Please use a PC Browser to access Register-Tadawul

What NNN REIT (NNN)'s 36th Consecutive Dividend Increase Means For Shareholders

National Retail Properties, Inc. NNN | 40.47 | +1.58% |

- On July 15, 2025, NNN REIT’s Board of Directors announced an increase in its quarterly dividend to US$0.60 per share, payable August 15, 2025 to shareholders of record as of July 31, marking a 3.4% rise.

- This latest dividend hike represents the company's 36th consecutive annual increase, highlighting a consistent and long-term emphasis on shareholder returns.

- We’ll examine how NNN REIT’s 36-year dividend growth streak impacts its investment narrative and the outlook for sustained stability.

NNN REIT Investment Narrative Recap

Being a shareholder in NNN REIT means believing in the enduring value of essential retail properties and a disciplined, long-term approach to shareholder returns. The recent dividend increase to US$0.60 per share underscores NNN REIT’s commitment to income generation, but it does not materially change the key catalysts or the primary concern, the impact of lingering vacancies and broader economic pressures on revenue stability.

Among recent announcements, the FY 2025 earnings guidance reaffirmed on May 1 stands out most in relation to the dividend news. While the 36th consecutive annual dividend hike signals confidence, ongoing adherence to net EPS targets could be influenced if current risks around tenant vacancies and debt costs are not fully resolved.

However, investors should also keep in mind the potential for higher financing costs stemming from...

NNN REIT's outlook projects $1.0 billion in revenue and $432.7 million in earnings by 2028. This scenario assumes annual revenue growth of 4.4% and an earnings increase of $34.5 million from the current earnings of $398.2 million.

Exploring Other Perspectives

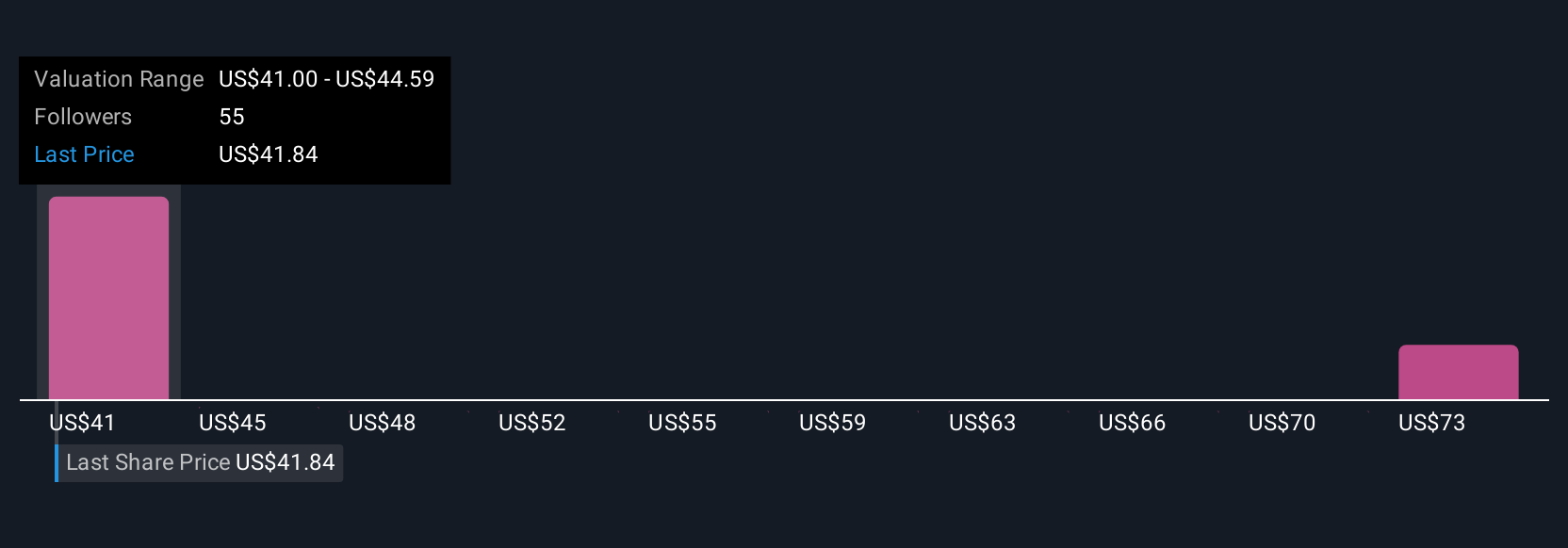

Simply Wall St Community members have set NNN REIT’s fair value between US$41 and US$85.59 across four opinions. As the company addresses furniture and restaurant vacancies, consider how this uncertainty could influence your outlook.

Build Your Own NNN REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NNN REIT research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NNN REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NNN REIT's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.