Please use a PC Browser to access Register-Tadawul

What Alkami Technology (ALKT)'s New Credit Union Partnerships and Industry Awards Mean For Shareholders

ALKAMI TECHNOLOGY, INC. ALKT | 21.84 | -2.02% |

- In recent weeks, Alkami Technology announced expanded collaborations with Hanscom Federal Credit Union and Red Rocks Credit Union to provide gamified mobile banking and advanced digital platforms, while earning industry recognition from the 2025 IDC FinTech Rankings Top 50 and J.D. Power certifications.

- This move highlights the growing demand for tailored digital banking solutions among credit unions and further reinforces Alkami’s role as a preferred innovation partner in the financial technology sector.

- We’ll explore how Alkami’s new partnership-driven growth in digital banking impacts its investment narrative and outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alkami Technology Investment Narrative Recap

To own Alkami Technology shares, one needs to believe that accelerating demand for digital transformation among credit unions and community banks will support Alkami’s platform-driven growth, despite competitive risks and the company’s client concentration. The recent partnerships with Hanscom Federal Credit Union and Red Rocks Credit Union provide validation for Alkami’s solutions, but do not fundamentally change the biggest near-term catalyst, expanding cross-sell of digital banking modules, or reduce the most pressing risk tied to sector consolidation and larger fintech competitors.

Of the recent announcements, the expanded collaboration with Red Rocks Credit Union stands out, as it underscores Alkami’s focus on deepening existing client relationships through data-driven marketing and integrated digital solutions. This aligns directly with cross-sell momentum as a catalyst, reinforcing Alkami’s opportunity to boost recurring revenue and average contract value among a concentrated client base.

However, investors should be mindful that while Alkami is growing its platform reach, escalating competition from larger fintech or big tech entrants remains a real risk that could ...

Alkami Technology's narrative projects $743.3 million in revenue and $62.2 million in earnings by 2028. This requires 24.5% yearly revenue growth and a $100.7 million increase in earnings from the current level of $-38.5 million.

Uncover how Alkami Technology's forecasts yield a $38.44 fair value, a 56% upside to its current price.

Exploring Other Perspectives

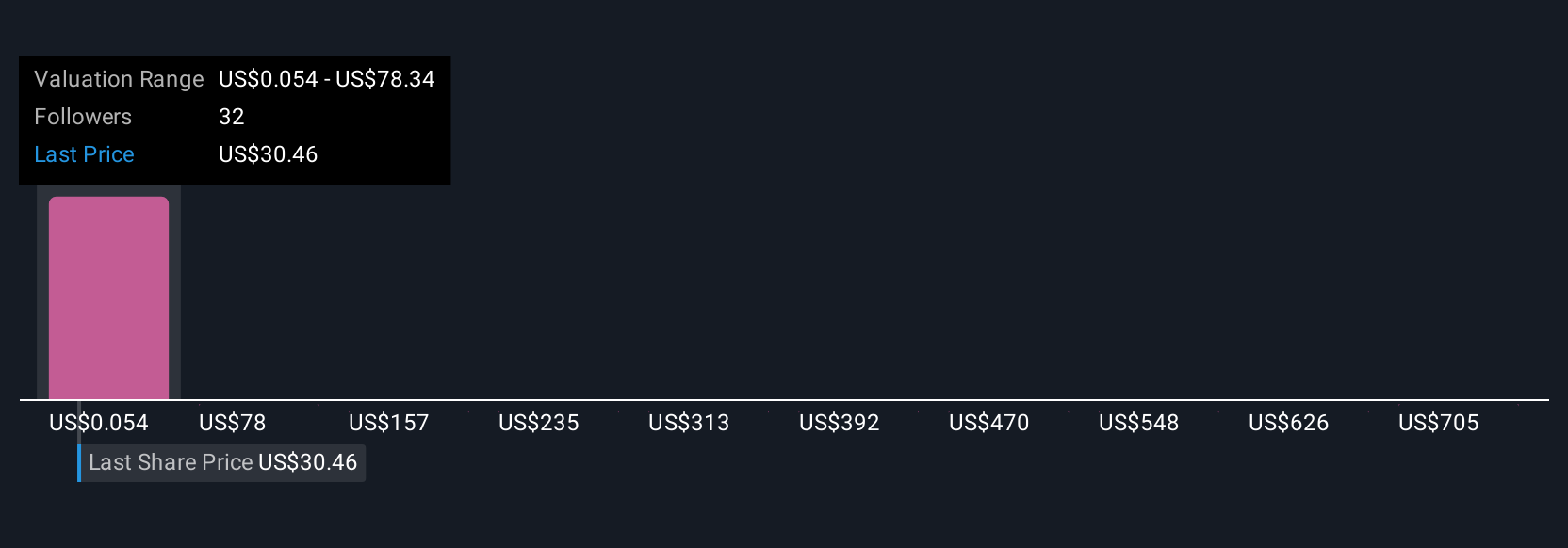

Ten analysts in the Simply Wall St Community estimate Alkami’s fair value between US$16.54 and US$122.14. With competitors moving fast in digital banking, these wide-ranging views highlight how much investor expectations about future performance can differ, consider exploring several different outlooks as you form your own view.

Explore 10 other fair value estimates on Alkami Technology - why the stock might be worth over 4x more than the current price!

Build Your Own Alkami Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alkami Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alkami Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alkami Technology's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.