Please use a PC Browser to access Register-Tadawul

What GoDaddy’s Recent Share Slide and New AI Web Tools Reveal About Company Value

GoDaddy, Inc. Class A GDDY | 124.80 | -0.99% |

If you have been watching GoDaddy’s stock lately, you might be wondering whether this is the right moment to buy, sell, or just keep an eye on it. The company’s share price has taken a bit of a hit recently, sliding 4.5% over the past week and down 5.9% over the last month. Year-to-date, GoDaddy is off by a hefty 32.1%, which might make some investors nervous. Step back, though, and the long-term picture looks very different. Over the past three and five years, GoDaddy shares have notched gains of 77.8% and 75.7% respectively, reflecting the steady expansion of the company’s core website and domain name business as demand for digital services continues to rise.

Recent market shakeups, including shifts in tech sentiment and overall risk appetite, have weighed on GoDaddy’s stock. Still, what really grabs my attention is how the valuation lines up. According to our six-point valuation framework, GoDaddy scores a perfect 6 out of 6, meaning the company passes every single undervaluation check with flying colors. That is not something you see every day in the tech sector, especially after a multi-year run.

So, what exactly goes into that impressive valuation score, and how do these approaches help investors size up the opportunity? Let’s break down the key methods and keep an eye out for an even smarter way to size up what GoDaddy is really worth at the end.

Approach 1: GoDaddy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and then discounting those amounts back to today’s dollars. In plain terms, it asks: what are all of GoDaddy’s future cash earnings really worth right now?

Currently, GoDaddy generates Free Cash Flow (FCF) of $1.43 billion. Analyst forecasts point to continued expansion, with FCF projected to reach $2.30 billion by 2029. Since Wall Street typically only looks five years ahead, the numbers beyond this are estimated by extrapolating historical performance and company trends. This forward-looking approach uses the 2 Stage Free Cash Flow to Equity model, which sums up the value of all expected future FCFs. Each of these is brought back to today’s value using a sensible discount rate.

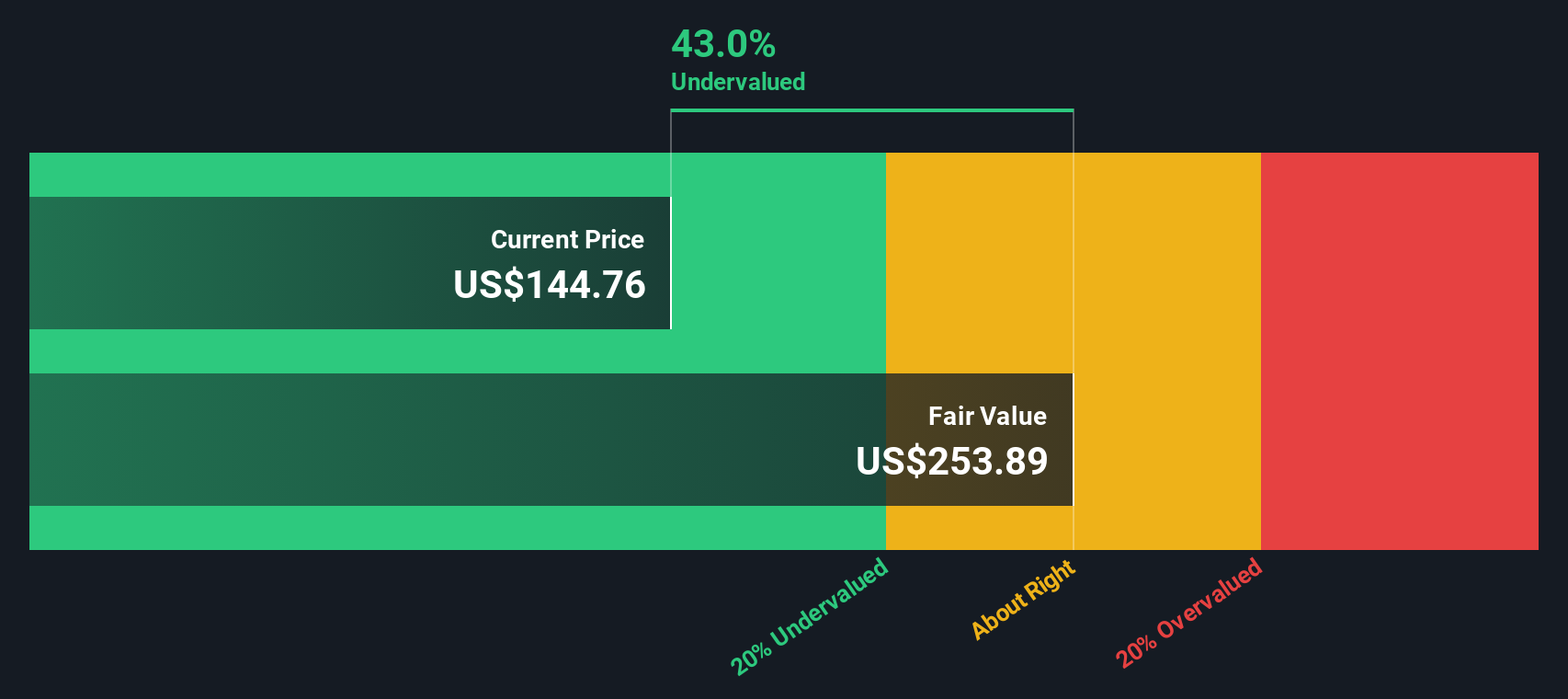

The result is a DCF fair value of $252.21 per share, compared to GoDaddy’s current trading level. This implies the stock is 46.5% undervalued, offering a sizable margin of safety for investors who trust the projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GoDaddy is undervalued by 46.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: GoDaddy Price vs Earnings

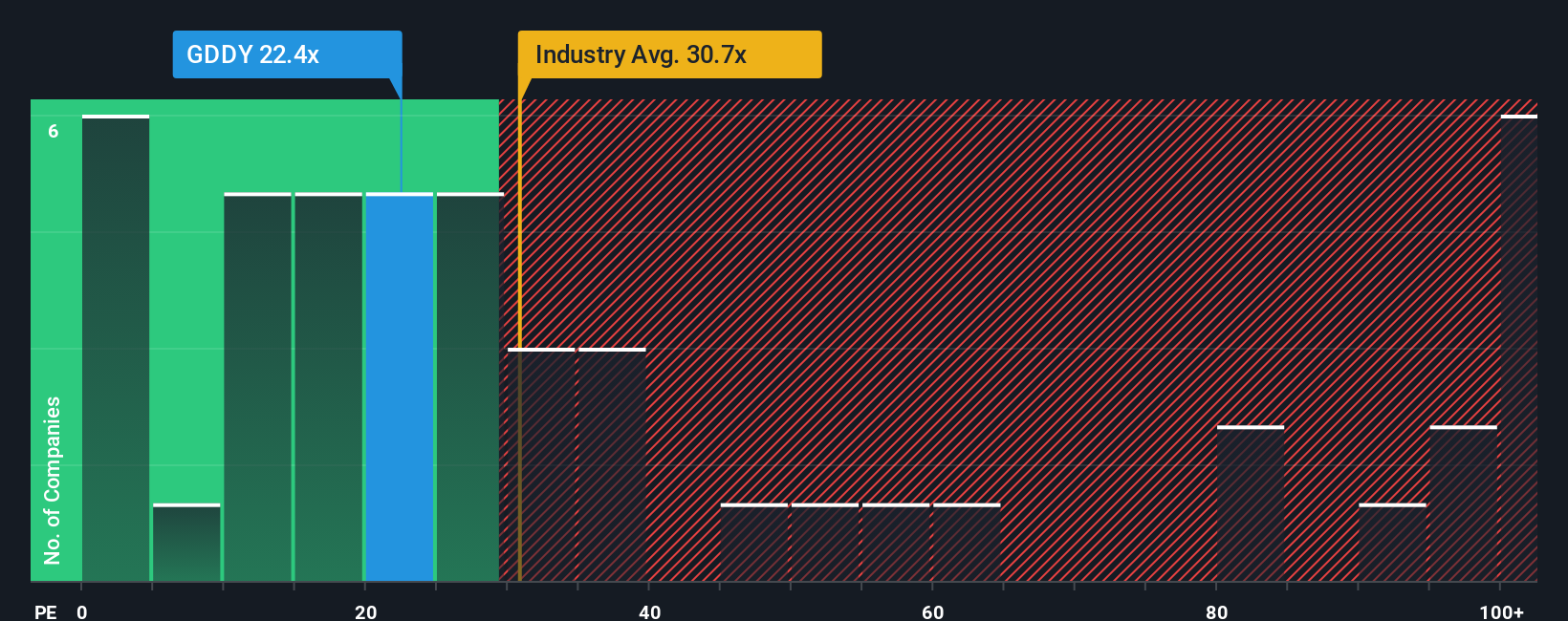

When valuing a profitable company like GoDaddy, the Price-to-Earnings (PE) ratio is a tried-and-true metric that helps investors see how much they are paying for each dollar of profit. A “fair” PE ratio isn’t a fixed number, though; it flexes depending on how quickly a company is growing and how much risk it carries. Fast growers or less risky businesses usually deserve a higher PE, while riskier or slower-growing companies tend to justify lower multiples.

GoDaddy trades at a PE ratio of 23.1x. For context, the average PE across its IT industry peers stands at 33.2x, while a direct peer average is even higher at 51.7x. This already suggests GoDaddy is trading below sector and peer benchmarks. However, a more holistic approach is to use the Simply Wall St “Fair Ratio.” In this case, the Fair Ratio is 34.3x. This proprietary metric accounts for multiple factors that basic comparisons often miss, such as GoDaddy’s earnings growth, margins, market capitalization, and risk profile.

Because the Fair Ratio combines these deeper fundamentals, rather than just emulating industry averages or peer multiples, it gives a tailored perspective on what GoDaddy’s PE should really be. With the company’s current PE of 23.1x sitting well below the Fair Ratio of 34.3x, GoDaddy appears attractively valued on this front.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GoDaddy Narrative

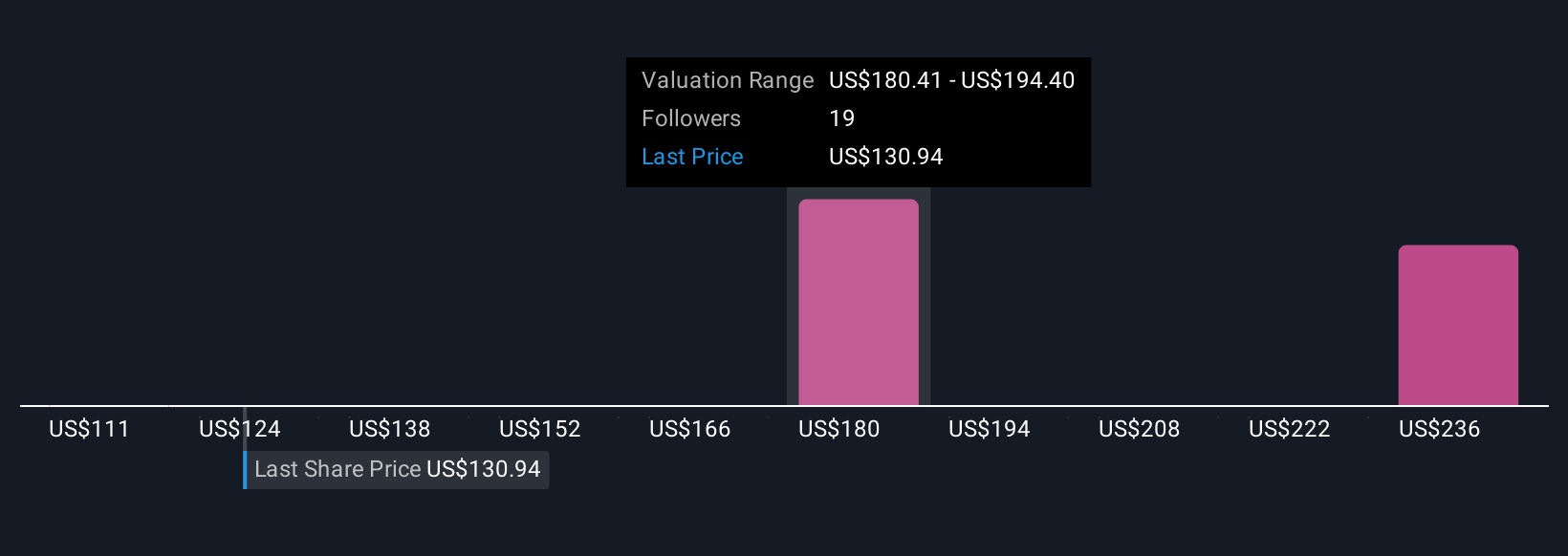

Earlier, we hinted there is a more insightful way to gauge valuation, so let’s introduce Narratives: an intuitive tool that helps you build your own story about GoDaddy, translating your view on its future revenue, profits, and margins into a personal fair value estimate.

A Narrative connects the dots between a company’s unique story, your forecast of its business performance, and what you believe is a reasonable price for the shares today. On Simply Wall St’s Community page (where millions of other investors participate), creating a Narrative is as simple as entering a few numbers and describing your reasoning.

What makes Narratives so useful is their dynamic nature. Each time fresh news, updates, or earnings come out, your Narrative and its fair value are updated automatically, helping you confidently decide if the stock looks attractive compared to its current price.

No two investors see the world the same way. For instance, on GoDaddy, the most optimistic Narrative in the Community sees a potential price of $250, while the most cautious sets fair value at $150. Narratives can reveal a wide range of informed perspectives in real time.

Do you think there's more to the story for GoDaddy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.