Please use a PC Browser to access Register-Tadawul

What OpenText (OTEX)'s AI-Integrated Cybersecurity Launch Means for Shareholders

Open Text Corporation OTEX | 33.20 | -0.63% |

- In late October 2025, OpenText announced new AI-embedded cybersecurity capabilities aimed at helping enterprises unify their defenses across identity, data, applications, and forensics, with features such as behavioral analytics, advanced permission settings, auto-remediation during app testing, and strengthened compliance controls now available in OpenText Cloud Editions 25.4.

- This move positions OpenText to further differentiate itself by directly embedding AI into everyday security workflows, addressing the growing need for adaptive and compliant enterprise cybersecurity solutions.

- We'll examine how OpenText's AI-driven cybersecurity enhancements may impact its investment narrative, especially as compliance demands rise.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Open Text Investment Narrative Recap

Investors in OpenText are generally buying into a vision where robust cloud and AI-driven offerings compensate for declining legacy business, and where strategic innovation in cybersecurity and compliance is seen as a key growth lever. The recent launch of AI-embedded cybersecurity features may support confidence in the company's ability to address one of its biggest short-term challenges: achieving a rebound in cloud revenue for its cybersecurity division, although material impact remains to be confirmed in coming quarters.

Among recent news, OpenText’s integration of Core Threat Detection and Response with Microsoft Defender and Entra ID stands out as especially relevant, further enhancing AI-powered threat detection and strengthening the appeal of its security portfolio just as enterprises face surging regulatory and compliance demands.

By contrast, investors should be aware there are ongoing risks tied to OpenText’s dependence on accelerating cloud adoption to offset legacy revenue declines…

Open Text's outlook forecasts $5.4 billion in revenue and $862.6 million in earnings by 2028. This scenario assumes 1.4% annual revenue growth and a $426.7 million increase in earnings from the current $435.9 million.

Uncover how Open Text's forecasts yield a $39.39 fair value, a 3% upside to its current price.

Exploring Other Perspectives

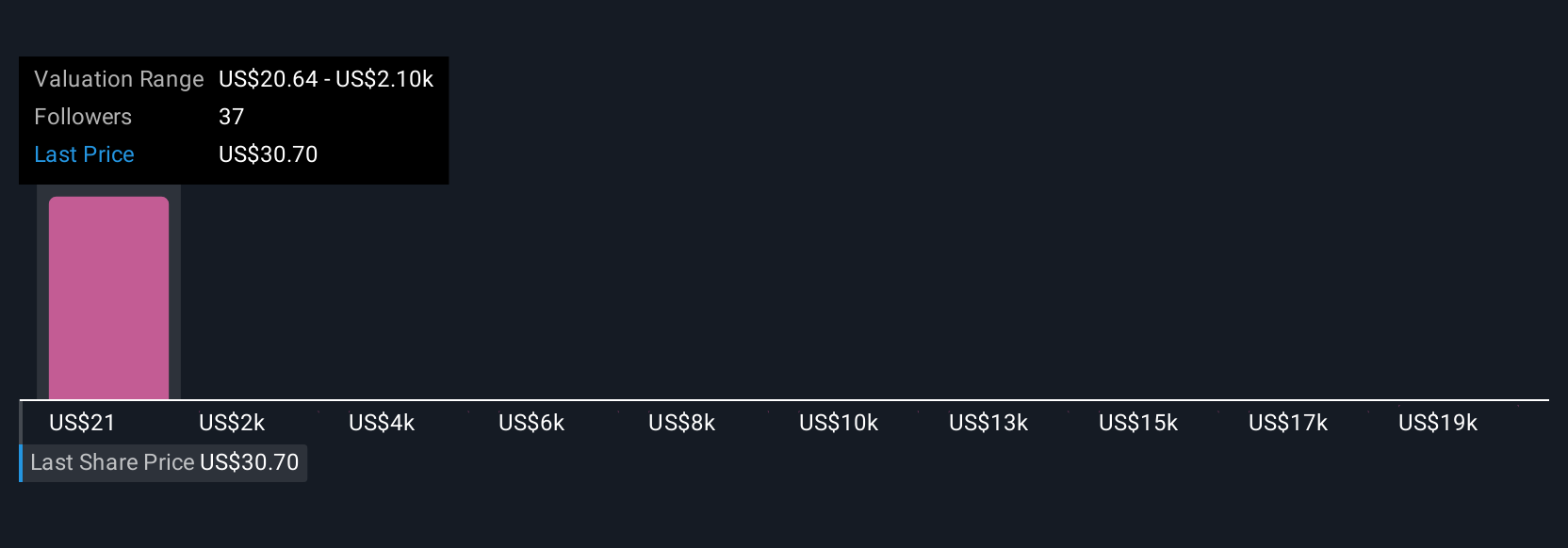

Community fair value estimates for OpenText range widely from US$21.43 to US$66.22 across six Simply Wall St Community analyses. With rising compliance needs spurring cloud and AI adoption, your outlook may shift as you consider these diverse views.

Explore 6 other fair value estimates on Open Text - why the stock might be worth 44% less than the current price!

Build Your Own Open Text Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Open Text research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Open Text research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Open Text's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.