Please use a PC Browser to access Register-Tadawul

What Cloudflare (NET)'s Digital Inclusion and Stablecoin Initiatives Mean for Shareholders

Cloudflare NET | 202.44 | -2.65% |

- In late September 2025, Cloudflare announced several major initiatives, including a partnership with Giga to help UNICEF and the ITU use its Speed Test solution for monitoring and improving school Internet connectivity worldwide, new tools for content control, and the introduction of a USD-backed stablecoin and open payments standard for the AI-driven web.

- These developments position Cloudflare at the intersection of digital infrastructure, payments innovation, and ethical content management, highlighting its expanding influence across key sectors shaping the future of the Internet.

- We'll examine how Cloudflare's collaboration with global partners to bridge the digital divide could impact its long-term growth narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

Cloudflare Investment Narrative Recap

To own Cloudflare stock, you need to believe in its ability to expand as a core provider of digital infrastructure and security, capturing new growth by supporting the AI-driven internet and large-scale partnerships. While recent partnerships and payments innovation highlight Cloudflare’s ambition, customer concentration and uncertain monetization of new initiatives remain the most important short-term catalyst and risk; these news events, while promising, do not immediately change those dynamics.

Among recent announcements, Cloudflare’s NET Dollar stablecoin is particularly relevant, as it is intended to support transaction models for a more autonomous, agentic web. This aligns directly with the company’s efforts to capture emerging revenue streams, but meaningful financial impact will depend on execution and adoption rates for these advanced payment solutions.

However, despite Cloudflare’s progress, persistent margin pressure and unanswered questions about the durability of its profitability growth are risks investors should be aware of if...

Cloudflare's narrative projects $3.8 billion revenue and $176.4 million earnings by 2028. This requires 26.5% yearly revenue growth and a $293.5 million increase in earnings from -$117.1 million today.

Uncover how Cloudflare's forecasts yield a $209.01 fair value, a 7% downside to its current price.

Exploring Other Perspectives

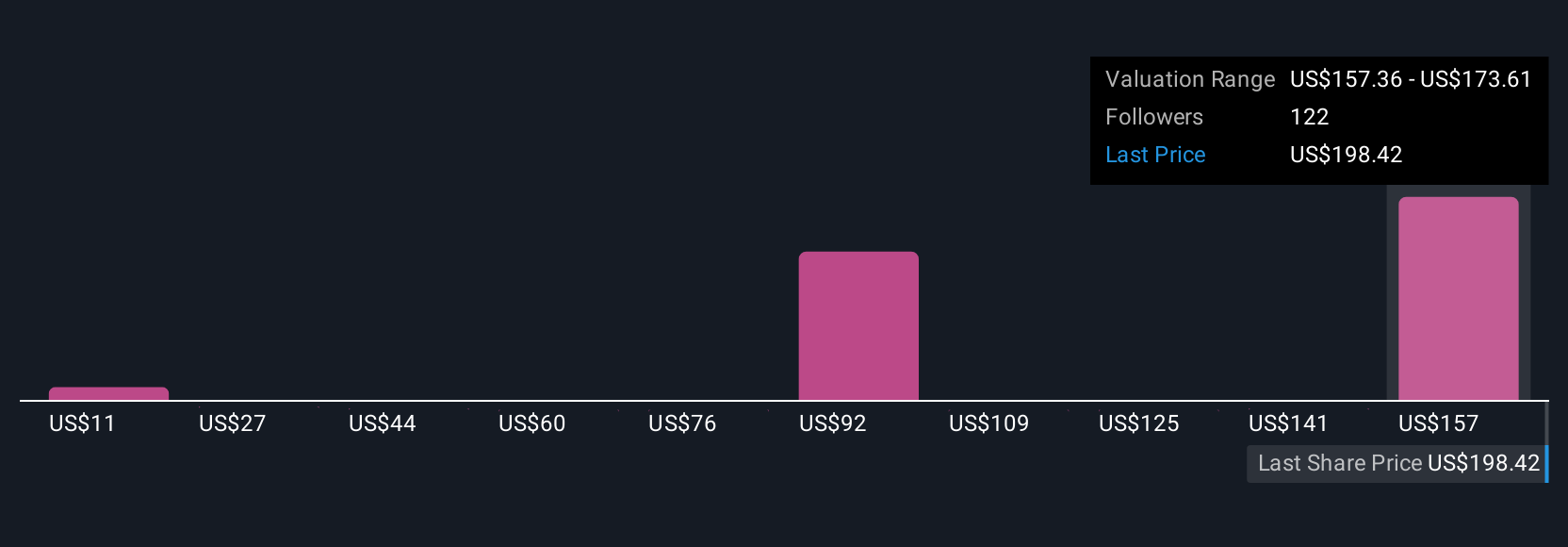

The Simply Wall St Community’s 32 fair value estimates for Cloudflare run from as low as US$11.11 up to US$209.01, a wide spectrum that reflects starkly different growth and risk expectations. With gross margins declining and profitability still some way off, you should weigh these diverse views alongside ongoing margin pressure to see how your outlook compares.

Explore 32 other fair value estimates on Cloudflare - why the stock might be worth less than half the current price!

Build Your Own Cloudflare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Cloudflare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cloudflare's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.