Please use a PC Browser to access Register-Tadawul

What BOK Financial (BOKF)'s Rising Credit Quality Scrutiny Means for Shareholders

BOK Financial Corporation BOKF | 119.09 119.09 | -1.22% 0.00% Pre |

- In the days leading up to BOK Financial's upcoming earnings release, disclosures of significant loan quality issues at other regional banks raised fresh concerns about industry-wide credit risks and potential loan losses. These developments have placed added focus on BOK Financial's exposure to credit trends and loan performance in the context of wider sector uncertainty.

- We'll examine how heightened attention to credit quality across regional banks shapes BOK Financial's investment narrative ahead of its quarterly results.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BOK Financial Investment Narrative Recap

To be a shareholder in BOK Financial, you need confidence in the long-term demand for regional banking services across fast-growing markets in the Midwest and Sun Belt, as well as the bank’s ability to maintain credit discipline even as commercial real estate and energy exposures grow. The recent disclosures regarding loan quality problems at peer banks have sharpened near-term investor focus on credit risk, a top concern already facing BOK Financial ahead of earnings. Unless new credit losses are announced, this news does not appear to materially alter the key catalyst or primary risk for the company right now.

The most relevant recent announcement is BOK Financial’s upcoming Q3 2025 earnings report, scheduled for October 20. With consensus expecting revenue to rise and a focus on credit quality following sector concerns, these results could serve as a pivotal update on the company’s core loan portfolio health and management’s outlook in this climate of heightened scrutiny.

In contrast, investors should keep in mind the specific risks tied to BOK Financial’s concentration in commercial real estate and energy loans, which...

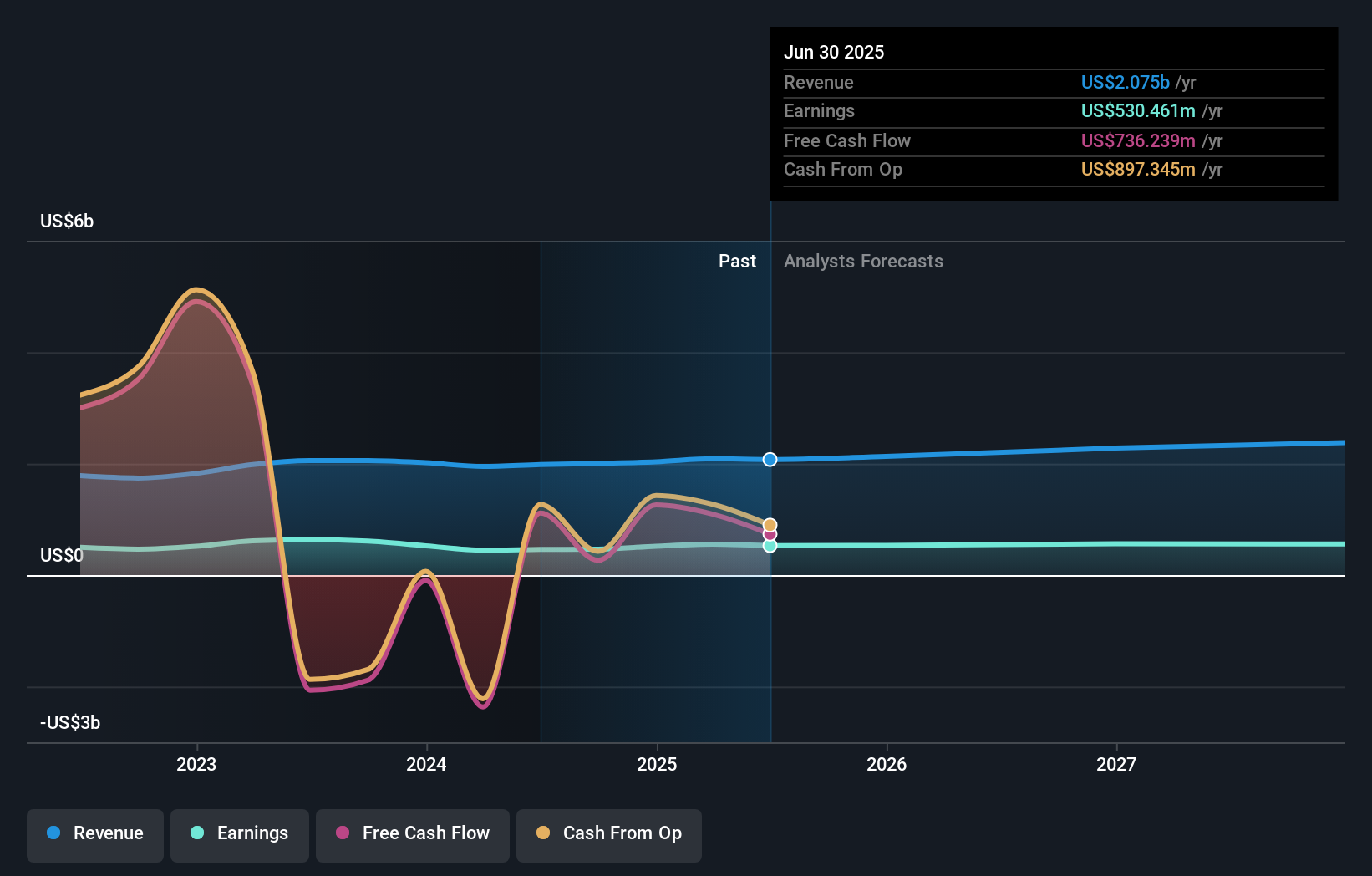

BOK Financial's narrative projects $2.5 billion in revenue and $579.1 million in earnings by 2028. This requires 5.9% yearly revenue growth and a $48.6 million earnings increase from the current $530.5 million.

Uncover how BOK Financial's forecasts yield a $117.60 fair value, a 9% upside to its current price.

Exploring Other Perspectives

One fair value estimate from the Simply Wall St Community places BOK Financial at US$146.35 per share. With concerns rising about credit quality across regional banks, you might find wide-ranging opinions among market participants worth exploring further.

Explore another fair value estimate on BOK Financial - why the stock might be worth just $146.35!

Build Your Own BOK Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BOK Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free BOK Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BOK Financial's overall financial health at a glance.

No Opportunity In BOK Financial?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.