Please use a PC Browser to access Register-Tadawul

What BILL Holdings (BILL)'s Embedded AP Automation Partnership With Acumatica Means For Shareholders

Bill.com Holdings BILL | 54.55 | -0.75% |

- Acumatica and BILL jointly announced a partnership to embed BILL’s Accounts Payable automation into Acumatica Cloud ERP, offering U.S. customers integrated bill management and payment directly within the ERP platform.

- This collaboration enables Acumatica users to streamline financial workflows across multiple industries by leveraging BILL’s extensive payment network and automation features within a single, unified experience.

- We'll explore how embedding BILL's AP automation within Acumatica Cloud ERP may accelerate embedded finance adoption and impact BILL Holdings’ growth narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

BILL Holdings Investment Narrative Recap

To invest in BILL Holdings, you need confidence in the continued digital transformation of SMB financial operations and the company’s ability to scale embedded finance products through partnerships. The recent Acumatica integration directly aligns with the critical near-term catalyst of distribution expansion, though risks surrounding SMB spending trends and competitive pressures from larger fintech providers remain front of mind for shareholders.

Among recent announcements, the partnership with Oracle NetSuite stands out alongside Acumatica as a meaningful development in broadening BILL’s embedded finance reach. These moves reinforce the focus on unlocking new distribution channels and building product stickiness, factors that could be pivotal in determining whether transaction growth keeps pace with market expectations.

By contrast, investors should also be aware of the risk that competitive pressures from fintech giants could...

BILL Holdings is projected to reach $2.1 billion in revenue and $94.8 million in earnings by 2028. This outlook assumes a 13.2% annual revenue growth rate and a $71 million increase in earnings from the current $23.8 million.

Uncover how BILL Holdings' forecasts yield a $61.05 fair value, a 19% upside to its current price.

Exploring Other Perspectives

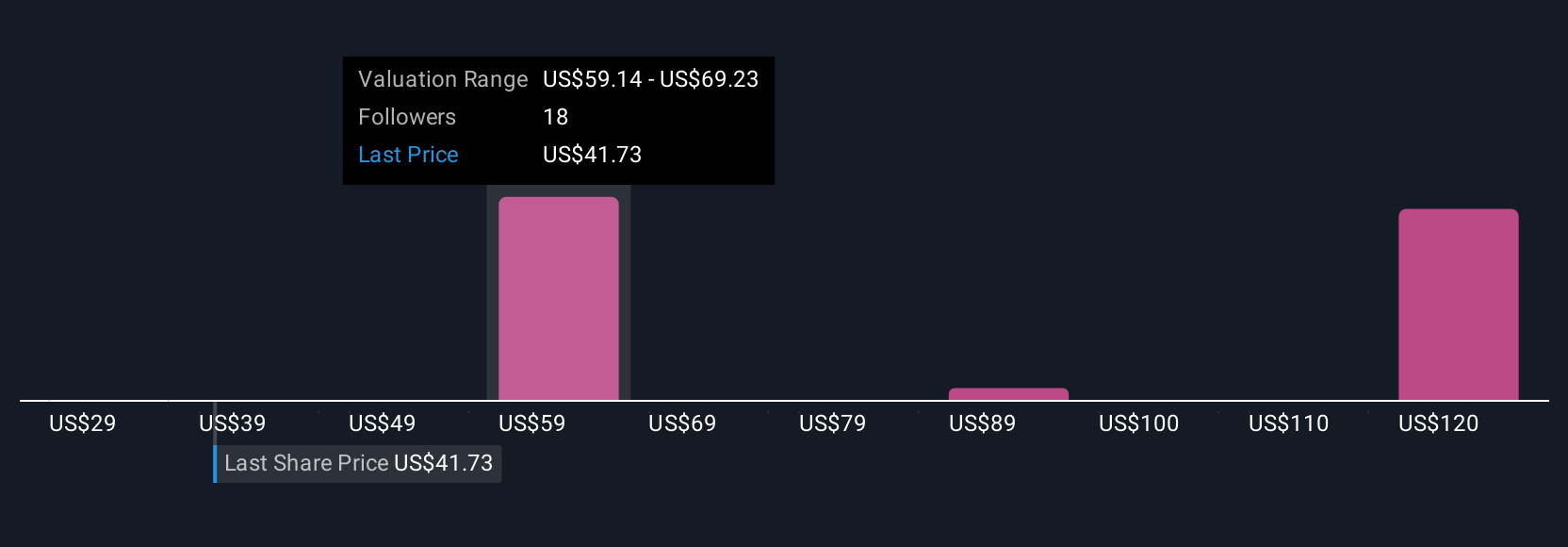

Five individual fair value assessments from the Simply Wall St Community range from US$61.05 to US$92.76 per share. As you compare these opinions, keep in mind how new embedded finance partnerships may influence future customer acquisition and revenue sustainability.

Explore 5 other fair value estimates on BILL Holdings - why the stock might be worth just $61.05!

Build Your Own BILL Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BILL Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BILL Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BILL Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.