Please use a PC Browser to access Register-Tadawul

What Sunrun (RUN)'s Analyst Upgrades and Potential Shareholder Returns Mean for Investors

Sunrun Inc. RUN | 17.93 | -4.17% |

- In recent days, Sunrun received a series of analyst upgrades led by BMO Capital, reflecting renewed optimism about the company's future cash generation and financial flexibility.

- Analysts noted that Sunrun may be positioned to initiate share buybacks or dividends by 2026, highlighting the company's potential to return capital to shareholders as its outlook improves.

- To better understand how potential shareholder returns may shape the company's path, we'll examine the implications of these upgrades for Sunrun's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Sunrun Investment Narrative Recap

For Sunrun shareholders, the core belief centers on the company's ability to capture residential solar and storage demand, driven by advancing grid services and customer adoption, while successfully managing regulatory risk and funding requirements. The recent analyst upgrades, highlighting potential for share buybacks or dividends by 2026, provide a positive sentiment shift, but they have not materially changed the short-term catalyst of scaling storage and grid services, nor the most immediate risk linked to changes in regulatory policy and solar tax incentives.

The recent announcement of Sunrun activating the nation's first residential vehicle-to-grid distributed power plant, in partnership with Baltimore Gas and Electric and Ford, adds meaningful context. This innovative approach connects with Sunrun’s efforts to unlock recurring revenue from grid services and storage, which remains critical given the uncertainty around policy support and incentive longevity.

However, in contrast to rising optimism, investors should be aware that regulatory and policy uncertainty could still...

Sunrun's narrative projects $2.9 billion in revenue and $465.4 million in earnings by 2028. This requires 10.4% yearly revenue growth and an earnings increase of $3.07 billion from current earnings of $-2.6 billion.

Uncover how Sunrun's forecasts yield a $19.39 fair value, in line with its current price.

Exploring Other Perspectives

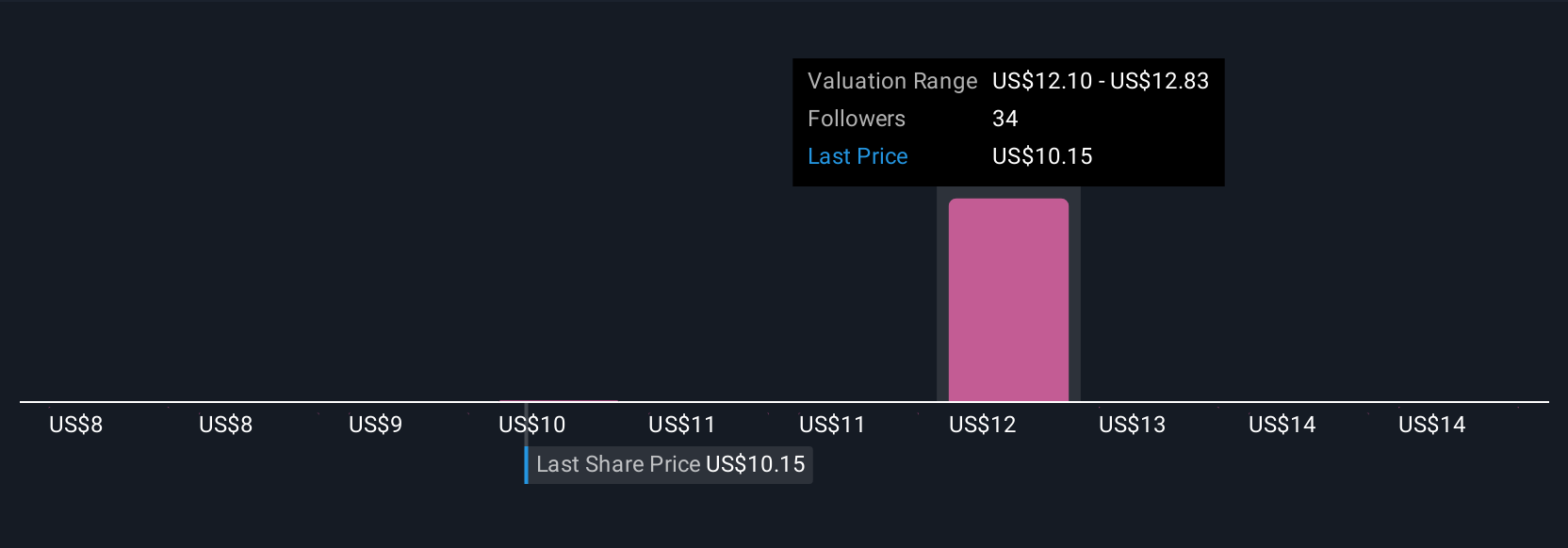

Six fair value estimates from the Simply Wall St Community place Sunrun’s value between US$8.58 and US$23.58 per share. While community opinions are broad, the ongoing uncertainty surrounding solar tax credits could influence Sunrun’s future direction and long-term profitability more than many expect.

Explore 6 other fair value estimates on Sunrun - why the stock might be worth as much as 21% more than the current price!

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.