Please use a PC Browser to access Register-Tadawul

Waters (WAT): Evaluating Valuation as Shares Hold Steady and Investors Await the Next Catalyst

Waters Corporation WAT | 384.63 | -0.18% |

This year, Waters’ share price has barely moved, even as the broader life sciences industry saw its own ups and downs. Despite the lack of headline-grabbing news, the 1-year total shareholder return is close to flat, which shows that momentum has cooled compared to its 5-year gain of 60%. That steadiness could suggest investors are waiting for the next catalyst before making a move.

If you’re watching the life sciences sector and want to see which healthcare names are showing real traction, it’s worth checking out See the full list for free.

With shares holding steady and solid long-term growth in the rearview mirror, the key question now is whether Waters is undervalued at current levels or if the market has already priced in its future gains.

Most Popular Narrative: 7% Undervalued

Waters' fair value, according to the most widely followed narrative, is set well above the last close price of $321.92. The narrative points to a potential upside at a time when many investors are on the sidelines waiting for the next big signal.

The planned combination with BD's Biosciences and Diagnostic Solutions business is expected to accelerate entry into biologics, precision medicine, and cell/gene therapy markets. These are segments with expanding analytical needs, unlocking new addressable markets and providing a multi-year revenue synergy opportunity, directly impacting future revenues and EPS growth.

What’s the secret behind Waters’ valuation boost? Unpack the synergy bets, revenue jump, and a margin profile that could rival top sector players. Discover which bold analyst assumptions power this narrative and get the numbers that matter most before the market moves.

Result: Fair Value of $347.14 (UNDERVALUED)

However, unexpected integration challenges or prolonged weakness in pharmaceutical research funding could quickly undermine the optimistic outlook that analysts expect for Waters.

Another View: Market Comparisons Paint a Different Picture

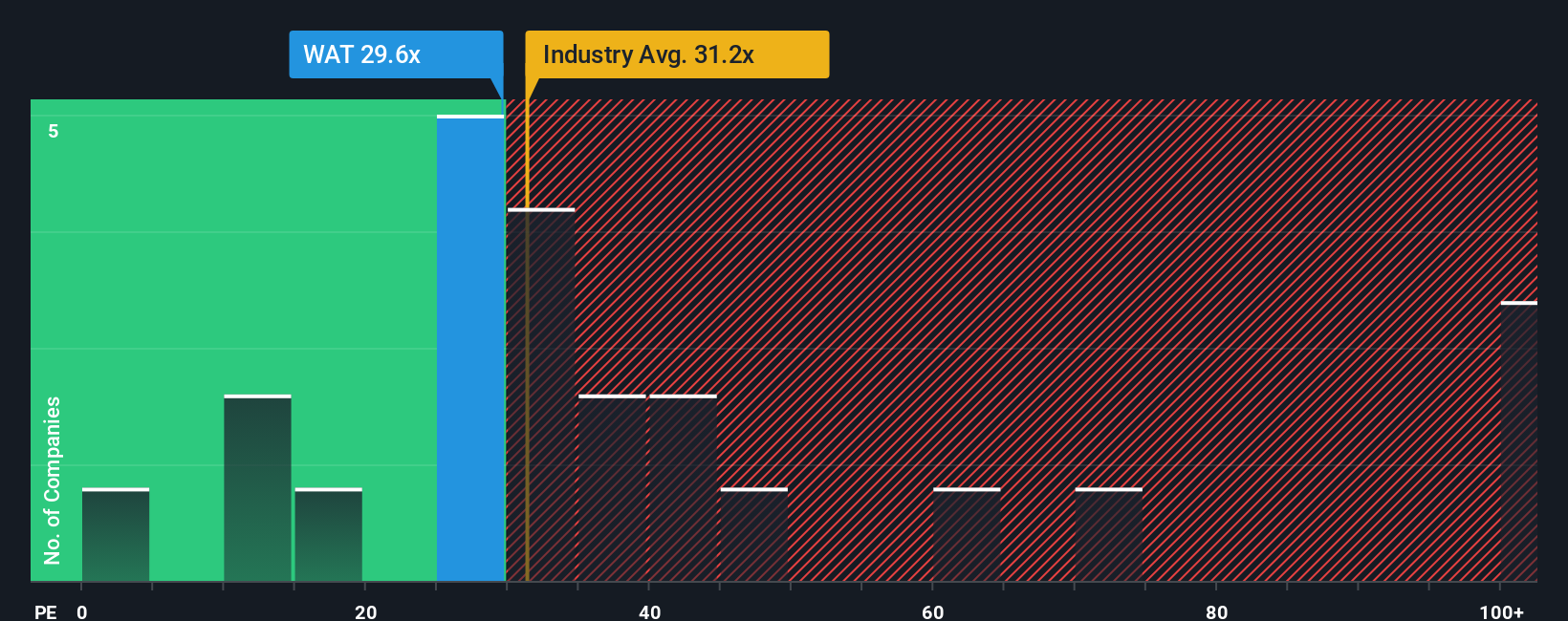

Looking at Waters’ valuation from a market pricing angle, its price-to-earnings ratio is 29x. This stands higher than the peer average of 25.9x and well above the fair ratio of 22.1x. This suggests investors may be paying a premium for the stock, which raises the question: does that premium reflect future growth or expose buyers to overvaluation risk?

Build Your Own Waters Narrative

If you think there’s a different angle to the Waters story or want to crunch the numbers yourself, you can quickly build your own view in just a few minutes with Do it your way.

A great starting point for your Waters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t get left behind while new trends take off. The smartest investors always look for fresh opportunities by tracking where momentum and value are building next.

- Capitalize on tomorrow’s biggest disruptors and see which companies are making noise with these 24 AI penny stocks.

- Lock in high yields by tapping into these 19 dividend stocks with yields > 3% and spot businesses rewarding shareholders right now.

- Position yourself ahead of the next wave in finance when you check out these 78 cryptocurrency and blockchain stocks making real moves in the digital market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.