Please use a PC Browser to access Register-Tadawul

What Aramark (ARMK)'s Next-Gen Stadium Concessions Rollout Means for Shareholders

Aramark ARMK | 37.42 | -0.51% |

- Earlier this month, Aramark Sports + Entertainment introduced a series of innovative culinary offerings, advanced self-checkout technologies, and exclusive merchandise partnerships across eight top NFL stadiums to enhance the 2025 football season experience for fans.

- This rollout showcases Aramark’s commitment to combining local flavors with technological convenience, aiming to elevate venue engagement and differentiate its service portfolio in the competitive sports entertainment sector.

- We'll examine how Aramark's integration of next-generation concession technology could influence its growth outlook and earnings story.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Aramark Investment Narrative Recap

To own shares in Aramark today, you’d need confidence that its investments in technology and high-traffic venues can translate into sustained contract wins and margin growth, even as margin pressure from wages and medical costs remains a constant threat. The NFL stadium rollout adds short-term energy but likely isn't material enough to move the needle on Aramark’s most important catalyst: large contract renewals and incremental new business from marquee clients. The most significant near-term risk continues to be persistent labor cost pressures, which could impact operating leverage if not offset by productivity improvements or pricing discipline.

Of the recent announcements, the company’s expansion of self-checkout kiosks and exclusive merchandise collaborations in NFL venues stands out for its relevance to current catalysts. While this initiative enhances Aramark's brand visibility and ups potential customer engagement, the larger impact depends on driving meaningful volume growth and disciplined cost management given the ongoing challenge from rising labor and benefit expenses.

Yet despite robust recent innovation, it's crucial for investors to also consider how ongoing labor cost headwinds could...

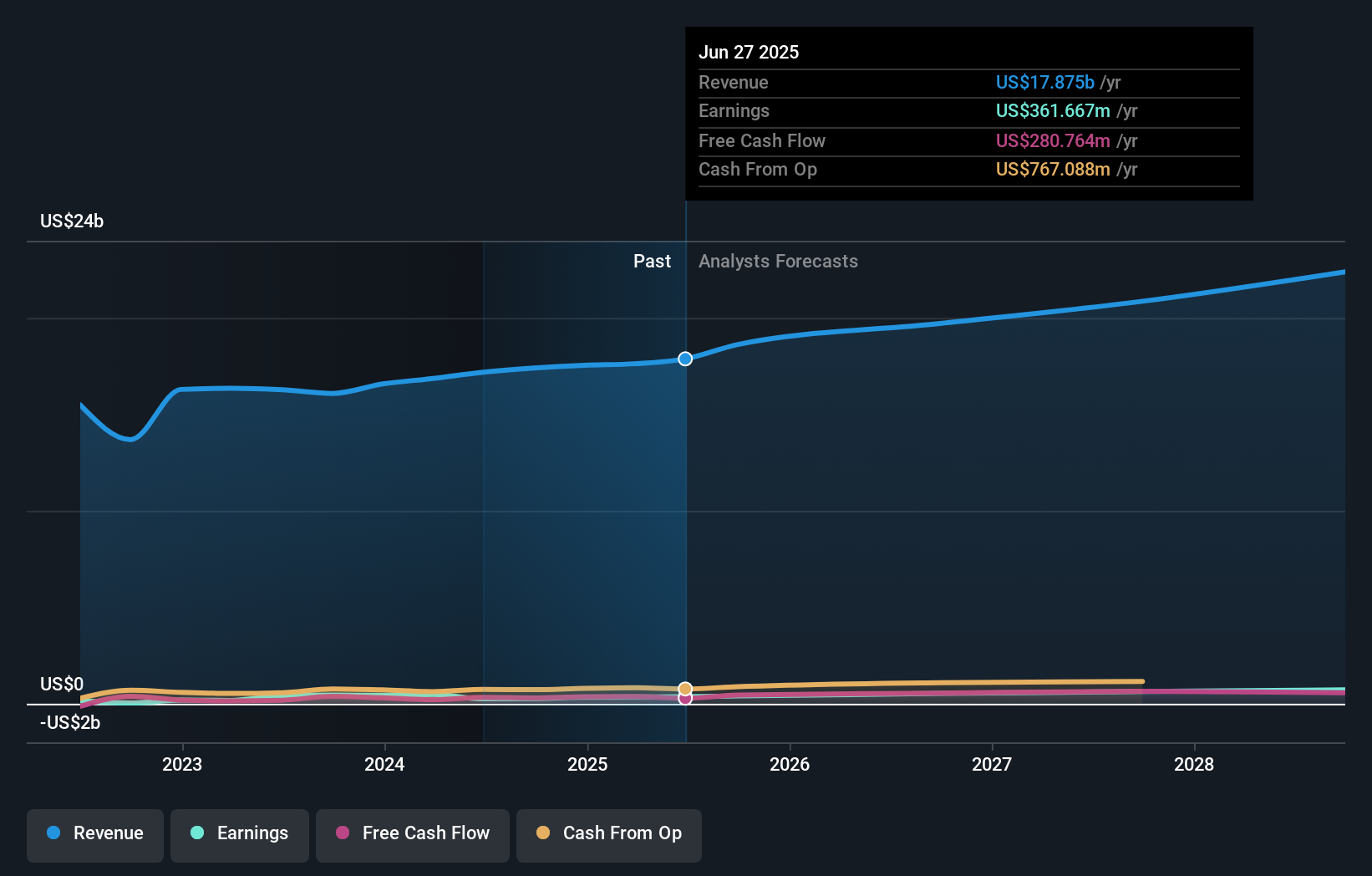

Aramark's narrative projects $21.9 billion revenue and $695.7 million earnings by 2028. This requires 7.1% yearly revenue growth and a $334 million earnings increase from $361.7 million today.

Uncover how Aramark's forecasts yield a $45.10 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two members of the Simply Wall St Community spanned from US$15 to US$45.10. While contract expansion anchors many expectations, persistent labor cost pressures remain a key issue that could shape future results, you may find other perspectives offer unique insights.

Explore 2 other fair value estimates on Aramark - why the stock might be worth less than half the current price!

Build Your Own Aramark Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aramark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aramark's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.