Please use a PC Browser to access Register-Tadawul

What Does Advent’s Stake Reduction Mean for First Watch Restaurant Group’s (FWRG) Ownership Dynamics?

First Watch Restaurant Group, Inc. FWRG | 16.36 | -1.92% |

- Advent International, a significant shareholder in First Watch Restaurant Group, sold 4,400,000 shares of common stock in a secondary offering facilitated by Barclays on September 8, 2025, reducing its stake but remaining a large holder.

- This major block sale highlights ongoing shareholder activity within First Watch and often prompts investor attention to insider trading patterns and company ownership structure.

- We'll examine how Advent International's sizable secondary share sale could shape First Watch's investment narrative and perceptions of its shareholder base.

Find companies with promising cash flow potential yet trading below their fair value.

First Watch Restaurant Group Investment Narrative Recap

Investors in First Watch Restaurant Group are generally betting on the brand's potential to expand aggressively in new markets and capitalize on consumer demand for fresh, daytime dining. The recent block sale by Advent International, while drawing some attention to short-term volatility, does not materially alter the company’s core growth catalysts or the primary risk of sustained pressure from commodity and labor cost inflation, which continues to impact margins. Of the recent updates, the August follow-on equity offering, raising US$88.5 million at a price similar to Advent’s sale, is most relevant. This capital raise supports First Watch’s ongoing restaurant expansion, which remains the key growth driver, but will also test whether the new units can offset margin pressures and validate the growth narrative amid rising input costs. By contrast, investors should be aware that despite the excitement around expansion, persistent food and labor cost inflation remains a factor that could…

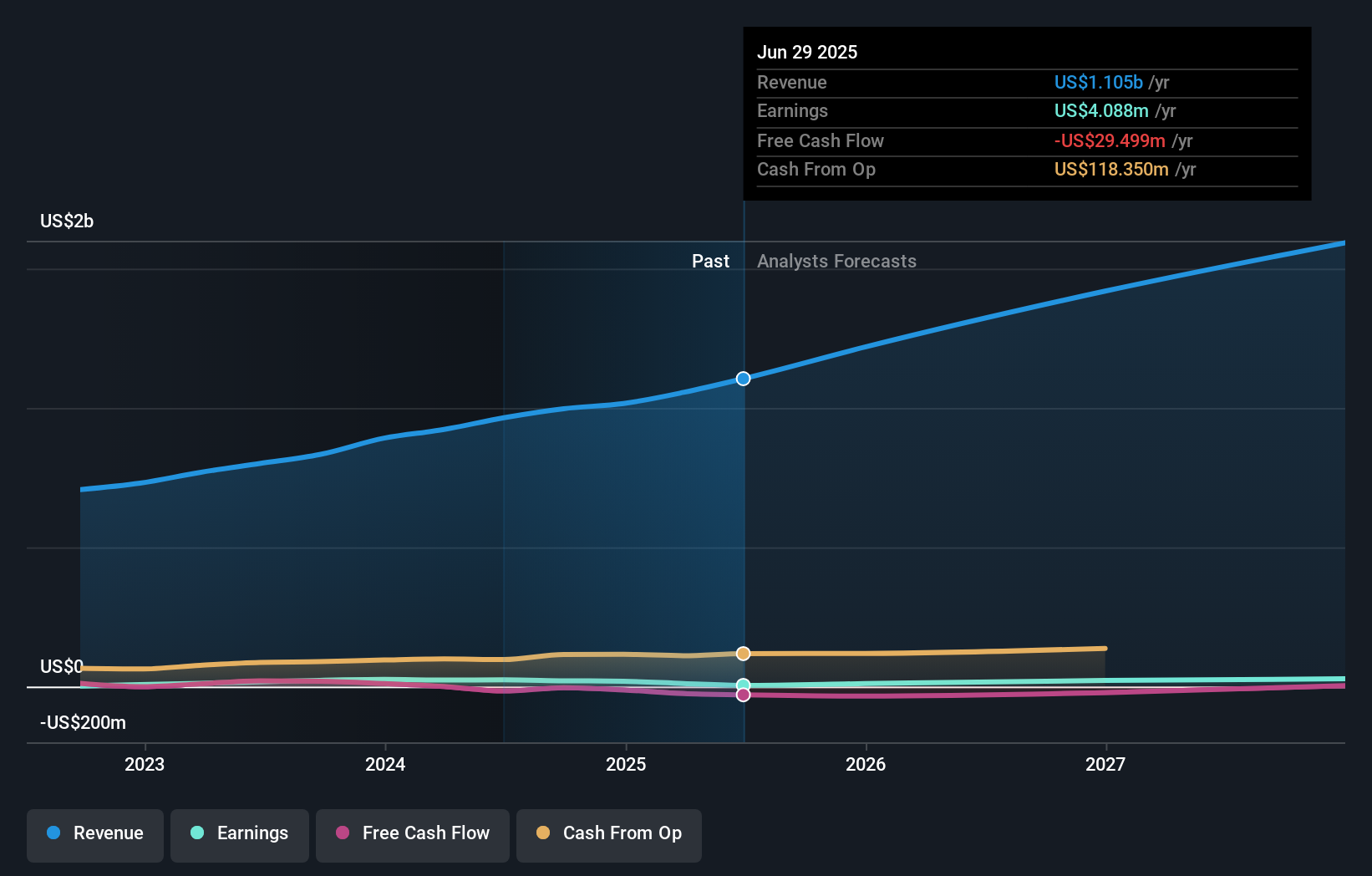

First Watch Restaurant Group's narrative projects $1.7 billion revenue and $33.8 million earnings by 2028. This requires 15.1% yearly revenue growth and an increase in earnings of $29.7 million from the current $4.1 million.

Uncover how First Watch Restaurant Group's forecasts yield a $22.00 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely, from US$7.08 to US$22, across 2 individual analyses. As new shares hit the market and inflationary pressures remain, it is clear perspectives on First Watch’s long-term earning power can differ greatly.

Explore 2 other fair value estimates on First Watch Restaurant Group - why the stock might be worth less than half the current price!

Build Your Own First Watch Restaurant Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free First Watch Restaurant Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Watch Restaurant Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.