Please use a PC Browser to access Register-Tadawul

Warrior Met Coal Ramps Up Blue Creek As Earnings Story Shifts

Warrior Met Coal, Inc. HCC | 85.01 | -0.58% |

- Warrior Met Coal (NYSE:HCC) has started longwall production at its Blue Creek mine around eight months ahead of its original schedule.

- The company reports that this early start is supporting record production, sales, and earnings in 2025 in what it describes as a challenging market.

- Warrior Met Coal has also finalized two federal coal leases that add major coal reserves to its asset base.

- Management highlights these milestones as key drivers for planned production and sales expansion in 2026 and later years.

Warrior Met Coal focuses on metallurgical coal, a key input for steelmaking, which keeps it closely tied to industrial and infrastructure demand. In this context, the early ramp up at Blue Creek and the newly secured federal leases represent a material change in the scale and longevity of its reserve base. For investors tracking NYSE:HCC, these updates help frame how the company is positioning itself within the metallurgical coal segment.

Looking ahead, the combination of earlier than planned longwall output and added reserves gives Warrior Met Coal more optionality in how it plans future production and sales volumes. Investors may want to watch how the company sequences capital spending, manages unit costs, and approaches contract versus spot sales as Blue Creek contributions build through 2026 and beyond.

Stay updated on the most important news stories for Warrior Met Coal by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Warrior Met Coal.

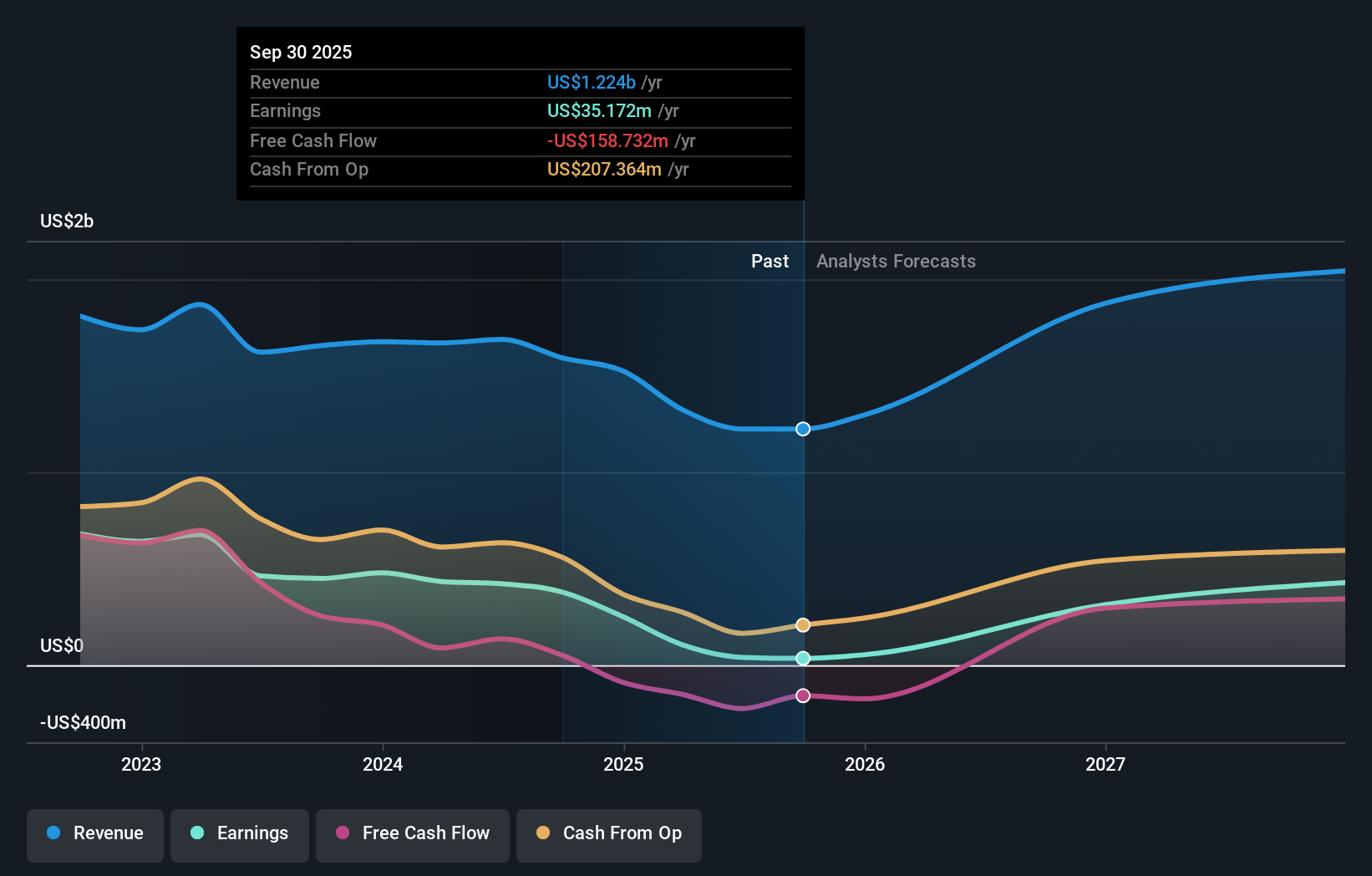

The early start at Blue Creek and the newly secured federal leases look central to how Warrior Met Coal is trying to reshape its production profile and cost base. Blue Creek contributed 1.3 million short tons in the fourth quarter of 2025, helping lift total steelmaking coal output to 3.39 million short tons versus 2.11 million short tons a year earlier. That higher volume fed into quarterly revenue of US$383.99 million and net income of US$22.96 million, compared with US$297.47 million and US$1.14 million respectively in the prior year period. At the same time, full year 2025 revenue and earnings stepped down from 2024, which suggests pricing and mix pressures despite the operational progress.

How This Fits Into The Warrior Met Coal Narrative

- The rapid Blue Creek ramp up and additional reserves line up with the narrative that future performance will rely on higher volumes from new capacity and tighter cost discipline.

- The weaker full year 2025 net income compared with 2024 highlights that exposure to soft steelmaking coal markets and pricing can still weigh on results, even as new mines come online.

- The finalized federal leases, which expand the reserve base, strengthen long term supply but are not fully reflected in earlier narrative focus on tax credits and cost advantages.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Warrior Met Coal to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Full year 2025 net income of US$57 million compared with US$250.6 million in 2024 points to earnings sensitivity to coal prices and product mix despite higher volumes.

- ⚠️ Analysts have flagged at least one key risk, including margin pressure from weaker realized prices and a higher mix of lower margin coal, which could limit the benefit of added capacity.

- 🎁 Record quarterly production of 3.39 million short tons in Q4 2025, with Blue Creek contributing materially, supports the idea that new assets can support volume led growth.

- 🎁 The 2026 production guidance of 12.0 million to 13.0 million short tons and sales of 12.5 million to 13.5 million short tons shows how management plans to use Blue Creek and the expanded reserves to lift throughput.

What To Watch Going Forward

From here, it is worth focusing on how quickly Blue Creek scales within the 2026 guidance range and what that does to unit costs and margins. Pricing for metallurgical coal and the company’s mix between premium and lower margin products will matter just as much as tonnage. You might also track capital spending through the rest of the Blue Creek build out, free cash flow trends, and how committed management stays to dividends and any buybacks once major capex winds down. For context, peers like Arch Resources and Teck Resources provide useful reference points on contract coverage, realized prices, and cost structures in seaborne met coal.

To stay updated on how the latest news impacts the investment narrative for Warrior Met Coal, head to the community page for Warrior Met Coal to follow the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.