Please use a PC Browser to access Register-Tadawul

What Paycom Software (PAYC)'s Enhanced HR Automation Tools and New EY Study Mean for Shareholders

Paycom Software, Inc. PAYC | 166.61 | +0.32% |

- In October 2025, Paycom Software announced upgrades to its Direct Data Exchange® analytics tool, incorporating fresh Ernst & Young (EY) research that detailed rising labor and nonlabor costs for manual HR tasks, as well as new feature coverage.

- EY's updated report highlighted that automating HR processes, such as through Paycom’s AI-driven “I want” engine and automated payroll platform Beti®, has enabled clients like The Kraft Group to realize substantial cost savings amid rising HR management expenses.

- We'll examine how Paycom’s expanded automation capabilities and client-reported efficiency gains influence its investment narrative and future growth outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Paycom Software Investment Narrative Recap

To own Paycom Software stock, investors need to believe that automation and AI-driven innovation will keep Paycom at the forefront of HR cost savings, fueling ongoing adoption and competitive differentiation. The latest Direct Data Exchange® upgrades, underpinned by EY-reported rising costs for manual HR processes, reinforce the near-term catalyst of higher client engagement and retention. However, the update does not materially alter the major immediate risk that widespread industry adoption of similar AI tools could narrow Paycom's differentiation and pressure margins.

Among recent announcements, the launch of “I want,” Paycom’s command-driven AI engine, stands out as most relevant. With EY’s report reflecting the steep labor costs tied to manual HR data searches, “I want” directly addresses growing client demand for cost reduction and efficiency, supporting Paycom’s case for platform stickiness and increased revenue per user in the quarters ahead. Still, the potential for further product commoditization among competitors...

Paycom Software's outlook anticipates $2.5 billion in revenue and $586.5 million in earnings by 2028. Achieving this would require 8.1% annual revenue growth and a $170.8 million increase in earnings from the current $415.7 million.

Uncover how Paycom Software's forecasts yield a $246.69 fair value, a 19% upside to its current price.

Exploring Other Perspectives

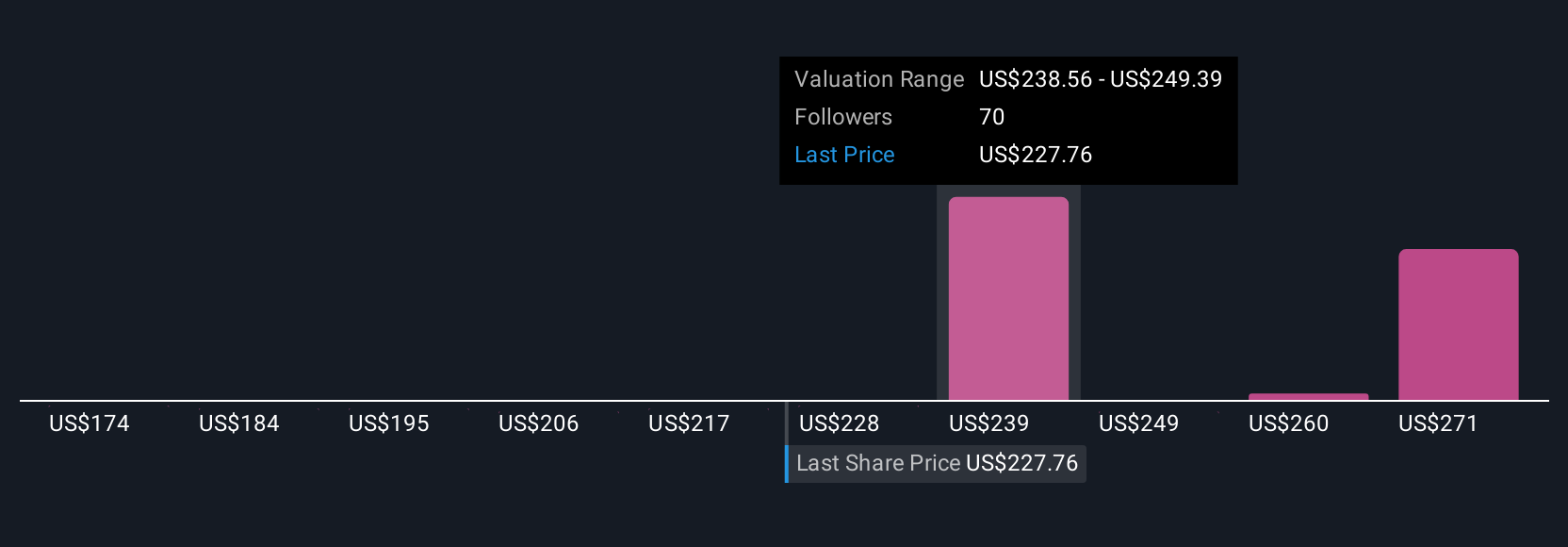

Five fair value estimates from the Simply Wall St Community range from US$226 to US$393 per share. While opinions differ, accelerating industry adoption of AI-powered automation may impact Paycom’s long-term profit margins and pricing power, so consider how your outlook aligns with these community viewpoints.

Explore 5 other fair value estimates on Paycom Software - why the stock might be worth just $226.28!

Build Your Own Paycom Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paycom Software research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Paycom Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paycom Software's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.