Please use a PC Browser to access Register-Tadawul

What First Advantage (FA)'s Upgraded 2024 Guidance After Q3 Beat Means For Shareholders

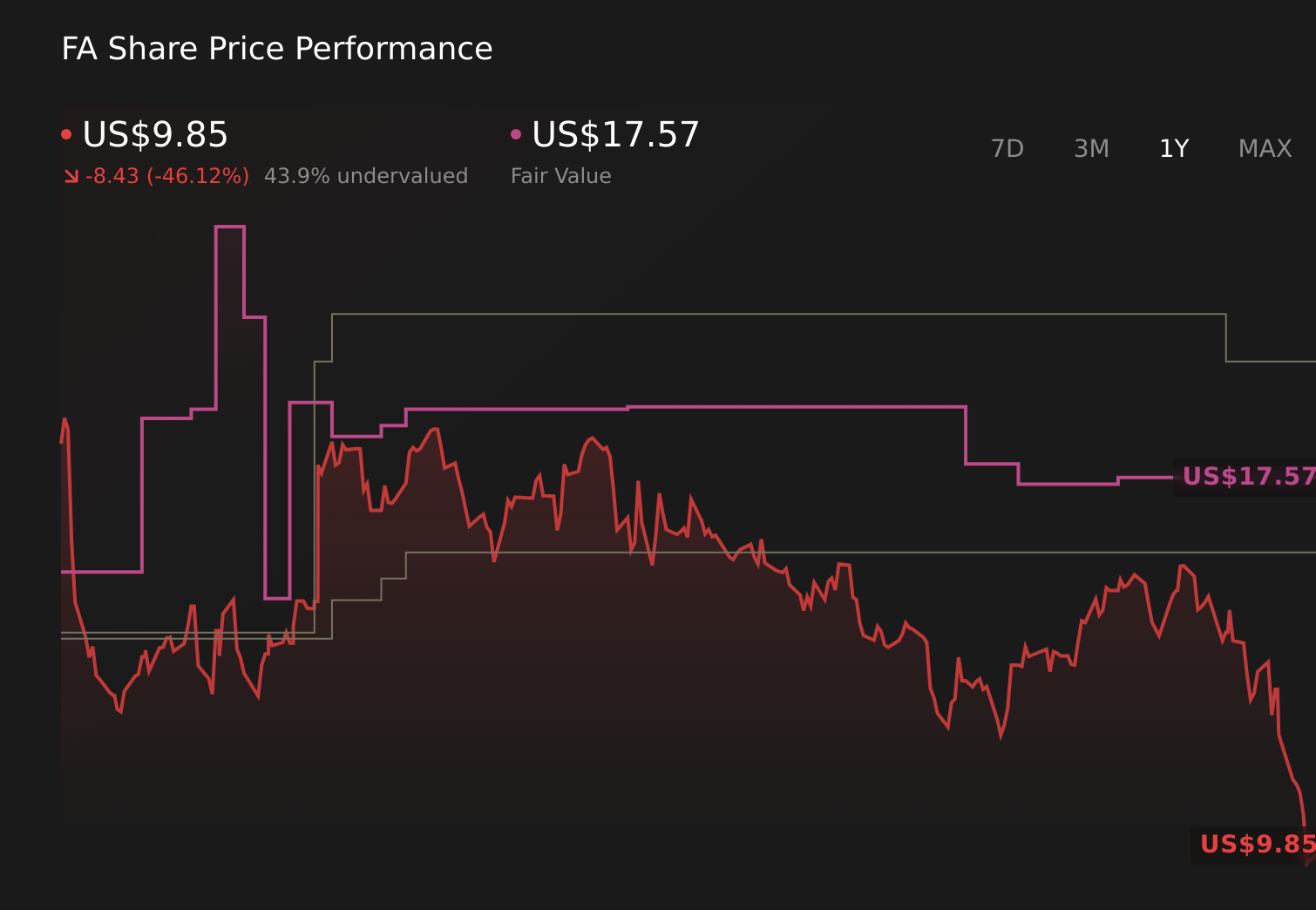

First Advantage Corp. FA | 9.85 | +2.60% |

- First Advantage recently reported a strong third-quarter performance, with revenue surpassing analyst expectations and management raising full-year guidance on the back of profitable growth.

- The company’s emphasis on new customer wins and upselling in retail & e-commerce and transportation & logistics highlights how targeted vertical strength is shaping its business mix.

- We will now examine how the upgraded full-year guidance influences First Advantage’s investment narrative and what it could mean for investors.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is First Advantage's Investment Narrative?

To own First Advantage, you need to believe in a business that can convert its leadership in background screening and identity services into durable, profitable growth, despite a patchy profit record and a relatively new management team. The latest quarter, where revenue topped expectations and guidance was raised, supports that thesis in the near term and has already been rewarded with a share price lift, but it does not erase the fact that the company is still loss making and has underperformed the broader market over the past year. Short term, upgraded guidance, improving margins and active buybacks are the key positives; on the flip side, execution risk around becoming sustainably profitable, integration of past acquisitions and a valuation that is not cheap on sales multiples remain central concerns. This earnings beat sharpens the catalysts, but it also raises the bar.

However, there is one profitability risk that investors should not overlook. Despite retreating, First Advantage's shares might still be trading 48% above their fair value. Discover the potential downside here.Exploring Other Perspectives

The single fair value estimate from the Simply Wall St Community clusters around US$17.57, suggesting that at least one private investor sees upside from the current price. Set that against the recent guidance upgrade and ongoing losses, and you can see why different market participants may reach very different conclusions about how quickly First Advantage can convert revenue growth into sustainable earnings. Exploring these contrasting views can help you weigh the optimism against the execution risks.

Explore another fair value estimate on First Advantage - why the stock might be worth as much as 23% more than the current price!

Build Your Own First Advantage Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Advantage research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free First Advantage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Advantage's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.