Please use a PC Browser to access Register-Tadawul

Warren Buffett Falls Behind Nancy Pelosi In Stock Market Returns Over The Last 11 Years: Here's What Data Shows

Apple Inc. AAPL | 259.48 | +0.46% |

Amazon.com, Inc. AMZN | 239.30 | -1.01% |

American Express Company AXP | 352.17 | -1.77% |

Bank of America Corp BAC | 53.20 | +0.23% |

Alphabet Inc. Class A GOOGL | 338.00 | -0.07% |

Nancy Pelosi‘s investments over 11 years have outperformed the ‘Oracle of Omaha’, Warren Buffett‘s Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK), with gains that are more than double the latter’s performance.

What Happened: According to the data from Quiver Quantitative, Pelosi’s investments have fetched her gains of 692.75% since May 16, 2014.

This is an aggregate of the sales and purchases made by her over the 11 years. The SPDR S&P 500 ETF Trust (NYSE:SPY), tracking the S&P 500 index, has returned just 197.16% in the same period.

Meanwhile, Buffett’s holding company, Berkshire Hathaway, which is headquartered in Omaha, Nebraska, has advanced 303.85% from $126.86 per share as of May 16, 2014, to $512.33 apiece as of May 6, 2025.

Buffett is known to be one of the best portfolio managers of all time. Berkshire holds major investments in Apple Inc. (NASDAQ:AAPL), American Express Co. (NYSE:AXP), Bank of America Corp. (NYSE:BAC), and Coca-Cola Co. (NYSE:KO).

BRK has returned 13.57% this year so far, while SPY is down 4.42%. This, as Berkshire is sitting on a cashpile worth $348 billion as of the first quarter of 2025.

However, Benzinga’s Government Trades Tracker shows that Pelosi has performed below the market over the past 12 months, losing -7.40% on average.

See Also: Warren Buffett Expresses Disappointment Over Dollar Depreciation: Don’t Want To Own Assets In A Currency That Is ‘Really Going To Hell’

Why It Matters: The top stocks in Pelosi’s portfolio with investments of around $250,000 to $500,000 include Alphabet Inc. (NASDAQ:GOOGL), Amazon.com Inc. (NASDAQ:AMZN), and Nvidia Corp. (NASDAQ:NVDA)

Tempus AI Inc. (NASDAQ:TEM), Apple Inc. (NASDAQ:AAPL), and Vistra Corp. (NYSE:VST) are also part of Pelosi’s portfolio.

During the premarket hours on Wednesday, SPY was 0.66% higher, whereas Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), tracking the Nasdaq 100, was up 0.68%.

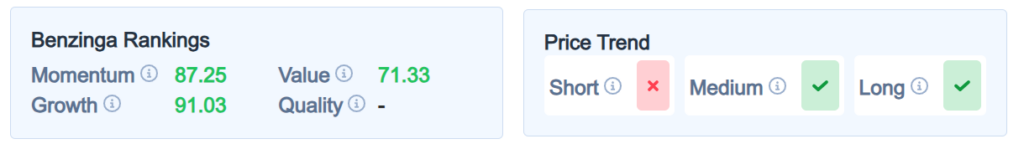

Benzinga Edge Stock Rankings shows that BRK-B had a strong price trend over the medium and long term but a weaker trend over the short term. Its momentum ranking was solid at 87.25th percentile, whereas its value ranking was also good at 71.33th percentile; the details of other metrics are available here.

Read Next:

- SMCI Issues Strong Q4 Revenue Outlook, Expects Nvidia’s Blackwell To Fuel Growth

Image via Shutterstock