Please use a PC Browser to access Register-Tadawul

What LXP Industrial Trust (LXP)'s Expanded, Lower-Cost Credit Facilities Mean For Shareholders

LXP Industrial Trust LXP | 48.31 | +1.90% |

- LXP Industrial Trust recently amended and restated its credit agreement, replacing its prior facilities with a US$600.0 million unsecured revolving credit facility and a US$250.0 million unsecured term loan featuring extended maturities and interest-only payments until final principal repayment dates.

- The new facilities introduce lower interest margins and fees tied to LXP’s leverage and credit rating, potentially strengthening its financial flexibility and capacity to fund future investments under more favorable borrowing terms.

- We’ll now examine how this expanded and lower-cost borrowing capacity may influence LXP Industrial Trust’s investment narrative and future capital allocation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is LXP Industrial Trust's Investment Narrative?

To own LXP Industrial Trust, you need to be comfortable with a slower‑growing, industrial‑focused REIT where the appeal is more about steady cash flow and disciplined balance sheet management than rapid expansion. The amended US$600.0 million revolver and US$250.0 million term loan fit that story by extending maturities and trimming borrowing costs, which should ease near‑term refinancing worries and modestly improve interest coverage, even though interest expenses are still not well covered by earnings. In the short term, key catalysts remain leasing performance, industrial rent trends and any adjustments to the common dividend, all now supported by more flexible liquidity. The bigger risks are that earnings are forecast to contract, recent margin strength is flattered by a one‑off gain, and the shares are not cheap on traditional earnings multiples.

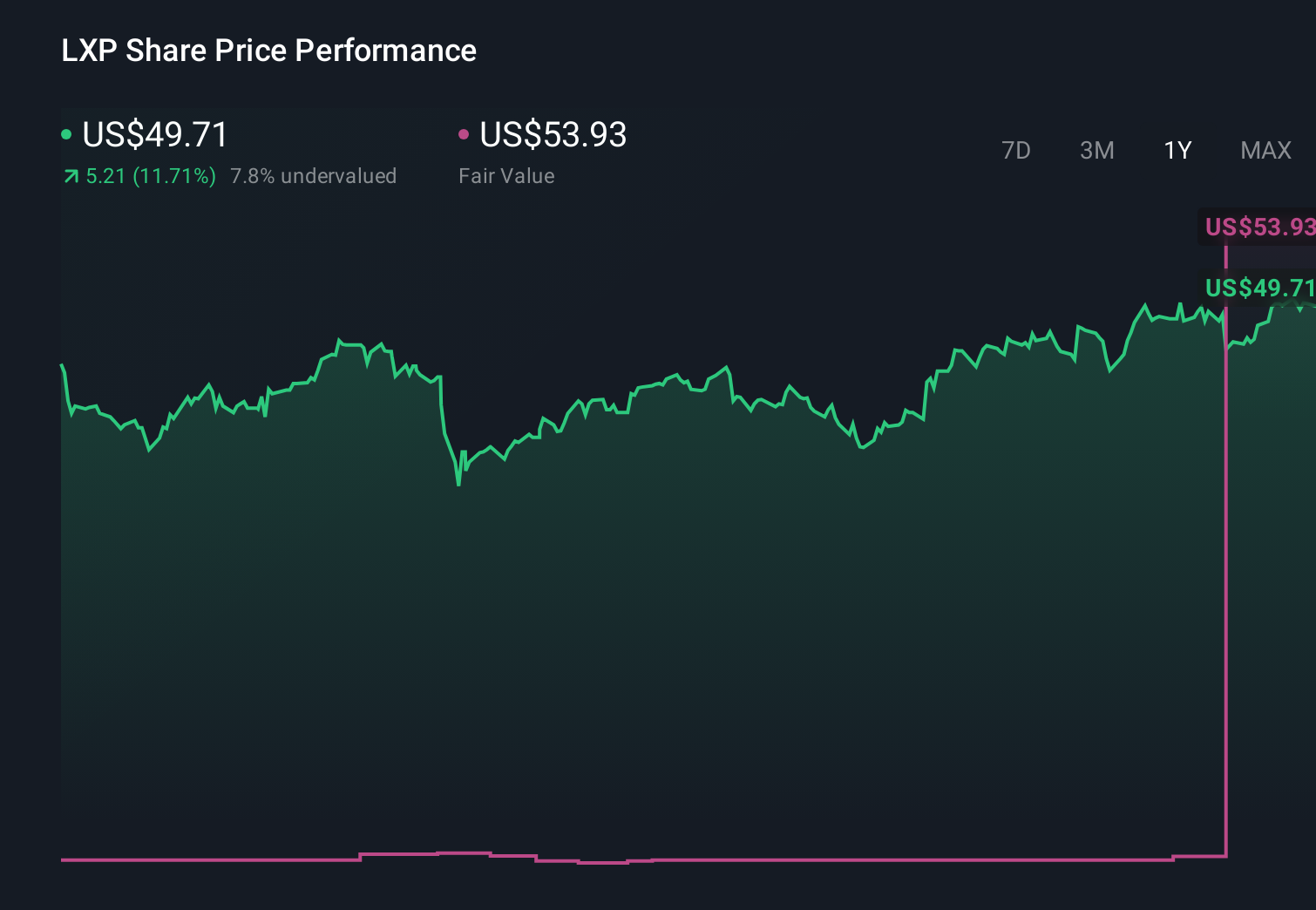

However, one risk investors should not ignore is how forecast earnings declines could pressure future payouts. Despite retreating, LXP Industrial Trust's shares might still be trading 22% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on LXP Industrial Trust - why the stock might be worth as much as 28% more than the current price!

Build Your Own LXP Industrial Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LXP Industrial Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free LXP Industrial Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LXP Industrial Trust's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.