Please use a PC Browser to access Register-Tadawul

What Confluent (CFLT)'s Appointment of Stephen Deasy as CTO Means for Shareholders

Confluent, Inc. Class A CFLT | 30.57 | +0.69% |

- Confluent, Inc. recently appointed Stephen Deasy as its Chief Technology Officer, entrusting him with the direction of the company’s platform development and engineering strategy, specifically targeting advances in AI and real-time data streaming capabilities.

- Deasy brings more than two decades of engineering leadership at prominent software firms such as Benchling, Atlassian, VMware, and EMC, positioning Confluent to deepen its focus on innovation for high-impact, intelligent data platforms.

- We’ll explore how Deasy’s expertise in scaling engineering organizations could influence Confluent’s investment narrative in AI and real-time infrastructure.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Confluent Investment Narrative Recap

To be a Confluent shareholder, you need to believe that real-time data and AI-driven applications will continue driving demand for enterprise streaming solutions, supporting the company's long-term revenue growth. The recent appointment of Stephen Deasy as CTO is not expected to materially impact the most important short-term catalyst for Confluent: accelerating adoption of cloud services and AI-powered real-time infrastructure, even as competitive risks and a potential slowdown in large client growth remain key concerns.

One recent announcement that stands out is the launch of Confluent Cloud in the AWS Marketplace's new AI Agents and Tools category. This move is highly relevant to Deasy’s mission, as it expands the reach of Confluent’s solutions for organizations building AI-powered applications, a key business driver cited as a medium-term growth catalyst.

In contrast, investors should be aware of how persistent customer optimization and slower adoption among larger clients could continue to pressure...

Confluent's narrative projects $1.7 billion revenue and $220.6 million earnings by 2028. This requires 16.5% yearly revenue growth and an earnings increase of $532.3 million from -$311.7 million today.

Uncover how Confluent's forecasts yield a $24.69 fair value, a 22% upside to its current price.

Exploring Other Perspectives

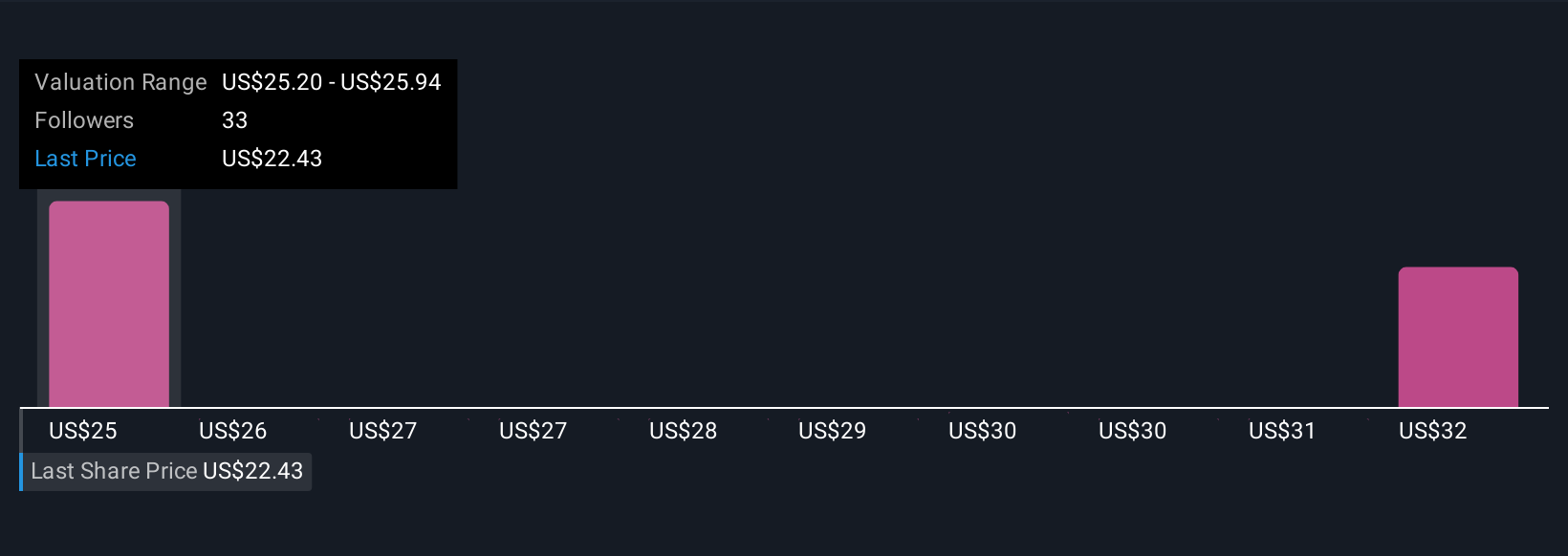

Two Simply Wall St Community members set fair values for Confluent between US$24.69 and US$32.45 per share, opinions vary widely on future potential. Your outlook on risks like cloud consumption headwinds could significantly shift your view on value and opportunity.

Explore 2 other fair value estimates on Confluent - why the stock might be worth as much as 60% more than the current price!

Build Your Own Confluent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Confluent research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Confluent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Confluent's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.