Please use a PC Browser to access Register-Tadawul

What Lantheus Holdings (LNTH)'s Class Action Lawsuit Over Pylarify Revenue Projections Means For Shareholders

Lantheus Holdings Inc LNTH | 63.69 | -1.85% |

- Robbins Geller Rudman & Dowd LLP has announced a class action lawsuit against Lantheus Holdings, Inc. and certain executives, alleging misleading statements about projected revenue, growth, and market dynamics for its key oncology product, Pylarify, during the period from February 26, 2025, to August 5, 2025.

- This legal development follows a period of disappointing financial results and reduced guidance, raising questions about Lantheus’s previous disclosures and increasing scrutiny from both investors and law firms.

- We’ll now examine how the heightened legal scrutiny over Pylarify’s revenue outlook could alter Lantheus Holdings’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Lantheus Holdings Investment Narrative Recap

To own Lantheus Holdings, you need to believe in its ability to revive and diversify growth beyond Pylarify, particularly as price pressure and competition erode that franchise’s momentum. The latest class action lawsuit and reports of falling sales and revised guidance have intensified focus on real-time execution, making Pylarify’s near-term performance the most important catalyst, and also the biggest risk, since weaker-than-expected results could further impact investor confidence.

Most relevant to this legal controversy is Lantheus’s August 6, 2025, earnings announcement, where management not only posted a year-over-year decline in sales but also lowered revenue guidance and revealed slipping sales for Pylarify. This heightened sensitivity to ongoing competition and puts even more weight on upcoming product milestones, particularly pipeline progress and the FDA’s decision on the new F-18 PSMA formulation, for regaining momentum.

Yet, beneath the headlines, investors should be aware of the ongoing risk of price compression within the PSMA PET imaging market and how...

Lantheus Holdings' narrative projects $1.8 billion in revenue and $419.8 million in earnings by 2028. This requires 5.7% yearly revenue growth and a $148.8 million increase in earnings from $271.0 million.

Uncover how Lantheus Holdings' forecasts yield a $89.50 fair value, a 70% upside to its current price.

Exploring Other Perspectives

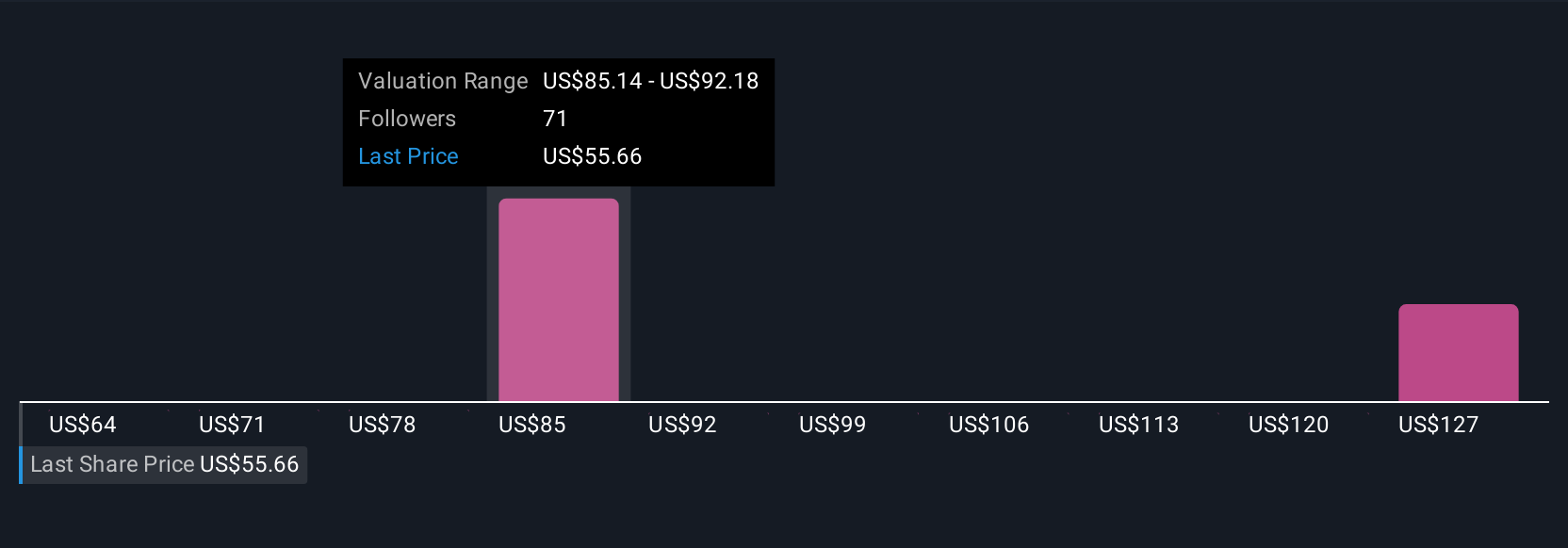

Community fair value estimates for Lantheus span from US$63 to US$136.60, with ten unique views from the Simply Wall St Community. However, ongoing price compression and competitive pressure around Pylarify could make these opinion gaps even more relevant, inviting you to explore several alternative viewpoints.

Explore 10 other fair value estimates on Lantheus Holdings - why the stock might be worth just $63.00!

Build Your Own Lantheus Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lantheus Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lantheus Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lantheus Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.