Please use a PC Browser to access Register-Tadawul

Walmart (WMT) Partners With Dollar Shave Club For School-Themed Razor Launch

Wal-Mart Stores, Inc. WMT | 116.09 | -0.60% |

Last week saw the launch of Dollar Shave Club's new College Razor Handles, available at Walmart (WMT) stores. This product release, part of a collaboration with 12 U.S. universities, may have complemented other factors in the retail sector, aligning with broader market moves. Despite a surge in anticipation of Federal Reserve decisions and tech earnings, the overall market remained relatively steady. Against this backdrop, Walmart's share price experienced a 3% increase, modestly contributing to the retail sector's performance, which saw ongoing consumer interest and focused product innovations enhancing its market position.

The launch of Dollar Shave Club's College Razor Handles at Walmart signals a focus on product innovation, potentially supporting the company's revenue and earnings growth. Collaborations with U.S. universities could amplify consumer engagement, boosting sales in the retail sector. While Walmart’s share price saw a 3% rise last week, its longer-term total shareholder return exhibits a remarkable 140.65% increase over five years, demonstrating strong performance compared to its peers.

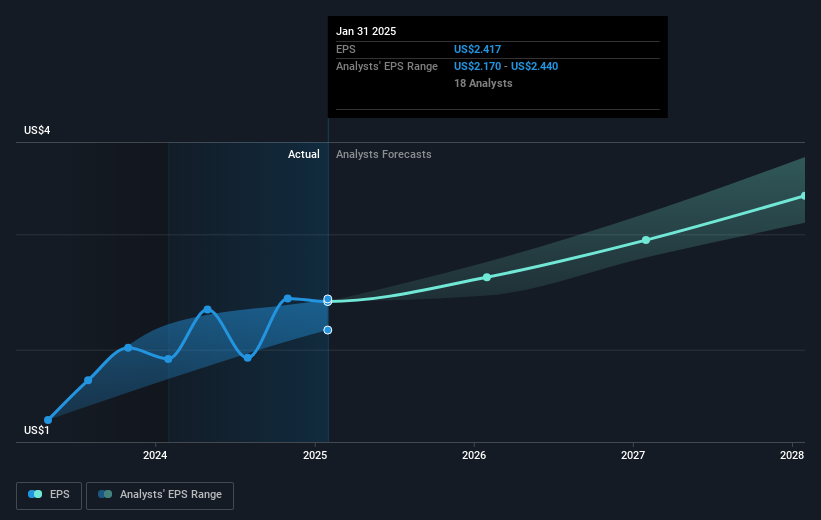

Walmart’s recent share price surge to US$98.33 brings it closer to the consensus price target of US$109.54, indicating potential upside. Enhanced product offerings like the College Razor Handles may influence future revenue projections positively, aiding growth in high-margin areas such as membership and advertising. The anticipated gains in operational efficiency through supply chain improvements and e-commerce enhancements may also impact earnings forecasts favorably. Challenges such as currency fluctuations and execution risks in international markets could still affect overall profitability, but the targeted innovations might alleviate some pressure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.