Please use a PC Browser to access Register-Tadawul

What BWX Technologies (BWXT)'s TRISO Fuel Milestone and US$2.6B Defense Contracts Mean For Shareholders

BWX Technologies, Inc. BWXT | 175.88 | -0.73% |

- In July 2025, BWX Technologies announced a key milestone in advanced TRISO nuclear fuel manufacturing and secured US$2.6 billion in new U.S. Naval Nuclear Propulsion Program contracts supporting submarine and aircraft carrier reactors over the next six to eight years.

- This combination of technological advancement and long-term government contract wins demonstrates BWXT's momentum both in next-generation nuclear innovation and in sustaining its core defense business.

- We'll explore how BWXT's advanced TRISO fuel manufacturing milestone adds to its evolving investment case in nuclear technologies.

BWX Technologies Investment Narrative Recap

To be a shareholder in BWX Technologies, you need to believe in the long-cycle potential of nuclear technology, particularly for advanced fuels and government-related defense projects. The recent TRISO fuel milestone and large naval contracts may help maintain momentum in core defense operations, but are unlikely to materially impact the most pressing short-term risk, inflation and raw material cost pressures in the commercial operations segment.

The most relevant recent announcement is the US$2.6 billion in new contracts with the U.S. Naval Nuclear Propulsion Program, a key catalyst for stable and visible government revenue streams. These long-term awards reinforce confidence in BWXT’s government operations, helping to offset uncertainties in emerging sectors like microreactors and medical isotopes.

However, even with defense stability, investors should be aware of potential inflationary impacts in commercial operations, as...

BWX Technologies is projected to reach $3.7 billion in revenue and $445.4 million in earnings by 2028. This outlook is based on an anticipated annual revenue growth rate of 10.2% and a $156.5 million increase in earnings from the current $288.9 million.

Exploring Other Perspectives

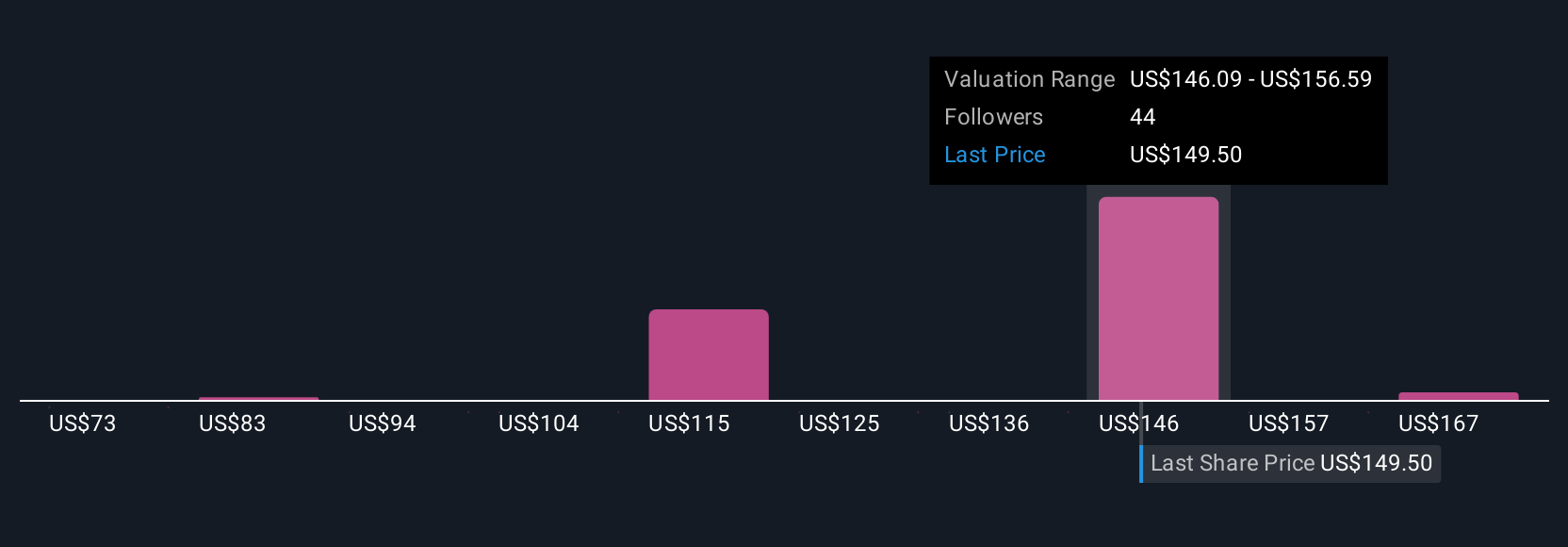

Seven members of the Simply Wall St Community see fair value between US$72.55 and US$177.60 per share, showing strongly varied opinions. While optimism on government contract growth stands out, be sure to consider a wide spectrum of alternative valuations before deciding.

Build Your Own BWX Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free BWX Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BWX Technologies' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.