Please use a PC Browser to access Register-Tadawul

Waste Management (NYSE:WM) Celebrates US$323 Million Recycling & RNG Projects Expansion

Waste Management, Inc. WM | 218.90 218.90 | +0.27% 0.00% Pre |

Waste Management (NYSE:WM) recently experienced a 16% price increase, coinciding with significant business expansions, including the opening of new recycling and renewable natural gas projects in the U.S., as part of a $3 billion investment in sustainability. Despite a 3% market decline, Waste Management's stock has been buoyed by a 34 cent quarterly dividend increase, solid earnings results with a $676 million rise in fourth-quarter sales, and promising revenue guidance for 2025. As the Dow Jones index showed slight gains amid tariff-related volatility, Waste Management's strategic initiatives underscore its robust position in the waste sector.

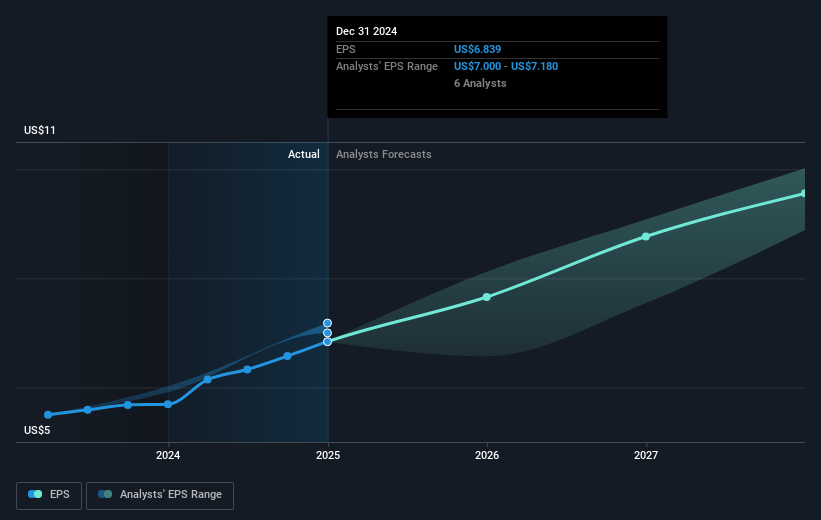

Over the past five years, Waste Management's total shareholder return reached 177.56%. This impressive performance underscores the company's successful execution of targeted initiatives and strategic growth plans. Key developments include the 2025 opening of four recycling and renewable natural gas projects, reflecting a US$3 billion commitment to sustainability. Similarly, the strong financial showing in 2024, with net income growing from US$2.3 billion to US$2.75 billion, supports the company's robust financial health.

Waste Management has also maintained steady dividend growth, including a recent increase to US$3.30 per share annually, reflecting its commitment to returning value to shareholders. Additionally, the company has strengthened its financial flexibility, as evidenced by the amended revolving credit agreement of US$3.5 billion. Over the past year, despite underperforming the US Commercial Services industry, Waste Management's earnings growth outpaced the industry average, highlighting its enduring competitive edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.