Please use a PC Browser to access Register-Tadawul

What Gen Digital (GEN)'s Upward Earnings Guidance Means For Shareholders Ahead of Q2 Results

Gen Digital Inc. - Common Stock GEN | 27.67 | -0.40% |

- Gen Digital announced it will release its fiscal second-quarter 2026 earnings after the market closes on November 6, following strong first-quarter results and an upward revision of its full-year outlook.

- This updated guidance reflects higher projected revenue and adjusted earnings per share, underscoring investor interest in the company's long-term growth trajectory ahead of the earnings announcement.

- We'll explore how Gen Digital's raised annual guidance and expectations for higher earnings per share could influence its broader investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Gen Digital Investment Narrative Recap

To see Gen Digital as a long-term investment, you need to believe in rising global demand for digital security and identity protection, driven by increasing cyber threats, platform innovation, and product integration. The company’s upgraded full-year outlook and stronger Q1 results position Q2 earnings as a focal point, but the core short-term catalyst remains management's ability to deliver on recurring revenue and margin expansion; integration risks tied to the MoneyLion and other acquisitions continue to weigh most on near-term outlook, though the updated guidance itself isn't materially reducing this risk.

Among recent developments, the launch of AI-driven deepfake protection in the Norton Genie AI Assistant stands out, as it aligns tightly with Gen's efforts to enhance platform differentiation and drive value-added upselling, a key growth lever highlighted by the new guidance and investor attention around upgraded earnings prospects.

By contrast, investors should keep a close eye on operational challenges from integrating recent acquisitions...

Gen Digital's outlook anticipates $5.3 billion in revenue and $1.2 billion in earnings by 2028. This scenario assumes annual revenue growth of 7.7% and an earnings increase of $603 million from the current $597 million.

Uncover how Gen Digital's forecasts yield a $34.64 fair value, a 30% upside to its current price.

Exploring Other Perspectives

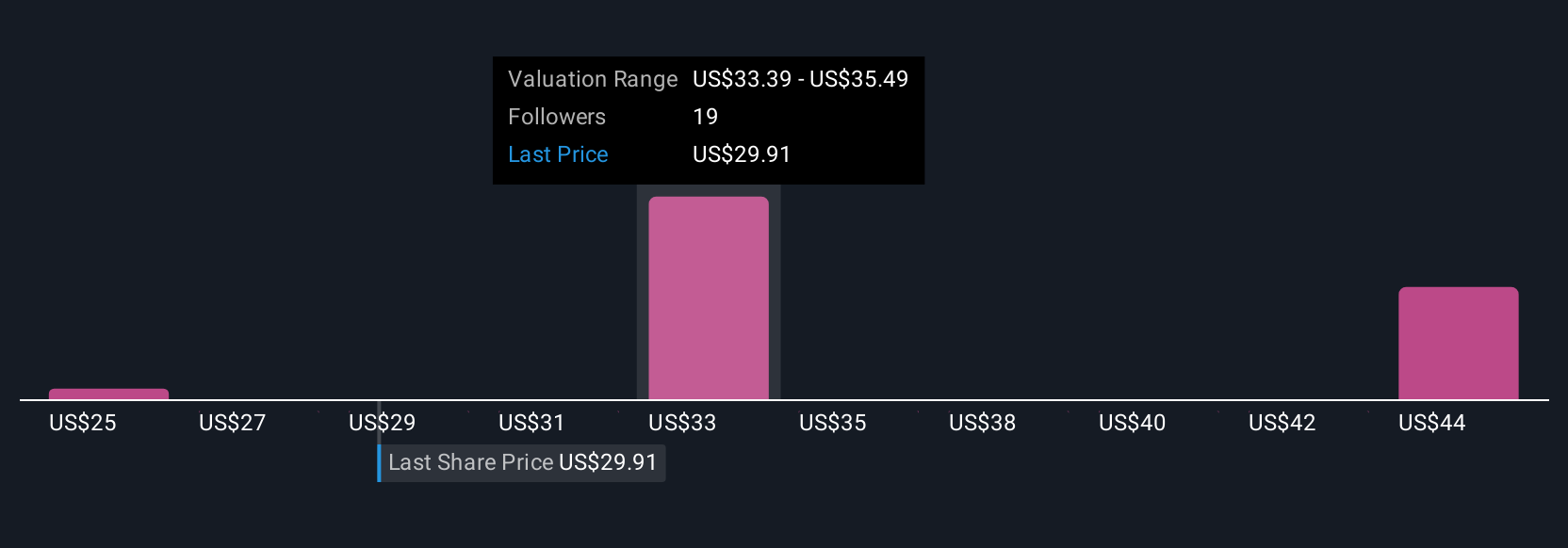

Five recent fair value estimates from the Simply Wall St Community span US$25 to US$39.13, capturing a wide spectrum of expectations. With product innovation driving increased guidance, perspectives on both value and risk differ, follow along to explore why these views may shift as new results emerge.

Explore 5 other fair value estimates on Gen Digital - why the stock might be worth 6% less than the current price!

Build Your Own Gen Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gen Digital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gen Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gen Digital's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.