Please use a PC Browser to access Register-Tadawul

What Kraft Heinz (KHC)'s Breakup Into Two Companies Means For Shareholders

Kraft Heinz Company KHC | 23.74 | +2.59% |

- Earlier in September 2025, Kraft Heinz announced it would separate back into two independently traded public companies, effectively unwinding its previous merger.

- This move has drawn interest for its potential to unlock value and refocus operations, despite vocal concerns from key shareholders.

- We will now explore how Kraft Heinz’s decision to split into two companies could reshape the investment narrative, especially regarding operational streamlining.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Kraft Heinz Investment Narrative Recap

Owning Kraft Heinz stock has always meant believing in the strength of its brands and the company’s ability to turn operational focus into reliable cash flow. With the newly announced split into two public companies, the most pressing short-term catalyst, a clearer strategy that could drive a share price re-rating, becomes even more immediate, yet so does the risk that execution setbacks or cost inflation could overwhelm any intended benefits. At this stage, the real impact of the split on near-term fundamentals remains to be seen.

Among recent developments, the planned tax-free spin-off stands out as the most relevant, since it is intended to reduce complexity and refocus resources. While product launches and global partnerships, including new plant-based and health-oriented products, highlight ongoing attempts at innovation, the actual catalyst for near-term value is likely to stem from the success, or lack thereof, in executing the two-company split.

But for investors, it is also important to recognize that while the split makes headlines, the ongoing drag from sluggish North America retail volume remains a critical risk worth...

Kraft Heinz's outlook projects $26.1 billion in revenue and $3.3 billion in earnings by 2028. This is based on 1.0% annual revenue growth and a $8.6 billion increase in earnings from the current level of -$5.3 billion.

Uncover how Kraft Heinz's forecasts yield a $29.71 fair value, a 13% upside to its current price.

Exploring Other Perspectives

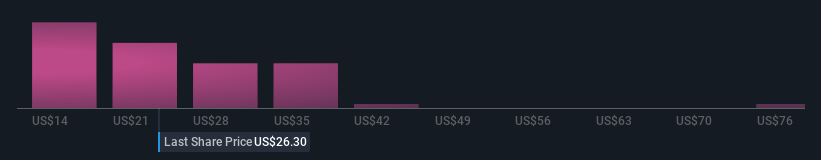

Private investors in the Simply Wall St Community assigned Kraft Heinz fair values ranging widely from US$24.47 to US$80.64 across 21 estimates. While many see hidden upside, persistent volume declines in North America still weigh heavily on the company's prospects, see how others are reassessing their outlook now.

Explore 21 other fair value estimates on Kraft Heinz - why the stock might be worth over 3x more than the current price!

Build Your Own Kraft Heinz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kraft Heinz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kraft Heinz's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.