Please use a PC Browser to access Register-Tadawul

Weibo (NasdaqGS:WB) Valuation in Focus After Beating Q2 2025 Earnings Expectations

Weibo Corp. Sponsored ADR Class A WB | 10.15 | -0.25% |

Weibo's Strong Earnings Spark Investor Interest

If you have been following Weibo (NasdaqGS:WB), you will have noticed the stock making a splash after the most recent earnings announcement. The company's second quarter report didn’t just beat analyst estimates; it delivered $0.54 earnings per share when only $0.43 was expected. That positive surprise got investors’ attention and gave the share price some extra fuel. But as anyone who has watched markets knows, one strong quarter can trigger a lot of excitement, sometimes more than long-term fundamentals would justify.

Stepping back, Weibo has seen its share price surge by 32% in the past three months, even while its core business metrics have looked more ordinary. Net income growth and return on equity mirror the industry average and remain relatively flat over the last five years. But with its recent move to pay dividends and earnings showing modest annual gains, the company’s latest results seem to have renewed optimism for future growth. Momentum has built up over the year, with the stock closing at a 52-week high of $12.5 and returning nearly 89% in the past twelve months, despite weaker long-term returns since 2020.

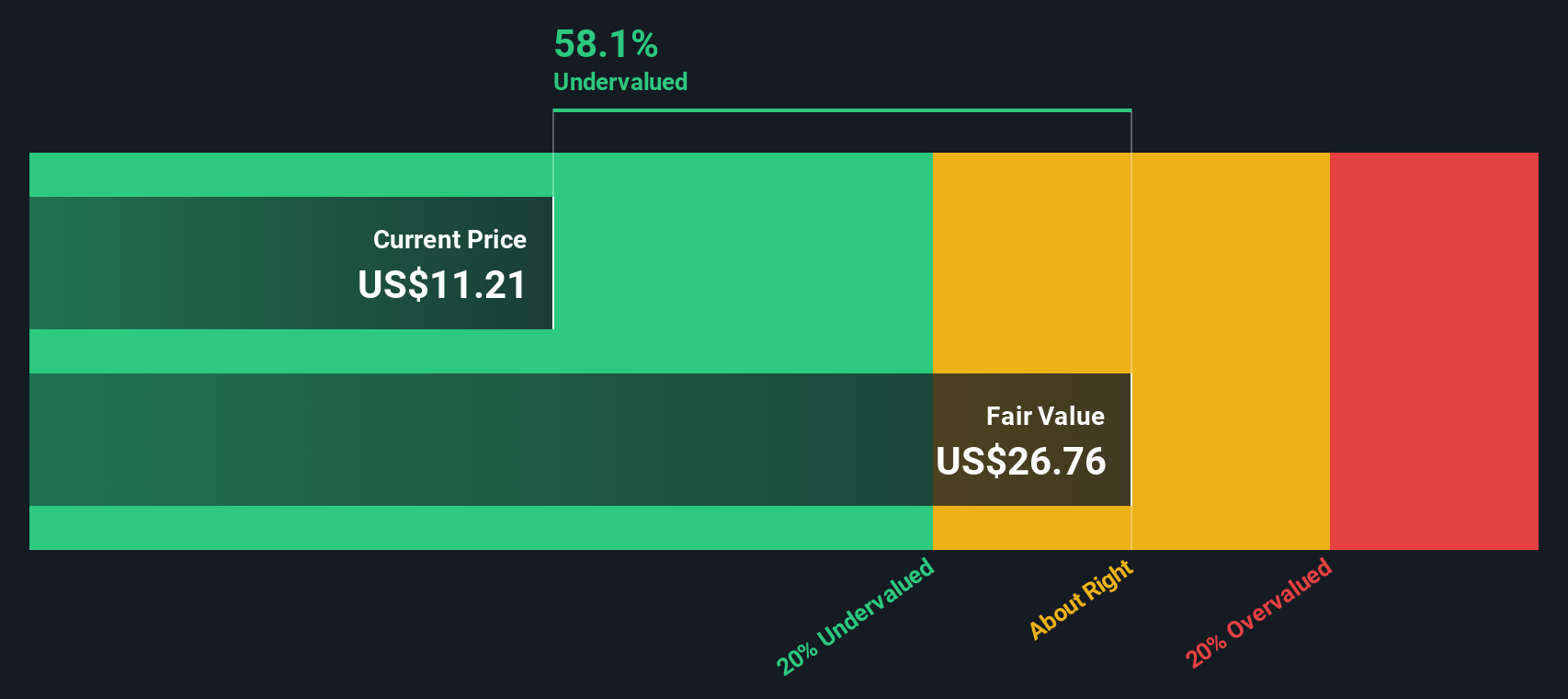

So after such a run, is Weibo undervalued or is the market already pricing in the next leg of growth?

Most Popular Narrative: 5% Overvalued

The current narrative views Weibo as slightly overvalued, estimating its fair value based on a blend of future earnings growth, profit margins, and a discounted cash flow model using a discount rate just above 10%.

Weibo's ongoing integration of advanced AI and large language models into its recommendation engine, content feed, and intelligent search is driving deeper user engagement and consumption efficiency. This lays the groundwork for expanding the user base and increasing the time spent on the platform, which should support sustained revenue and improved earnings as advertising inventory and monetizable traffic grow.

Curious why Weibo's valuation is under the microscope? Behind this narrative are bullish growth forecasts, profitability assumptions, and a price-to-earnings target that could surprise even seasoned investors. Wonder which metrics are moving the needle on fair value? The full narrative unpacks the projections and discount rate. It might change how you see the stock’s future trajectory.

Result: Fair Value of $11.96 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory uncertainty in China and increasing competition from short-video platforms could threaten Weibo’s earnings outlook and future valuation.

Find out about the key risks to this Weibo narrative.Another View: Discounted Cash Flow Model Tells a Different Story

While the most common valuation relies on forecasts and market multiples, the SWS DCF model presents a more optimistic picture for Weibo. According to this approach, the company is significantly undervalued by current market standards. Could this be where the real opportunity lies?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Weibo Narrative

If you have a different perspective or prefer to analyze the numbers on your own, it’s quick and easy to craft your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Weibo.

Looking for more investment ideas?

Unleash your portfolio’s potential with innovative themes and growth opportunities you might be missing right now. Move ahead and don’t let exciting investments pass you by!

- Capitalize on strong fundamentals by browsing penny stocks with impressive financial health. Check out penny stocks with strong financials making waves in the market.

- Ride the momentum in artificial intelligence and spot emerging AI trailblazers. Tap into exclusive picks with AI penny stocks transforming tomorrow’s industries.

- Get ahead of the curve by targeting value-packed opportunities. Find companies undervalued by their future cash flows in our tailored undervalued stocks based on cash flows selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.