Please use a PC Browser to access Register-Tadawul

Waystar Adopts EDB Postgres AI As Shares Trade Below Valuation Estimates

Waystar Holding Corp. WAY | 25.07 | -2.79% |

- Waystar Holding (NasdaqGS:WAY) is adopting EDB Postgres AI to consolidate and scale its data infrastructure for healthcare payments.

- The move focuses on operationalizing artificial intelligence in mission critical healthcare transaction processing with an emphasis on reliability, efficiency, and data sovereignty.

Waystar Holding, trading at around $27.62, is making this technology shift at a time when its shares reflect recent pressure, with a 7 day return of 6.6% decline and a 30 day return of 16.2% decline. The stock is also down 12.0% year to date and 32.1% over the past year, which gives extra context to a move aimed at tightening its core payments infrastructure.

For investors, the adoption of EDB Postgres AI centers on how reliably and efficiently Waystar can handle sensitive, regulated healthcare payment data at scale. As the company executes on this transition, attention will be on whether the new setup supports transaction processing at high volumes while maintaining data control in a tightly regulated environment.

Stay updated on the most important news stories for Waystar Holding by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Waystar Holding.

Quick Assessment

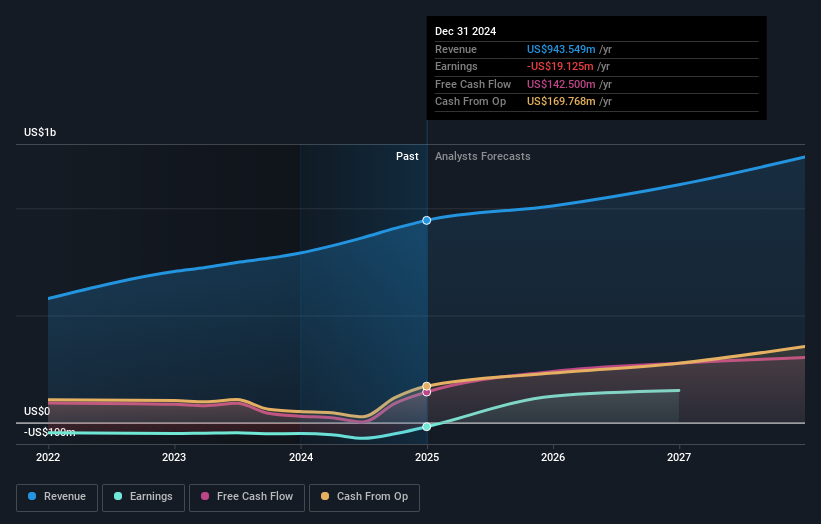

- ✅ Price vs Analyst Target: At US$27.62 versus a consensus target of US$46.90, the share price sits about 41% below analyst expectations.

- ✅ Simply Wall St Valuation: Simply Wall St estimates the stock is trading roughly 33.5% below its fair value, flagging it as undervalued.

- ❌ Recent Momentum: The 30 day return of about 16.2% decline shows recent negative momentum despite the infrastructure upgrade news.

Check out Simply Wall St's in depth valuation analysis for Waystar Holding.

Key Considerations

- 📊 The move to EDB Postgres AI targets more scalable, controlled handling of healthcare payment data. This sits at the core of Waystar's business model.

- 📊 Watch how efficiently the platform supports higher transaction volumes, any impact on margins around the current 10.7% net income margin, and progress relative to analyst expectations.

- ⚠️ The key risk is execution, as any disruption or delays in migrating critical payment workloads could affect revenue collection and investor confidence.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Waystar Holding analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.