Please use a PC Browser to access Register-Tadawul

What CME Group (CME)'s Middle East Move and Crypto Derivatives Expansion Means for Shareholders

CME Group Inc. Class A CME | 273.55 | +0.88% |

- CME Group has recently expanded into the Middle East with the opening of a Dubai office under a DFSA license and introduced new options on Solana (SOL) and XRP futures, accompanied by the launch of the USD/AED currency pair trading on EBS Market and EBS Direct.

- These moves underscore CME Group’s efforts to reach a broader international client base and broaden its suite of cryptocurrency derivatives, reflecting both regional growth ambitions and increasing institutional demand for crypto-related risk management tools.

- We’ll now explore how CME Group’s entry into the Middle East, led by a new Dubai office, could shape its investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CME Group Investment Narrative Recap

To be a shareholder in CME Group, you need to believe in the continued growth of global derivatives trading, driven by persistent demand for risk management across asset classes, as well as the company’s ability to broaden its international client base and product offering. While CME Group’s move into Dubai and the expansion of cryptocurrency-related products align with key long-term growth themes, these developments aren't expected to materially alter the most significant near-term catalyst, global volatility levels, or address the major risk of prolonged periods of market calm reducing trading volumes.

Of the company’s recent announcements, the launch of new options on Solana (SOL) and XRP futures stands out as most directly related to the expansion in Dubai, given the rising institutional demand for regulated crypto derivatives in emerging markets. The introduction of diverse cryptocurrency contracts aligns with CME’s goal of maintaining relevance as institutional preferences evolve, though the core catalyst of robust risk-hedging activity remains tied to wider factors such as global macroeconomic uncertainty.

Yet, in contrast to expansion headlines, investors should be aware that if volatility in key markets subsides for an extended period…

CME Group's outlook anticipates $7.3 billion in revenue and $4.3 billion in earnings by 2028. This projection is based on a 4.4% annual revenue growth rate and a $0.6 billion increase in earnings from the current $3.7 billion level.

Uncover how CME Group's forecasts yield a $282.11 fair value, a 5% upside to its current price.

Exploring Other Perspectives

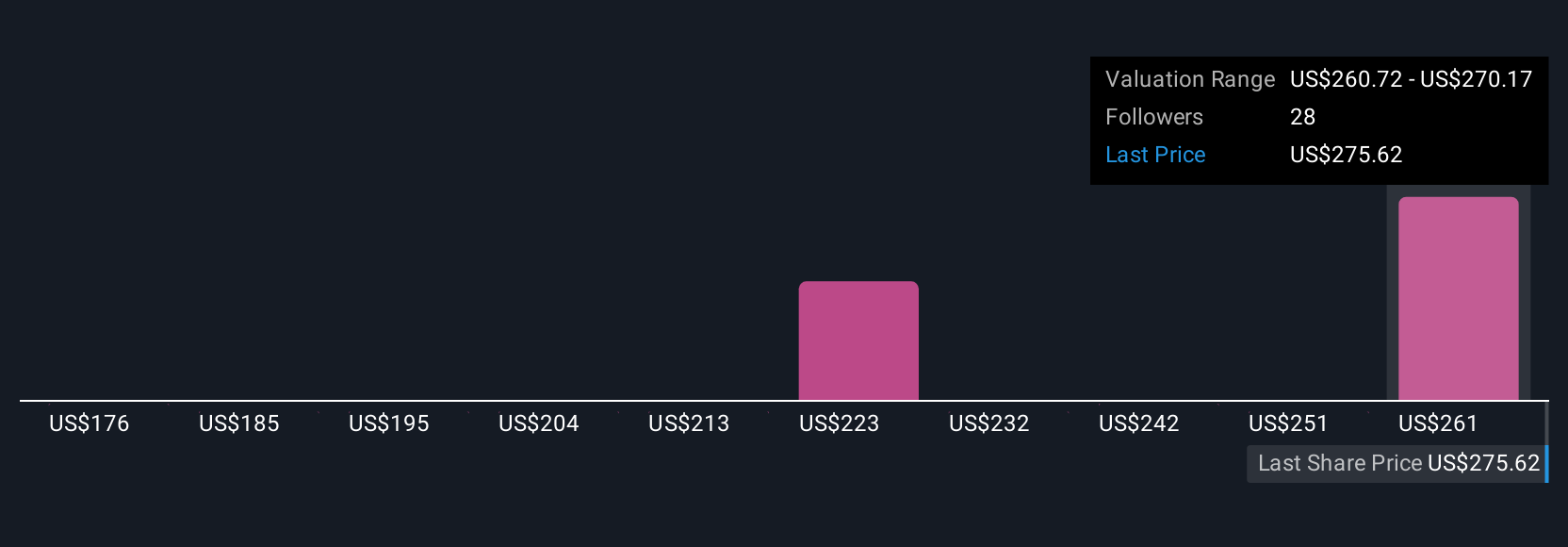

Five members of the Simply Wall St Community estimate CME Group’s fair value in a wide US$175.71 to US$282.11 range. With global volatility as a central catalyst, perspectives on future growth and potential can vary greatly, explore these differing views for a broader take on the company’s outlook.

Explore 5 other fair value estimates on CME Group - why the stock might be worth as much as 5% more than the current price!

Build Your Own CME Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CME Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CME Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CME Group's overall financial health at a glance.

No Opportunity In CME Group?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.