Please use a PC Browser to access Register-Tadawul

What Northrop Grumman (NOC)'s New Autonomy Partnerships Mean for Shareholders

Northrop Grumman Corp. NOC | 685.00 686.00 | -1.87% +0.15% Post |

- In July 2025, Northrop Grumman launched partnerships with Merlin and Red 6 to integrate advanced autonomy solutions onto its new Beacon testbed, supporting U.S. government autonomy initiatives and expanding open-access validation of mission systems.

- These collaborations are designed to accelerate operational testing and development of software-driven, autonomous defense platforms, positioning Northrop Grumman at the forefront of next-generation uncrewed systems innovation.

- We'll review how Northrop Grumman's focus on rapid autonomous technology integration could influence its long-term investment prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Northrop Grumman Investment Narrative Recap

For a shareholder, belief in Northrop Grumman centers on sustained US and allied defense spending, rapid innovation in autonomous systems, and the company’s ability to convert backlog into profitable growth, particularly for flagship programs like B-21 and Sentinel. The new partnerships with Merlin and Red 6 enhance its technological leadership in autonomy, but are unlikely to outweigh the ongoing risk that government program delays or budget uncertainties could disrupt near-term sales momentum and longer-term visibility.

Among recent developments, Northrop Grumman’s July 2025 earnings release stands out. The company reported year-over-year increases in revenue and net income, and raised its full-year EPS guidance, citing higher segment margins and strong order trends, factors closely tied to the same uncrewed and autonomous platforms prioritized in its Beacon partnerships. This financial update provides context to the company’s technology initiatives as part of the current growth catalysts.

Yet, despite positive developments, there remains an important risk investors should keep in mind: if defense budget priorities shift or key program contracts face political delays, the result could be ...

Northrop Grumman's outlook anticipates $47.5 billion in revenue and $4.4 billion in earnings by 2028. This is based on a 5.5% annual revenue growth rate and a $0.5 billion increase in earnings from the current $3.9 billion level.

Uncover how Northrop Grumman's forecasts yield a $599.94 fair value, in line with its current price.

Exploring Other Perspectives

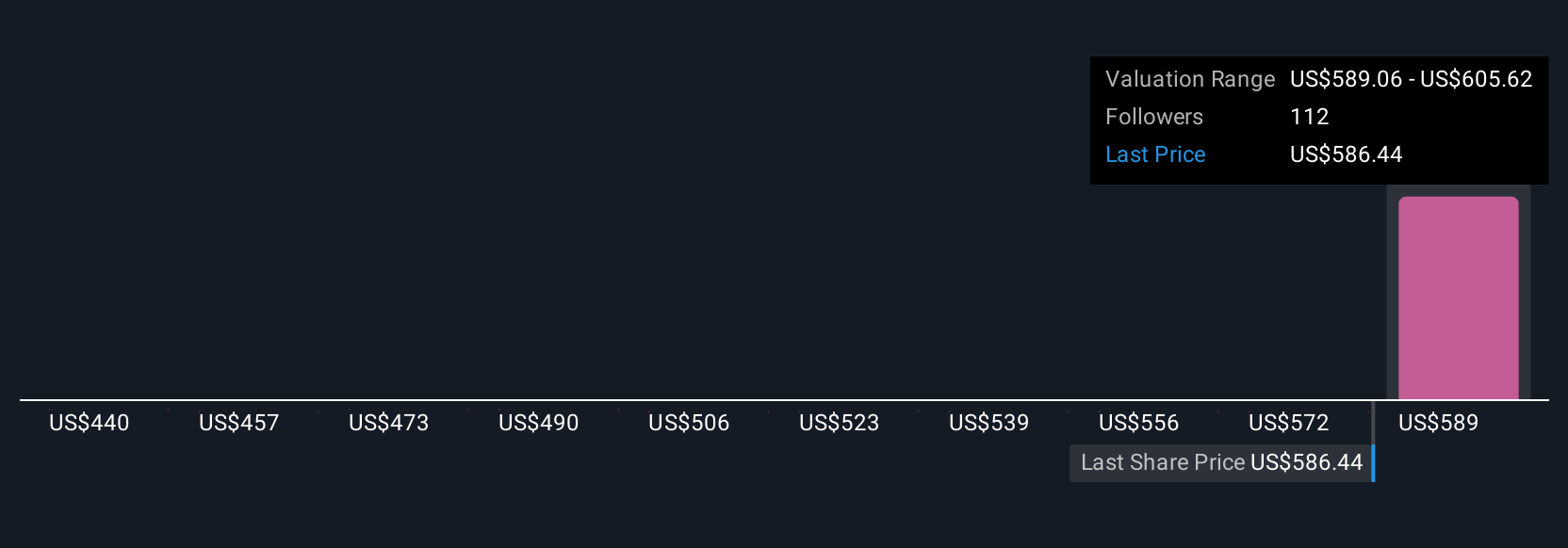

Simply Wall St Community members have submitted five unique fair value estimates for Northrop Grumman, ranging from US$440 to US$607.27 per share. Against this diversity of views, ongoing reliance on major US government contracts calls attention to how quickly sentiment could shift if critical awards are delayed or reprioritized, so it pays to compare multiple perspectives.

Explore 5 other fair value estimates on Northrop Grumman - why the stock might be worth as much as $607.27!

Build Your Own Northrop Grumman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northrop Grumman research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northrop Grumman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northrop Grumman's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.