Please use a PC Browser to access Register-Tadawul

Walmart (NYSE:WMT) Partners With Megan Thee Stallion For Exclusive Hot Girl Summer Swimwear

Wal-Mart Stores, Inc. WMT | 115.42 | -1.17% |

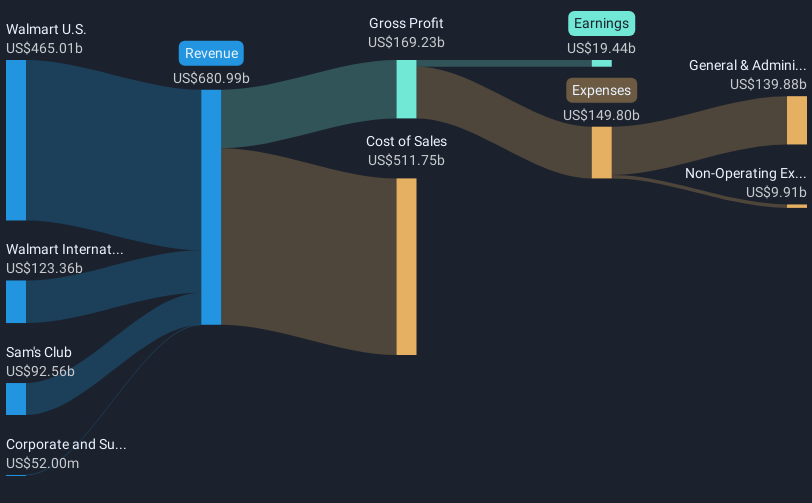

Megan Thee Stallion's launch of her swimwear brand, Hot Girl Summer, marked a significant collaboration with Walmart (NYSE:WMT), with her collection debuting in stores and online. Walmart's share price moved significantly, rising 5% over the last month. This performance could be linked to the vibrant retail initiatives such as Megan's launch, alongside continuous expansion of products like LK's allergen-conscious meat sticks and Women's health lines, potentially boosting consumer interest. Despite strong corporate earnings and a favorable market climate marked by a 1.6% climb over recent days, Walmart's legal challenge from Zest Labs may have tempered investor optimism slightly.

The recent collaboration between Megan Thee Stallion and Walmart with the launch of Hot Girl Summer swimwear suggests a boost in consumer engagement and potentially higher short-term sales. However, the long-term performance of Walmart shares provides a broader perspective. Over the past five years, the company's total returns, including dividends, have surged 154.26%. This robust performance contrasts with the shorter-term gains highlighted in the introduction. In comparison, Walmart's 1-year return outpaced the US Consumer Retailing industry, which saw a 32% increase.

The collaboration and product expansion with lines like LK's allergen-conscious meat sticks and women's health products might not just impact immediate revenue but could signal a sustained push into higher-margin sectors. This aligns with expectations that Walmart's operational shifts into areas like e-commerce and strategic supply chain investments could bolster top-line growth. Analysts expect revenue growth at 4.1% annually over the next three years with projected earnings of US$25.8 billion by 2028. However, challenges such as ongoing legal issues with Zest Labs and broader inflationary pressures might temper these expectations.

The share price's recent rise offers an alignment with the consensus analyst price target of US$107.01, which is about 7.9% higher than the current price of US$98.55. The nearly 10% discount to the price target suggests that there might be room for appreciation if the company meets expected earnings and revenue targets. Investors should weigh these projections against potential risks in the wider market environment and Walmart's specific operational challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.