Please use a PC Browser to access Register-Tadawul

Werner Enterprises (WERN): Evaluating Valuation Following Strong Quarterly Earnings Outperformance

Werner Enterprises, Inc. WERN | 35.57 35.57 | +2.33% 0.00% Post |

Werner Enterprises (WERN) just wrapped up an impressive quarter, outpacing analyst expectations for revenue, earnings per share, and adjusted operating income. This solid performance has caught the attention of investors and may influence stock sentiment going forward.

Werner Enterprises' strong earnings beat comes at a time when its share price has seen little momentum, with this year's share price return dipping into negative territory. The big-picture view is similar; a one-year total shareholder return of -0.23% suggests recent gains have yet to reverse the longer-term trend, but these fresh results could signal a turning point.

If you’re looking to uncover more companies with momentum and strong leadership, now might be the perfect moment to discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and a string of tough years behind it, investors have to weigh whether Werner Enterprises is currently undervalued and primed for a rebound or if the market has already accounted for future growth.

Most Popular Narrative: 5.6% Undervalued

Werner Enterprises finished the quarter above expectations, but the current price still sits slightly below where the most popular narrative values it. Focus is rapidly shifting to whether aggressive technology investments will reshape its longer-term prospects.

Continued investment in fleet modernization, digital platforms, and automation, including EDGE TMS and AI-driven efficiencies, is enabling meaningful structural cost reduction, improved productivity, and enhanced customer service. These investments are expected to drive expanding net margins and support long-term earnings growth as demand trends recover.

Here's the real intrigue: the fair value is built on a mix of expected margin expansion, technology-driven efficiencies, and key contract wins. Want to see which bold forecasts and future profit ratios set the stage for that price? Dig into the full breakdown for the surprising drivers behind the valuation.

Result: Fair Value of $29.07 (UNDERVALUED)

However, persistent insurance costs or rising driver shortages could quickly challenge Werner Enterprises' margin expansion story and future earnings trajectory.

Another View: Looking at Valuation Through Earnings

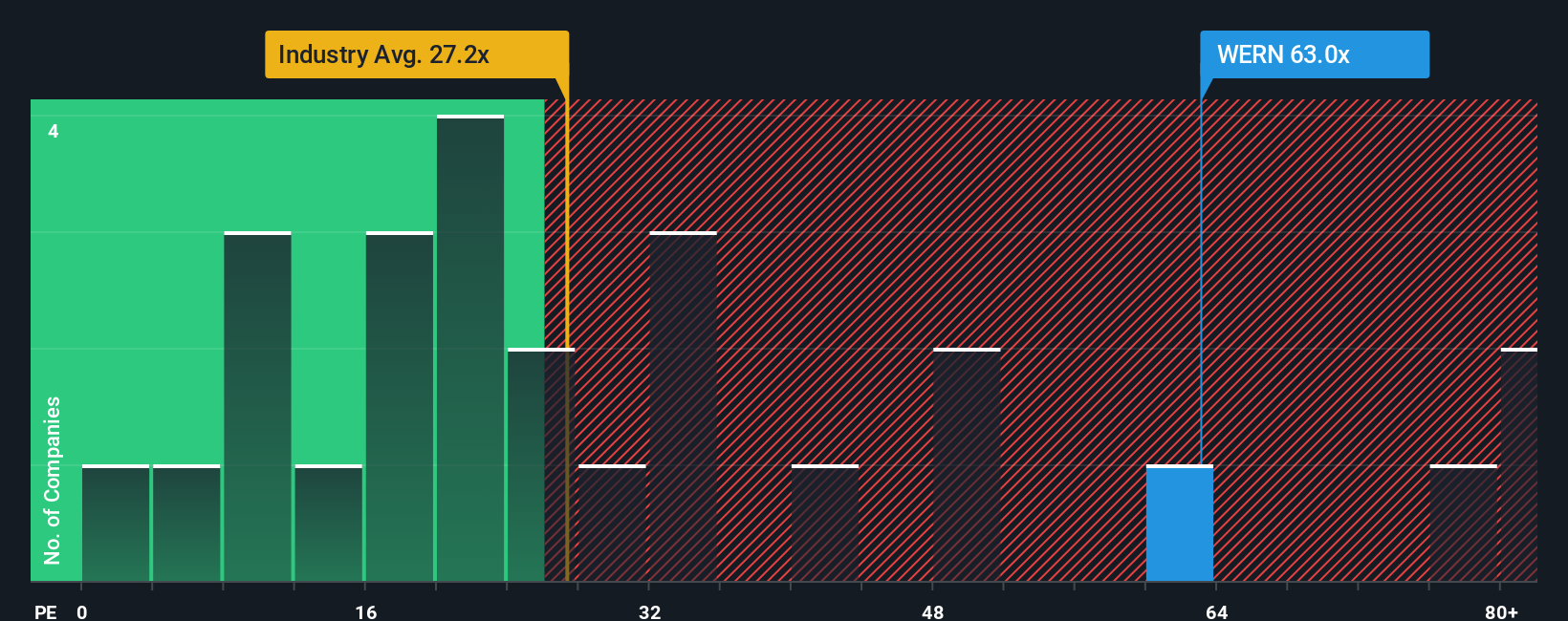

While the fair value estimate paints Werner Enterprises as undervalued, a glance at its earnings-based valuation tells a different story. The company trades on an earnings ratio of 30.2x, noticeably above the US Transportation industry average of 23.2x, its peer average of 22.5x, and even its own fair ratio of 14.1x. This notable premium highlights a risk: if investor sentiment shifts or earnings growth stalls, there could be more downside than upside in the short term. Is the market betting too much on a turnaround or simply pricing in future improvements that may never arrive?

Build Your Own Werner Enterprises Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can shape your own view in just a few minutes: Do it your way

A great starting point for your Werner Enterprises research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't limit your opportunities. There are sectors and stocks gaining momentum right now. Make your next move count by looking beyond the obvious winners.

- Unlock potential by reviewing these 900 undervalued stocks based on cash flows that could be trading at a discount and positioned for a turnaround.

- Capitalize on technological disruption by scanning these 24 AI penny stocks powering advances in artificial intelligence and automation.

- Boost your portfolio's passive income with these 19 dividend stocks with yields > 3% offering yields above 3% and strong dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.