Please use a PC Browser to access Register-Tadawul

Wayfair Google Alliance Puts AI Shopping And Valuation In Focus

Wayfair, Inc. Class A W | 81.43 | +2.34% |

- Wayfair (NYSE:W) has announced a partnership with Google to co develop the Universal Commerce Protocol.

- The initiative focuses on using AI to improve online shopping experiences for consumers and merchants.

- The companies aim to create shared standards that can be used across different platforms and retail channels.

Wayfair, an online home goods retailer, has been operating in an industry where digital shopping tools and AI driven recommendations are becoming more common across large marketplaces and smaller platforms alike. Retailers and tech firms have been testing ways to link product search, personalization, and checkout across multiple devices and channels, as shoppers expect more tailored and seamless experiences.

For you as an investor, this partnership highlights how NYSE:W is relying on a large technology provider for core commerce infrastructure and AI capabilities. Over time, the Universal Commerce Protocol could influence how other retailers and platforms approach interoperability and shopping standards. This may affect how competitive advantages in e commerce are built and maintained.

Stay updated on the most important news stories for Wayfair by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Wayfair.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$107.54 versus a consensus target of US$114.21, the price is around 6% below analysts' central view.

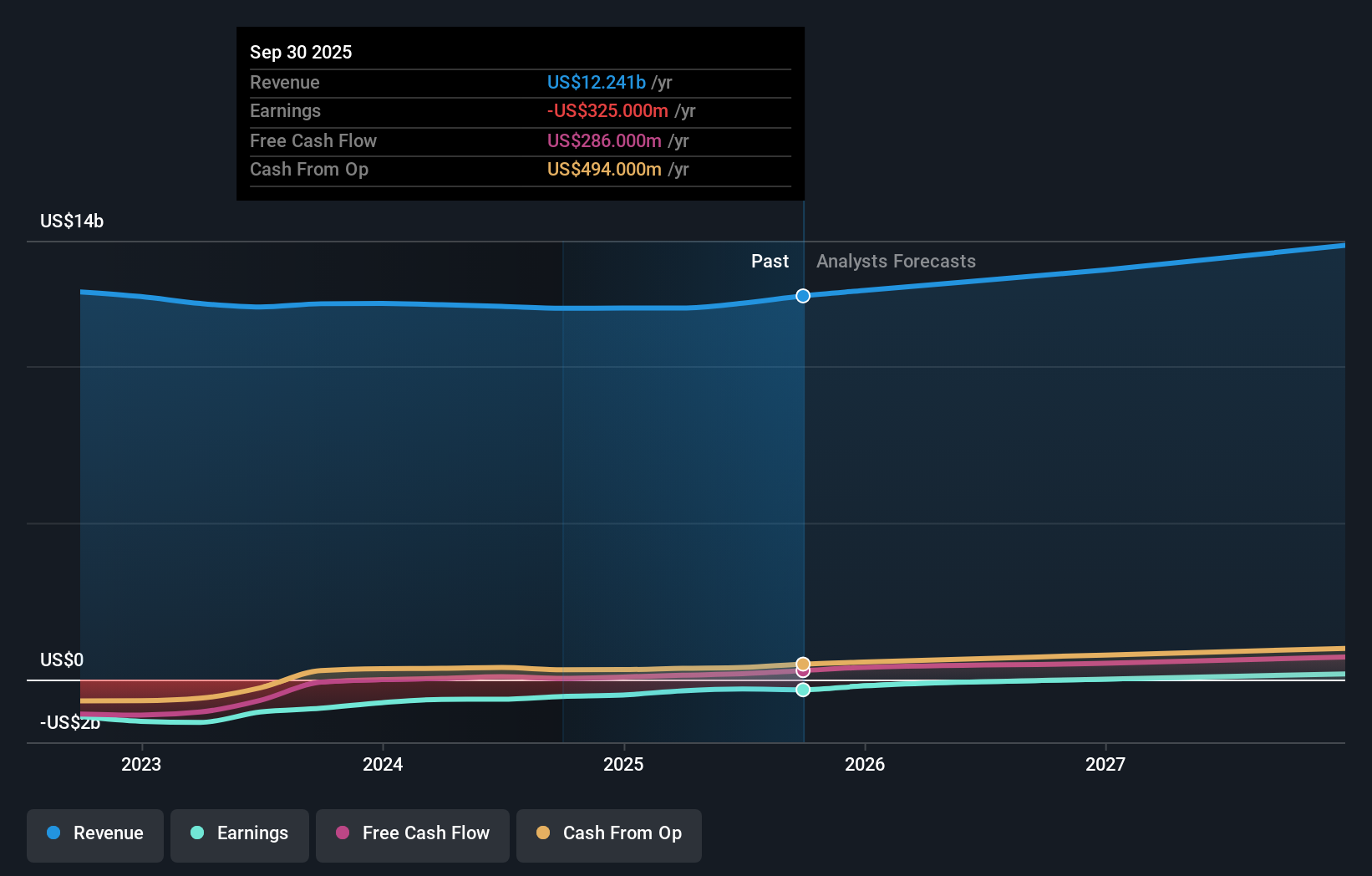

- ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading about 41.6% below its fair value.

- ✅ Recent Momentum: The 30 day return is about 6.4%, which shows positive recent momentum.

Check out Simply Wall St's in depth valuation analysis for Wayfair.

Key Considerations

- 📊 The Google partnership and Universal Commerce Protocol project link Wayfair more closely to AI driven shopping tools that could influence traffic, conversion and customer experience over time.

- 📊 Watch the gap between the current price and the analyst target range of US$80 to US$150, as well as any updates to Simply Wall St's estimated fair value as this initiative progresses.

- ⚠️ The presence of a major risk related to negative shareholders' equity means you should keep an eye on balance sheet strength if growth investments in AI and infrastructure continue.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Wayfair analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.