Please use a PC Browser to access Register-Tadawul

What OSI Systems (OSIS)'s $26 Million Security Contract Win Means for Shareholders

OSI Systems, Inc. OSIS | 271.26 | +5.07% |

- On September 9, 2025, OSI Systems, Inc. announced that its Security division received an order worth approximately US$26 million to supply radio frequency-based systems designed to identify threats to public safety and infrastructure security.

- This sizable contract underlines demand for OSI’s specialized security technologies and highlights the company’s ability to attract large, mission-critical projects.

- We’ll explore how this major security order reinforces OSI Systems’ recurring government contract momentum highlighted in its long-term investment narrative.

Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

OSI Systems Investment Narrative Recap

To be a shareholder in OSI Systems, it’s important to believe in the company’s ability to secure mission-critical security contracts and build long-lasting relationships with government customers. The recent US$26 million order reinforces this core investment thesis, but it does not materially change the immediate risk around payment and cash flow cycles with sovereign clients or the ongoing reliance on government funding, which remains the biggest short-term concern. One recent announcement that ties closely to this momentum is the July US$34 million contract for Z Portal and CarView systems, further illustrating the company’s strength in capturing large inspection infrastructure deals. This throughput of sizeable security orders continues to highlight OSI’s ability to feed its project pipeline and support recurring contract revenue expectations. Yet, despite these successes, investors should remain mindful that the company’s concentration in government-related orders brings exposure to...

OSI Systems' narrative projects $2.0 billion in revenue and $199.7 million in earnings by 2028. This requires 5.6% yearly revenue growth and a $50.1 million increase in earnings from the current $149.6 million.

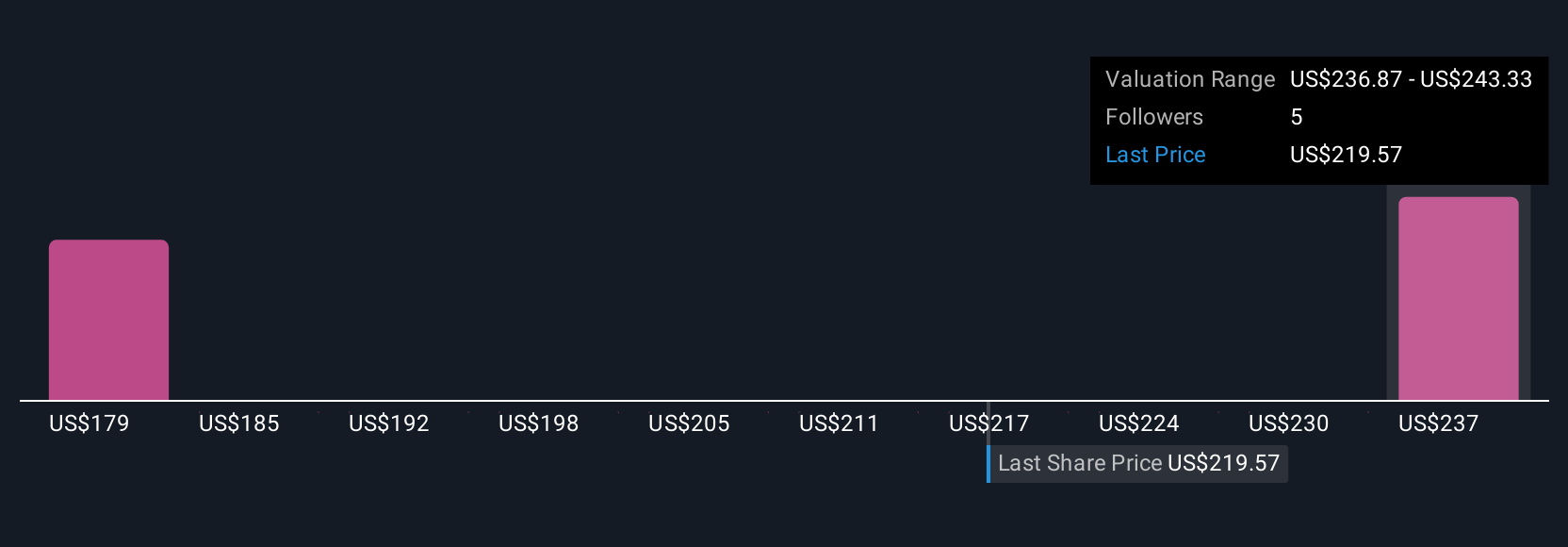

Uncover how OSI Systems' forecasts yield a $249.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three opinions from the Simply Wall St Community ranked OSI’s fair value between US$197,732 and US$271,800 per share. As you review these valuations, consider how recurring government contracts and payment cycles can weigh on cash flow and impact the company’s near-term financial position.

Explore 3 other fair value estimates on OSI Systems - why the stock might be worth as much as 16% more than the current price!

Build Your Own OSI Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OSI Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OSI Systems' overall financial health at a glance.

No Opportunity In OSI Systems?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.