Please use a PC Browser to access Register-Tadawul

What American Water Works Company (AWK)'s $1 Billion Equity Raise Means for Shareholders

American Water Works Company, Inc. AWK | 122.95 | -1.11% |

- American Water Works Company recently completed a US$1 billion follow-on equity offering of over 7 million common shares at US$142 each, with leading financial institutions including RBC Capital Markets, TD Securities, Truist Securities, and BofA Securities acting as co-lead underwriters.

- This sizable capital raise positions the company to pursue growth initiatives and provides fresh resources for infrastructure investments and potential acquisitions within the regulated water utility sector.

- We’ll explore how this significant equity financing round could influence American Water Works Company’s long-term expansion strategy and investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

American Water Works Company Investment Narrative Recap

To invest in American Water Works Company, you have to believe in the essential and growing demand for safe, reliable water services and the company’s ability to convert infrastructure spending into consistent, regulated returns. The recent US$1 billion equity raise provides fresh capital for acquisitions and infrastructure projects, supporting future growth initiatives, but it does not significantly alter the near-term catalyst of acquiring and integrating municipal systems, or directly mitigate the pressing risk of rising operating and financing costs.

One of the most relevant recent announcements was management’s stated commitment to an active pipeline of acquisitions, driven by regulatory requirements and infrastructure upgrades across multiple states. This aligns closely with the intended use of proceeds from the new equity raise, underscoring the importance of timely execution on acquisitions to accelerate revenue growth even as costs remain a concern.

On the flip side, investors should be aware that continued cost pressures, even as new capital is raised, could still lead to...

American Water Works Company's outlook projects $6.0 billion in revenue and $1.4 billion in earnings by 2028. This scenario assumes a 6.8% annual growth rate in revenue and a $0.3 billion increase in earnings from the current $1.1 billion.

Uncover how American Water Works Company's forecasts yield a $143.00 fair value, in line with its current price.

Exploring Other Perspectives

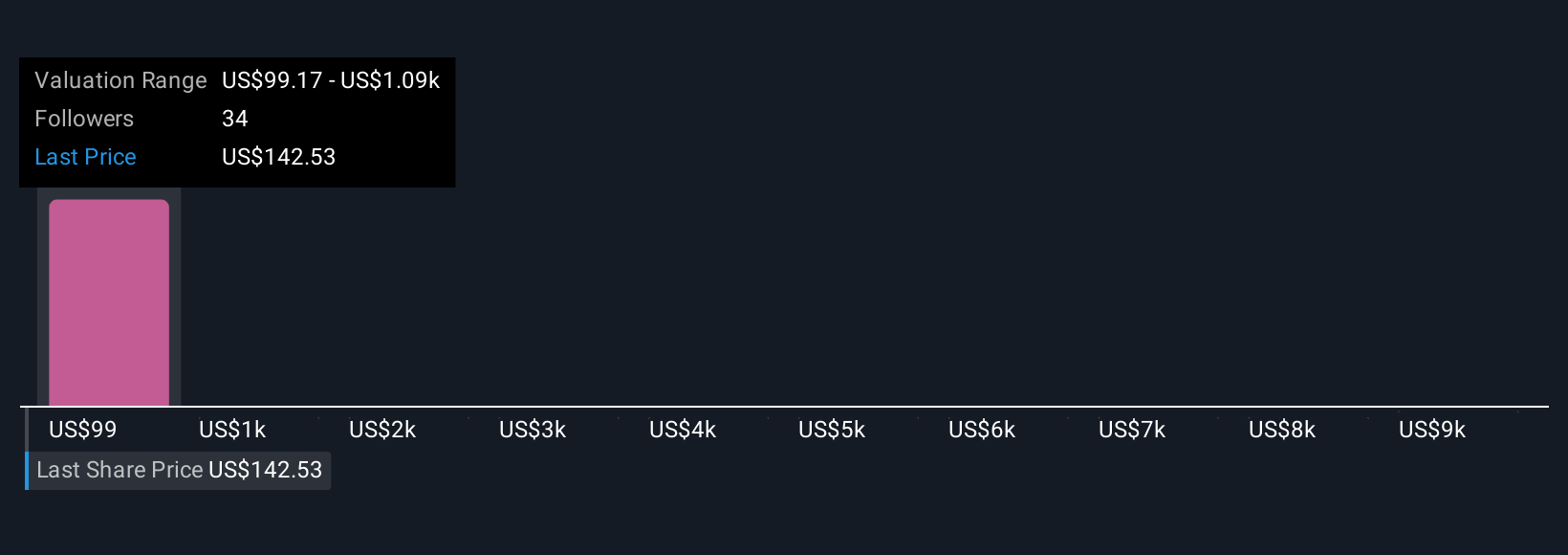

Four members of the Simply Wall St Community estimate fair value for American Water Works Company spanning from US$100 up to US$9,999 per share. This diversity of opinion stands in contrast to ongoing concerns about rising operating and financing costs, inviting you to consider a wide spectrum of potential outcomes.

Explore 4 other fair value estimates on American Water Works Company - why the stock might be worth 31% less than the current price!

Build Your Own American Water Works Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Water Works Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Water Works Company's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.