Please use a PC Browser to access Register-Tadawul

Western Digital (WDC) Is Up 22.4% After Analyst Upgrades on AI Storage Demand and Capital Return Moves

Western Digital Corporation WDC | 176.34 | -5.80% |

- In recent days, Western Digital saw a surge in analyst upgrades as investment banks cited rising global demand for its hard disk drives, which are increasingly used to support artificial intelligence applications and cloud data centers.

- This growing optimism is underscored by Western Digital's focus on enterprise storage, recent divestiture of its flash memory business, and new capital return initiatives like share repurchases and recurring dividends, highlighting management’s confidence in future cash flows.

- We'll explore how heightened analyst confidence and focus on AI-driven storage demand may reshape Western Digital's investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Western Digital Investment Narrative Recap

To be a Western Digital shareholder today, you have to believe that the explosive growth in data generated by AI and cloud services will continue to drive demand for high-capacity hard disk drives, securing the company’s revenue and margin expansion. The latest surge in analyst upgrades highlights bullish sentiment, but the most important short-term catalyst, AI-driven hyperscale demand, remains closely linked to the company’s concentration risk, as any change in purchasing patterns by major cloud customers could prove material.

Among Western Digital’s recent announcements, the authorization of a $2 billion share repurchase program stands out. This move aligns with management’s stated confidence in future cash flows and directly supports the ongoing AI and cloud-led storage demand thesis that is underpinning both analyst optimism and strong recent market returns.

On the other hand, investors should be aware that over 90% of revenue comes from a handful of large customers, meaning...

Western Digital is projected to achieve $11.9 billion in revenue and $2.2 billion in earnings by 2028. This outlook relies on a 7.6% annual revenue growth rate and a $0.6 billion increase in earnings from the current $1.6 billion.

Uncover how Western Digital's forecasts yield a $97.91 fair value, a 25% downside to its current price.

Exploring Other Perspectives

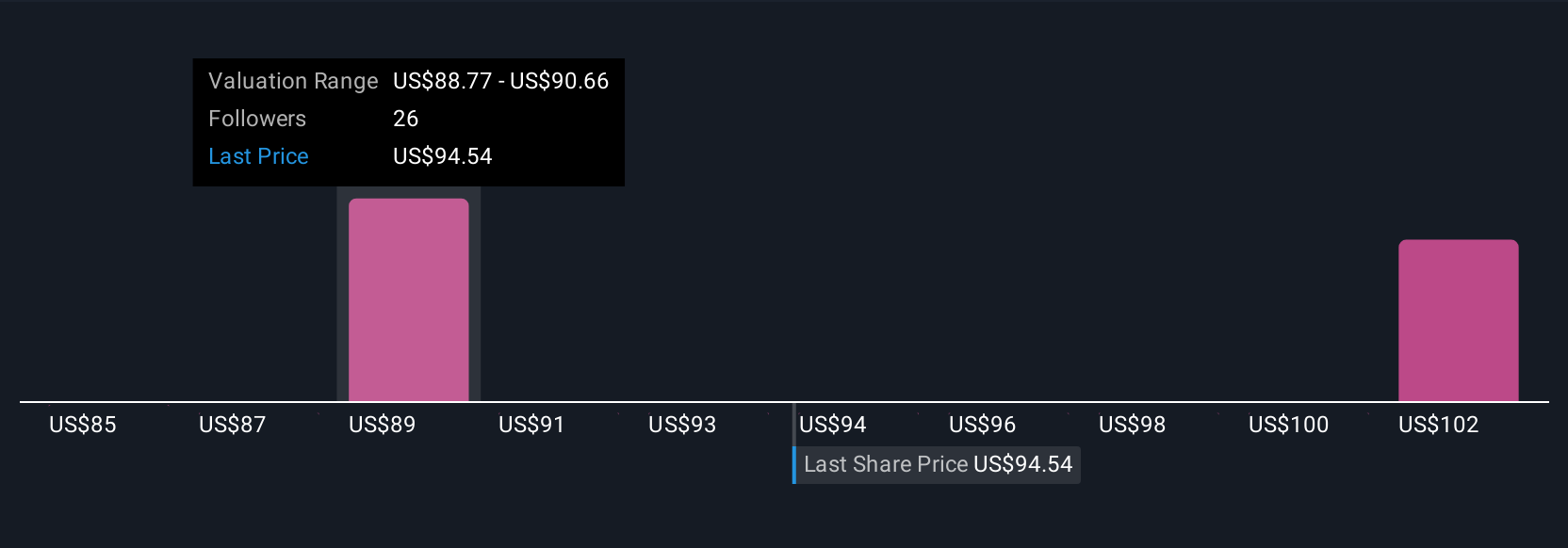

Four new fair value estimates from the Simply Wall St Community span US$85 to US$108, reflecting a broad spectrum of opinions. With much of Western Digital’s growth linked to a concentrated customer base, these contrasting perspectives highlight why scrutiny of demand sustainability is essential.

Explore 4 other fair value estimates on Western Digital - why the stock might be worth as much as $108.35!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.