Please use a PC Browser to access Register-Tadawul

What Bitdeer Technologies Group (BTDR)'s Rising Sales and Deepening Losses Mean for Shareholders

Bitdeer Technologies Holding Co Ordinary Shares BTDR | 10.01 | +1.62% |

- Earlier this month, Bitdeer Technologies Group reported second quarter 2025 earnings, with sales rising to US$155.58 million but a net loss increasing to US$147.73 million compared to the same period last year.

- Despite higher quarterly sales and a six-month shift to net income, the company reported a much larger quarterly net loss, reflecting the complexity of its financial performance.

- We'll explore how the combination of higher sales and a substantial quarterly net loss impacts Bitdeer's long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Bitdeer Technologies Group Investment Narrative Recap

To be a shareholder in Bitdeer Technologies Group, you need to believe in its ability to grow and diversify revenue streams by scaling self-mining operations and leveraging proprietary ASIC technology, despite ongoing losses and volatility. The recent Q2 2025 results, with higher sales but a sharply higher net loss, don't appear to materially shift the most important short-term catalyst, successful commercialization of ASICs, and the biggest risk: high operating expenses putting pressure on margins.

Of the recent announcements, the June 2025 self-mining update stands out, with a 39% monthly increase in self-mined Bitcoin due to new SEALMINER hardware. This production growth is closely tied to the company's goal of expanding its mining capacity and achieving stronger revenue through internal improvements, which remains a key catalyst as Bitdeer seeks scale advantages.

Yet, in contrast to surging mining production, the elevated net loss this quarter signals there are financial hurdles that investors should be aware of, especially if...

Bitdeer Technologies Group's narrative projects $1.7 billion in revenue and $196.5 million in earnings by 2028. This requires 76.7% yearly revenue growth and a $386.8 million increase in earnings from the current -$190.3 million.

Uncover how Bitdeer Technologies Group's forecasts yield a $22.22 fair value, a 66% upside to its current price.

Exploring Other Perspectives

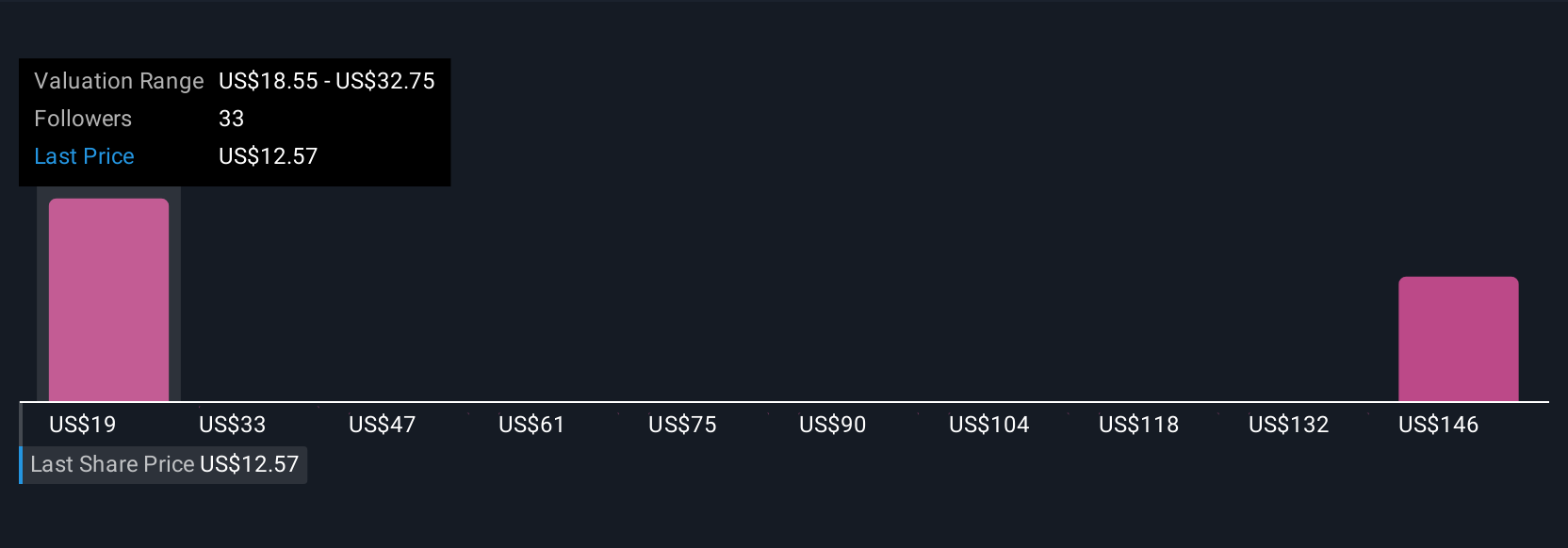

Seven members of the Simply Wall St Community estimate Bitdeer’s fair value between US$18.55 and US$178.45. Despite these broad views, high operating expenses continue to raise questions about the path to consistent profitability, so consider how different outlooks can affect your own assessment.

Explore 7 other fair value estimates on Bitdeer Technologies Group - why the stock might be a potential multi-bagger!

Build Your Own Bitdeer Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bitdeer Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitdeer Technologies Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.