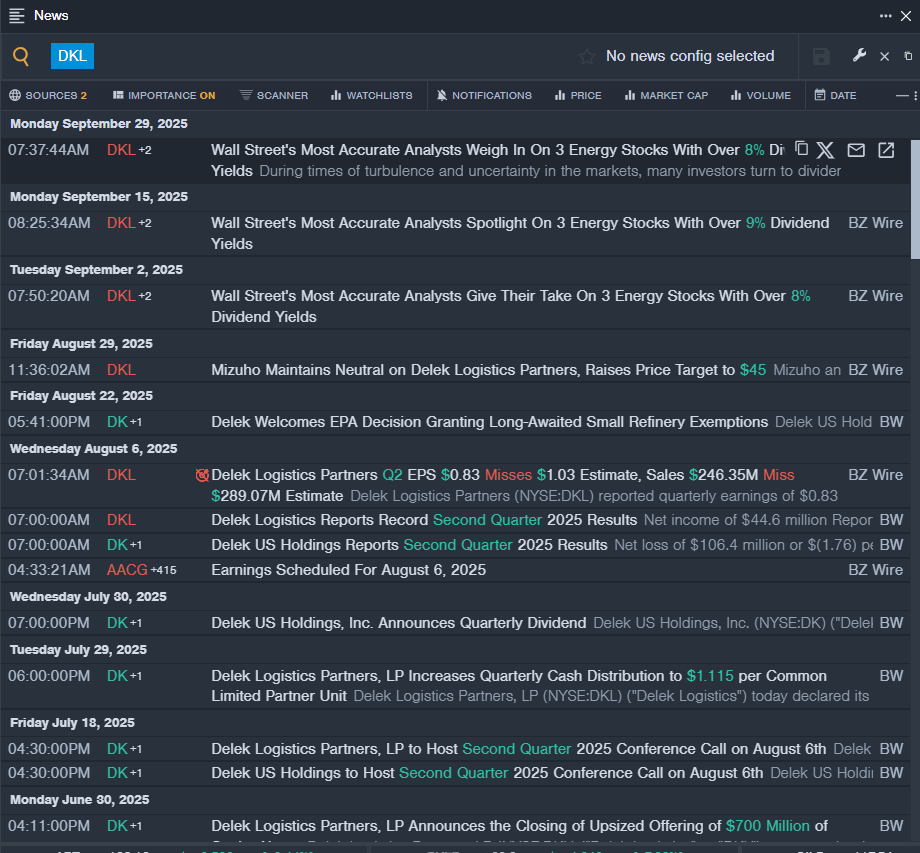

Delek Logistics Partners LP (NYSE:DKL)

- Dividend Yield: 10.36%

- Mizuho analyst Gabriel Moreen maintained a Neutral rating and increased the price target from $44 to $45 on Aug. 29, 2025. This analyst has an accuracy rate of 68%.

- Raymond James analyst Justin Jenkins maintained an Outperform rating and raised the price target from $44 to $46 on Jan. 28, 2025. This analyst has an accuracy rate of 77%

- Recent News: On Aug. 6, Delek Logistics Partners posted weaker-than-expected quarterly results.

- Benzinga Pro's real-time newsfeed alerted to latest DKL news

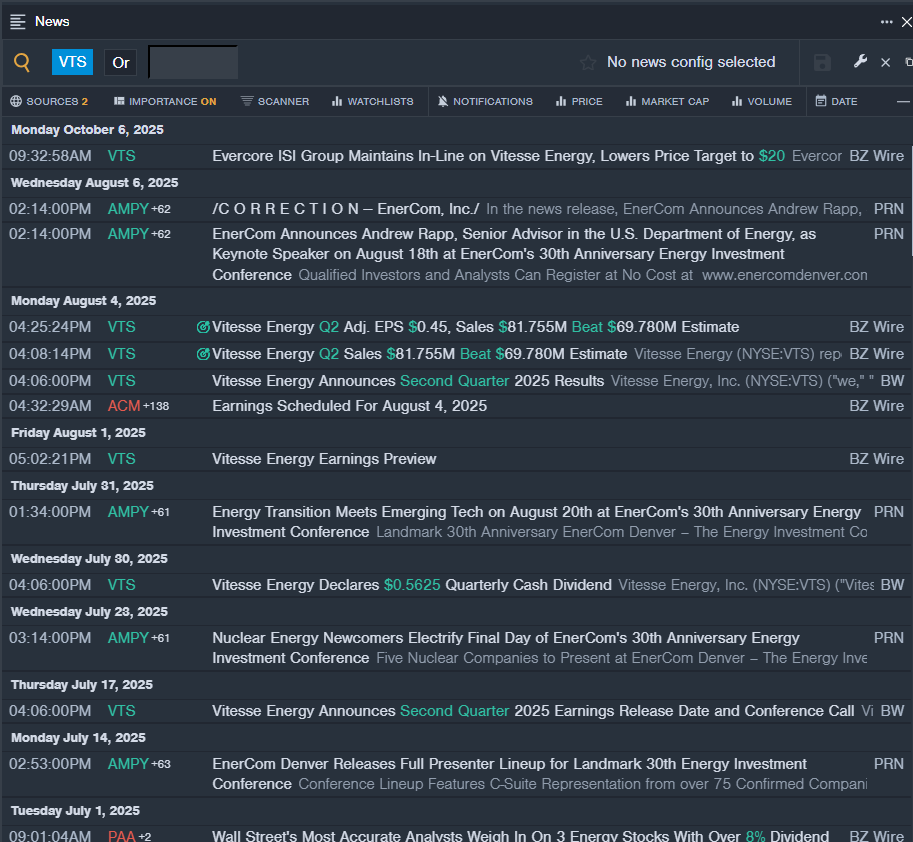

Vitesse Energy Inc (NYSE:VTS)

- Dividend Yield: 10.19%

- Evercore ISI Group analyst Chris Baker maintained an In-Line rating and cut the price target from $22 to $20 on Oct. 6, 2025. This analyst has an accuracy rate of 69%.

- Roth MKM analyst John White maintained a Buy rating and increased the price target from $30.5 to $33 on April 2, 2025. This analyst has an accuracy rate of 63%.

- Recent News: On Aug. 4, Vitesse Energy posted upbeat quarterly sales.

- Benzinga Pro’s real-time newsfeed alerted to latest VTS news

Read More:

- Bank of America Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street’s Most Accurate Analysts

Photo via Shutterstock