Please use a PC Browser to access Register-Tadawul

What Cboe Global Markets (CBOE)'s Exit from Japanese Equities Means for Shareholders

CBOE Holdings, Inc. CBOE | 253.02 253.02 | +0.76% 0.00% Pre |

- Cboe Global Markets has announced it will wind down its Japanese equities business, including ceasing operations for its proprietary trading system and block trading platform, with plans to suspend activities by August 29, 2025, pending regulatory consultations.

- This move reflects Cboe's approach to concentrate its efforts and resources on markets and opportunities deemed more likely to enhance shareholder value amidst changing business conditions in Japan.

- We'll explore how Cboe's exit from the Japanese equities market could reshape its global focus and reinforce its resource allocation strategy.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cboe Global Markets Investment Narrative Recap

To believe in Cboe Global Markets as a shareholder, you have to trust in its ability to grow by focusing on the most promising market opportunities, particularly in options and derivatives trading. The decision to wind down its Japanese equities business does not appear to have a material impact on the company’s near-term catalysts, such as the expansion of options products and platform innovations, nor does it directly escalate the most pressing risks like regulatory delays or technology execution challenges.

One relevant recent announcement is Cboe’s guidance update, which projected mid to high single-digit organic net revenue growth for 2025. This positive outlook was reaffirmed following the company’s strong Q1 performance, demonstrating that management remains focused on initiatives with the potential for the highest returns, despite withdrawing from lower potential areas like Japanese equities.

By contrast, investors should also keep an eye on how regulatory approvals for new trading hours could pose...

Cboe Global Markets' narrative projects $2.5 billion in revenue and $1.0 billion in earnings by 2028. This requires a 16.9% annual revenue decline and an earnings increase of $197.9 million from current earnings of $802.1 million.

Uncover how Cboe Global Markets' forecasts yield a $235.40 fair value, a 3% downside to its current price.

Exploring Other Perspectives

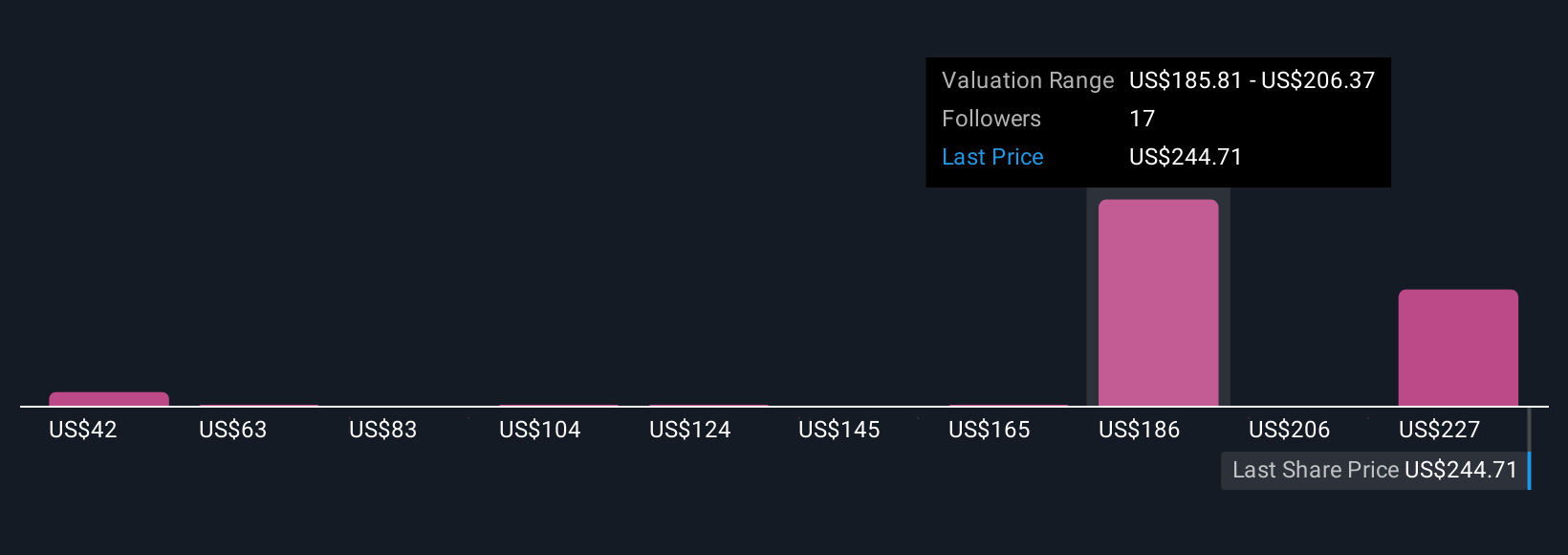

Nine fair value estimates from the Simply Wall St Community range from as low as US$41.96 to US$235.40 per share. While many see diverse futures for Cboe, the company’s emphasis on product growth and platform migration is a point you should weigh while reviewing these differing viewpoints.

Explore 9 other fair value estimates on Cboe Global Markets - why the stock might be worth as much as $235.40!

Build Your Own Cboe Global Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cboe Global Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cboe Global Markets' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.