Please use a PC Browser to access Register-Tadawul

What CytomX Therapeutics, Inc.'s (NASDAQ:CTMX) 35% Share Price Gain Is Not Telling You

CytomX Therapeutics, Inc. CTMX | 6.03 | +5.89% |

Despite an already strong run, CytomX Therapeutics, Inc. (NASDAQ:CTMX) shares have been powering on, with a gain of 35% in the last thirty days. This latest share price bounce rounds out a remarkable 597% gain over the last twelve months.

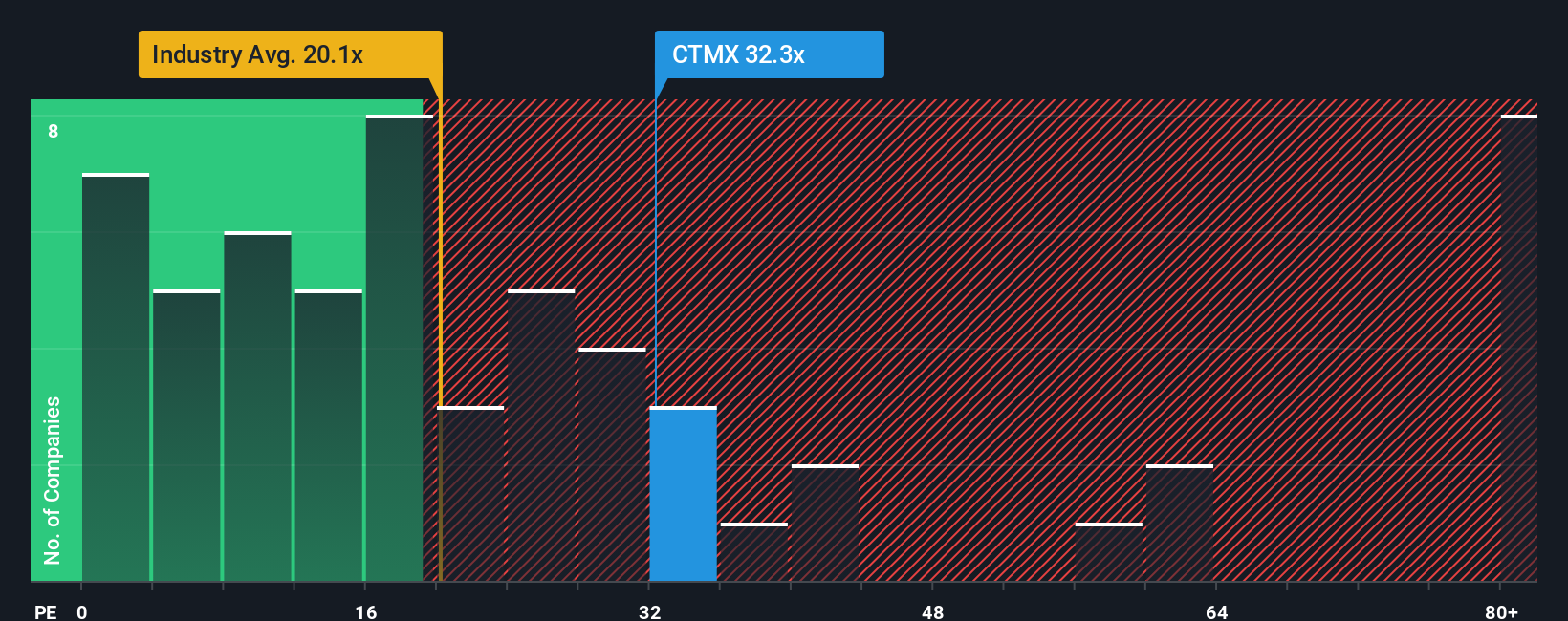

Since its price has surged higher, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 19x, you may consider CytomX Therapeutics as a stock to avoid entirely with its 35.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for CytomX Therapeutics as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

How Is CytomX Therapeutics' Growth Trending?

In order to justify its P/E ratio, CytomX Therapeutics would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 44% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

The Final Word

The strong share price surge has got CytomX Therapeutics' P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Of course, you might also be able to find a better stock than CytomX Therapeutics. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.