Please use a PC Browser to access Register-Tadawul

What Banc of California (BANC)'s J.P. Morgan Upgrade and Cost Savings Outlook Means For Shareholders

Banc of California, Inc. BANC | 19.83 | 0.00% |

- Earlier this week, J.P. Morgan upgraded Banc of California from Neutral to Overweight, highlighting expectations for lower funding costs and the potential for the bank to outperform its growth targets for loans and deposits in 2025.

- An important aspect of this upgrade is J.P. Morgan's suggestion that Banc of California may achieve greater expense reductions than previous guidance, warranting its addition to the positive catalyst watch list.

- We'll now explore how J.P. Morgan's confidence in Banc of California's cost-saving potential could impact the company's investment narrative.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

Banc of California Investment Narrative Recap

To invest in Banc of California, you need to believe the company can turn lower funding costs and expense reductions into sustainable improvement, despite its focus on Southern California commercial real estate and the execution risks from recent mergers. J.P. Morgan's recent upgrade adds weight to cost-saving and growth expectations, but it does not fundamentally change the importance of successfully integrating Pacific Western Bank, still the key catalyst for margin improvement, or the ongoing risk from asset concentration in a competitive market.

Among recent company news, the July 2025 share repurchase update stands out, with over 8.8 million shares repurchased last quarter and total buybacks hitting US$150 million. This is closely tied to the key catalyst of realizing merger synergies and indicates management’s focus on returning capital while executing on integration and efficiency.

Yet, in contrast to optimism about operating leverage, investors should be mindful of how region-specific commercial real estate exposure could affect...

Banc of California's outlook sees revenue reaching $1.4 billion and earnings rising to $382.6 million by 2028. Achieving this would require annual revenue growth of 15.0% and an earnings increase of approximately $275 million from the current $107.9 million level.

Uncover how Banc of California's forecasts yield a $18.05 fair value, a 6% upside to its current price.

Exploring Other Perspectives

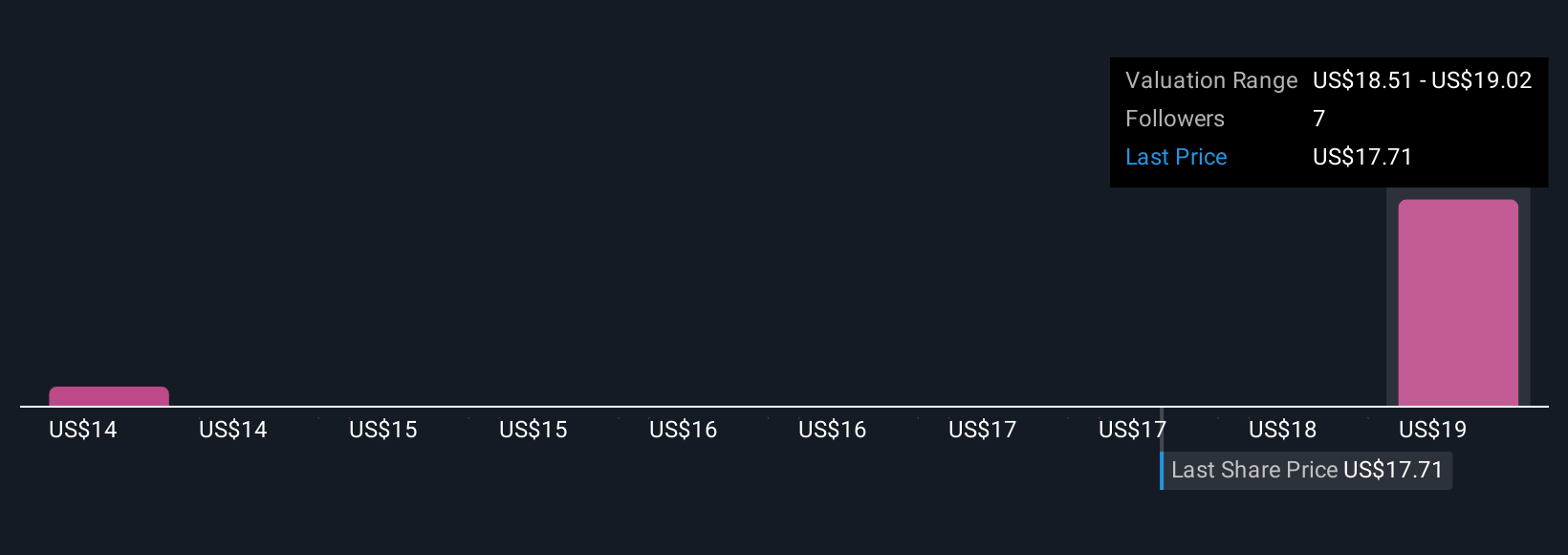

Members of the Simply Wall St Community produced three fair value estimates for Banc of California ranging from US$13.85 to US$18.43 per share. Their estimates show just how differently market participants weigh execution risk around cost-cutting and merger integration, offering you several alternative viewpoints on the company’s outlook.

Explore 3 other fair value estimates on Banc of California - why the stock might be worth 19% less than the current price!

Build Your Own Banc of California Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banc of California research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Banc of California research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banc of California's overall financial health at a glance.

No Opportunity In Banc of California?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.