Please use a PC Browser to access Register-Tadawul

What Encompass Health (EHC)'s Dividend Raise and New Hospitals Mean For Shareholders

Encompass Health Corporation EHC | 108.01 | +0.39% |

- Encompass Health recently approved a US$0.02 increase to its quarterly dividend, declaring a US$0.19 per share payment for October 2025, while announcing the opening of a 50-bed rehabilitation hospital in Daytona Beach and plans for a new 40-bed facility in Tennessee.

- These moves reinforce the company’s dedication to both returning value to shareholders and expanding access to specialized rehabilitative care across key markets.

- We will examine how the boost to the dividend and new hospital openings could reshape Encompass Health's long-term growth outlook.

Encompass Health Investment Narrative Recap

For investors considering Encompass Health, the core belief hinges on the continued demand for inpatient rehabilitation and the company’s position to capture this need through expansion and operational efficiency. The recent dividend increase and new hospital openings signal confidence in near-term cash flows and market growth; however, these updates do not fundamentally alter the biggest short-term catalyst, which remains the company's ability to add new beds and maintain high occupancy rates. Key risks, such as regulatory pressures on Medicare reimbursement, persist and are unchanged by this recent news.

Among recent company announcements, the opening of the 50-bed rehabilitation hospital in Daytona Beach directly supports the thesis of meeting rising patient demand through capacity growth. This expansion is aligned with Encompass Health’s catalyst of capturing revenue through strong discharge rates in high-occupancy facilities, reinforcing its operational model and growth strategy. Still, investors should consider how...

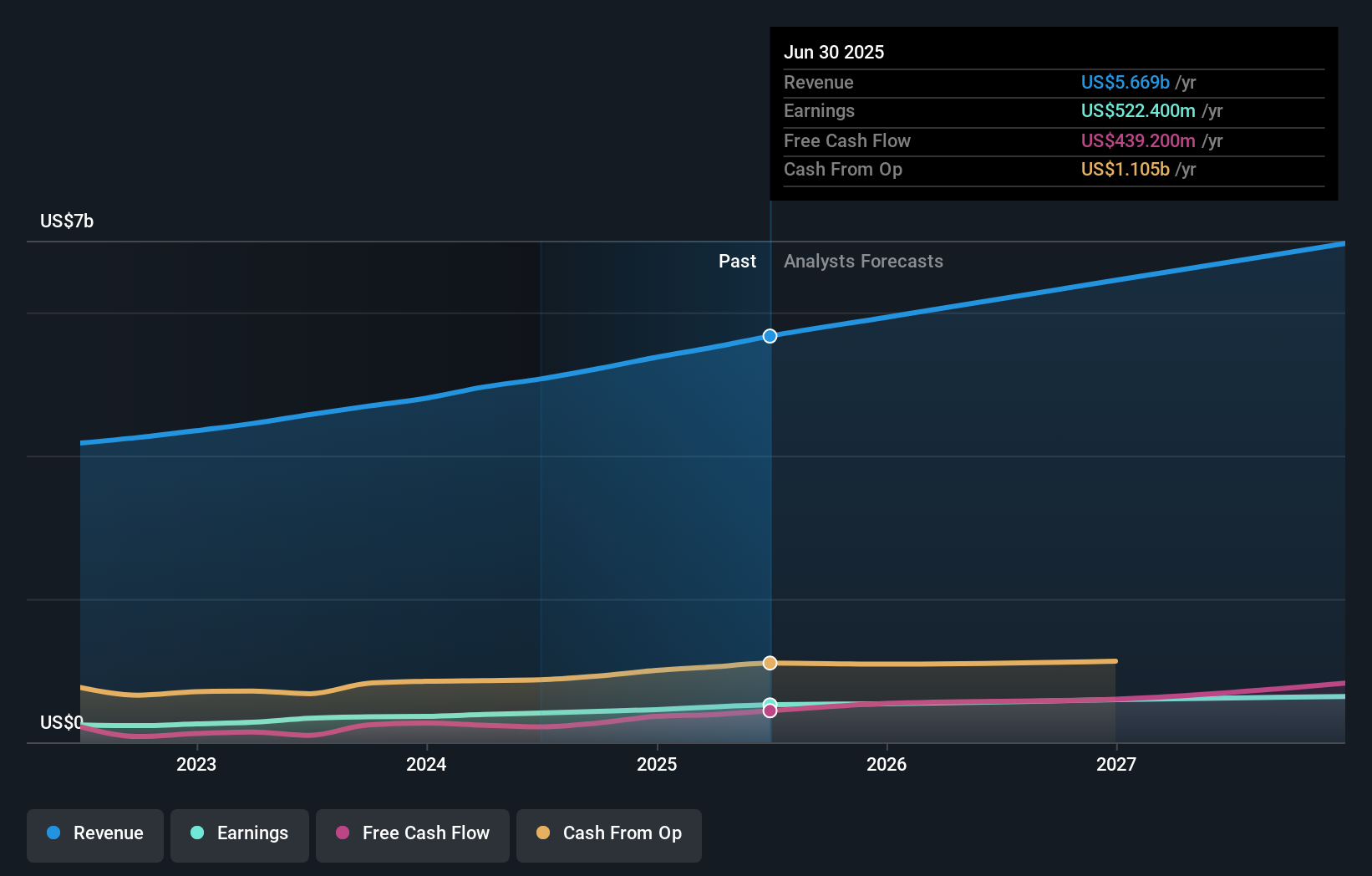

Encompass Health's narrative projects $7.0 billion revenue and $647.8 million earnings by 2028. This requires 8.2% yearly revenue growth and a $153.5 million earnings increase from $494.3 million today.

Exploring Other Perspectives

Only one US$131.58 fair value estimate was submitted by the Simply Wall St Community, offering a single viewpoint on Encompass Health’s valuation. While opinion diversity is low, persistent regulatory risk continues to weigh on the outlook for revenue streams, inviting you to weigh alternative views on the company’s future.

Build Your Own Encompass Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encompass Health research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encompass Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encompass Health's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.