Please use a PC Browser to access Register-Tadawul

What Does a 775% Rally in Bitmine Mean for Investors in 2025?

BitMine Immersion Technologies BMNR | 34.86 35.70 | -9.17% +2.41% Pre |

Trying to figure out what to do with Bitmine Immersion Technologies stock? You're not alone. In the past year, this name has delivered a jaw-dropping 459.2% return, including a recent 14.6% bump in the last 30 days and an eye-popping 775.6% gain so far this year. Most investors would call that more than just a hot streak. These moves have been fueled by deepening interest in digital assets and renewed optimism in sectors tied to blockchain infrastructure, which is exactly Bitmine's sweet spot. However, with every major rally comes the looming question: has the market gotten ahead of itself, or is there still room to run?

That's where valuation comes into play. Using a six-point checklist to look for signs a stock is undervalued, Bitmine comes in with a score of 0, undervalued in exactly zero out of six categories right now. That might raise some eyebrows, especially among value investors watching from the sidelines while the momentum crowd enjoys the ride.

So, how should you think about Bitmine's worth at these levels? Up next, we're diving into the core valuation methods and how Bitmine stacks up, plus a look at a more nuanced approach for those seeking an edge in turbulent markets.

Bitmine Immersion Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Bitmine Immersion Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates the present value of a company by projecting its future cash flows and discounting them back to today's dollars. This method offers a way to gauge what a business might truly be worth beyond the market's current enthusiasm.

For Bitmine Immersion Technologies, the most recent reported Free Cash Flow (FCF) stands at $0.84 Million. Analysts expect significant growth over the next decade, with estimates of FCF rising to $7.75 Million by 2035. Notably, analysts usually only provide up to five years of cash flow projections, but further estimates for Bitmine have been extrapolated to highlight potential future performance.

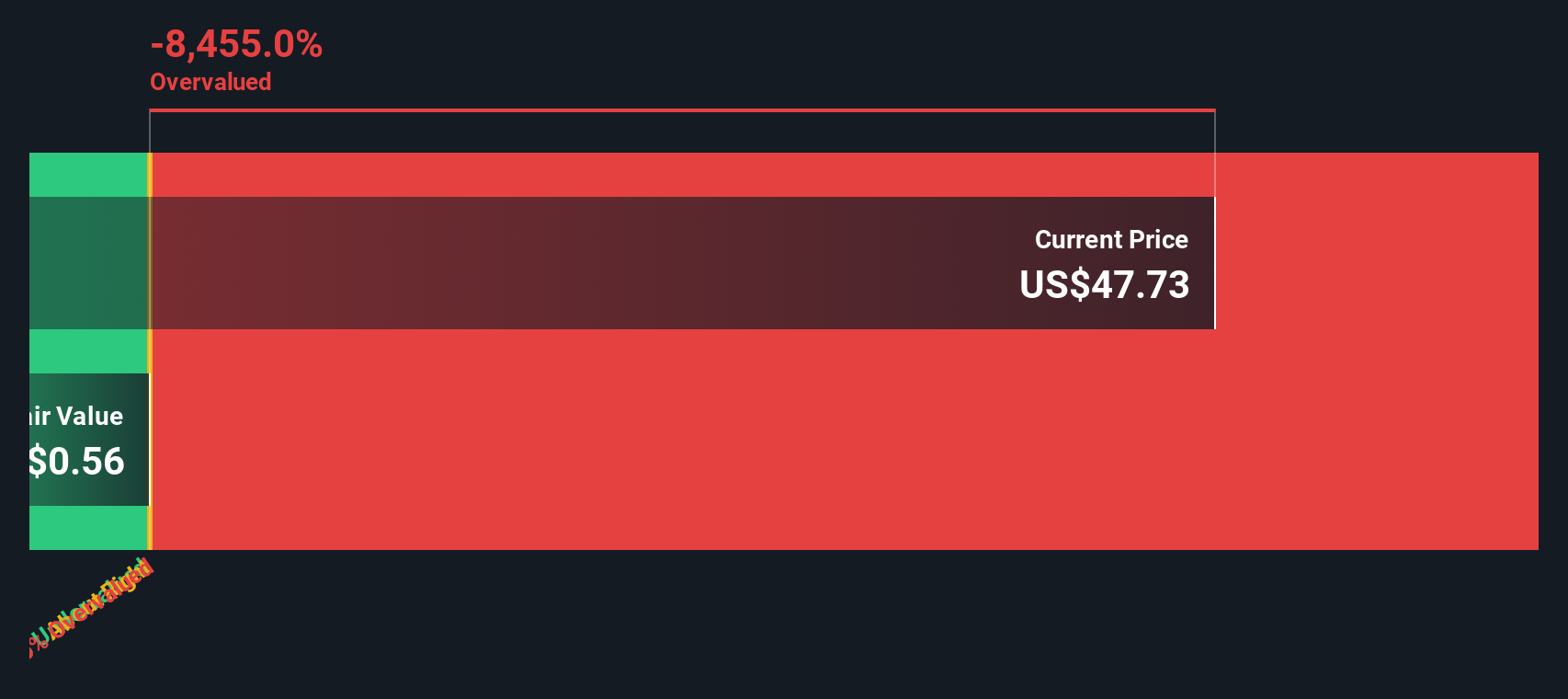

Based on the DCF model, Simply Wall St calculates an intrinsic value of $0.55 per share for Bitmine Immersion Technologies. Compared to the current share price, the DCF analysis suggests the stock is 11,031.4% overvalued. This represents an extreme premium to its underlying cash flow outlook.

While rapid FCF growth is impressive, the DCF verdict is resolute: the market price is running far ahead of fundamental value at present levels.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Bitmine Immersion Technologies.

Approach 2: Bitmine Immersion Technologies Price vs Book

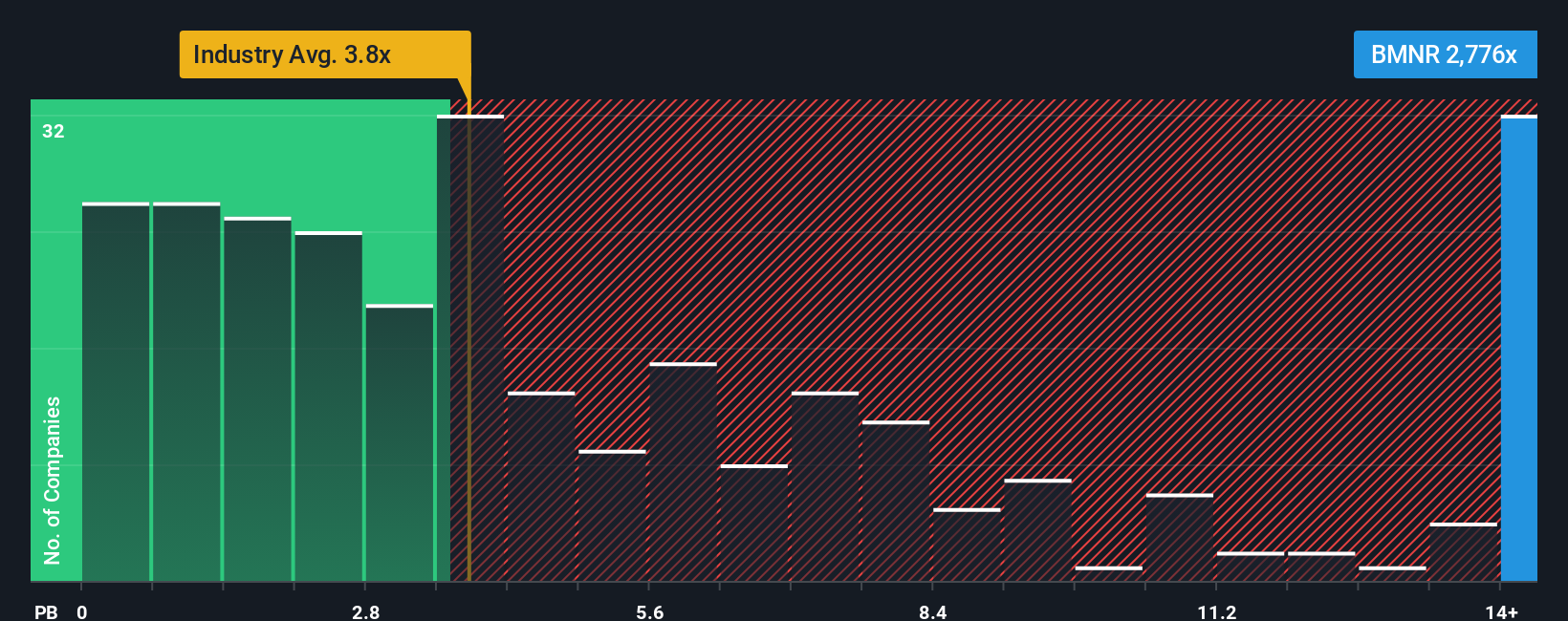

For companies like Bitmine Immersion Technologies, which are not currently profitable, the Price-to-Book (PB) ratio is a widely used valuation metric. The PB ratio compares a company's market value to its net assets, making it particularly useful for businesses in high-growth or asset-heavy industries where profits may be volatile or thin. It gives investors insight into how much they are paying for each dollar of the company's book value.

Growth expectations and risk profile play a huge role in determining what constitutes a "normal" or "fair" PB ratio. High-growth companies will often command a higher PB multiple, whereas firms with uncertain prospects or greater risk typically trade closer to, or even below, their book value. As a result, the current PB ratio always needs to be put in context with industry norms and growth outlooks.

Bitmine is currently trading at a staggering 3,694.91x PB. For comparison, the average PB ratio for the Software industry sits at just 3.95x, and Bitmine’s peer group is at 13.19x. This large premium suggests the stock price is dramatically outpacing the value of the underlying assets.

To get a more individualized perspective, Simply Wall St calculates a proprietary “Fair Ratio,” which adjusts for factors like the company’s earnings growth prospects, market cap, profit margins, industry characteristics, and risk. Unlike a straightforward peer or industry comparison, this Fair Ratio attempts to capture a more complete picture of what a reasonable valuation looks like for Bitmine Immersion Technologies specifically.

Comparing Bitmine’s actual PB multiple to its Fair Ratio shows a significant gap. This indicates the market is pricing in extremely ambitious expectations, and the stock appears greatly overvalued versus its underlying book value.

Result: OVERVALUED

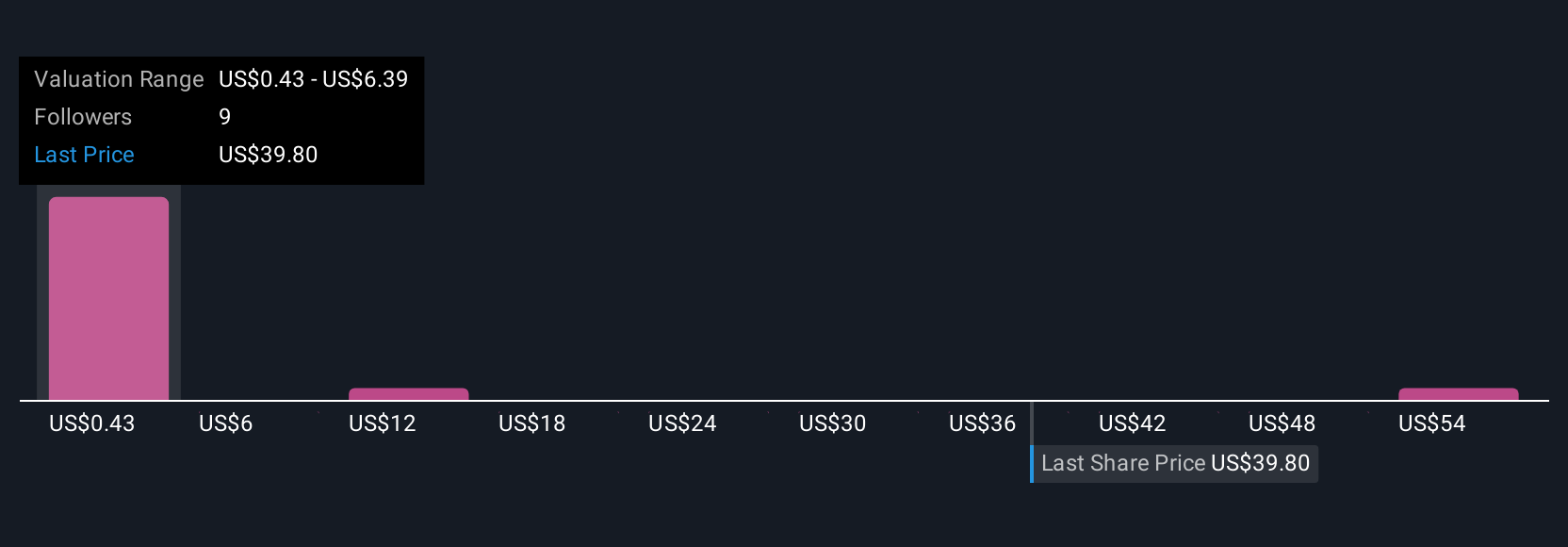

Upgrade Your Decision Making: Choose your Bitmine Immersion Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story about a company, capturing the reasons behind your outlook with numbers like fair value, future revenue, earnings, and profit margins. Narratives connect your perspective about the company's growth or risk to an actual financial forecast and a fair value estimate, closing the gap between intuition and analysis. On Simply Wall St's platform, Narratives are simple to use and accessible in the Community page, where millions of investors share and refine their views. By comparing each Narrative’s fair value to the current share price, you can quickly decide whether Bitmine is a buy, hold, or sell for you. Best of all, Narratives update automatically when new information such as financials or news emerges. This feature keeps your view current. For Bitmine Immersion Technologies, one investor’s Narrative could see sky-high growth justifying a premium, while another might assign a much lower fair value. This shows how flexible and insightful this approach can be.

Do you think there's more to the story for Bitmine Immersion Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.